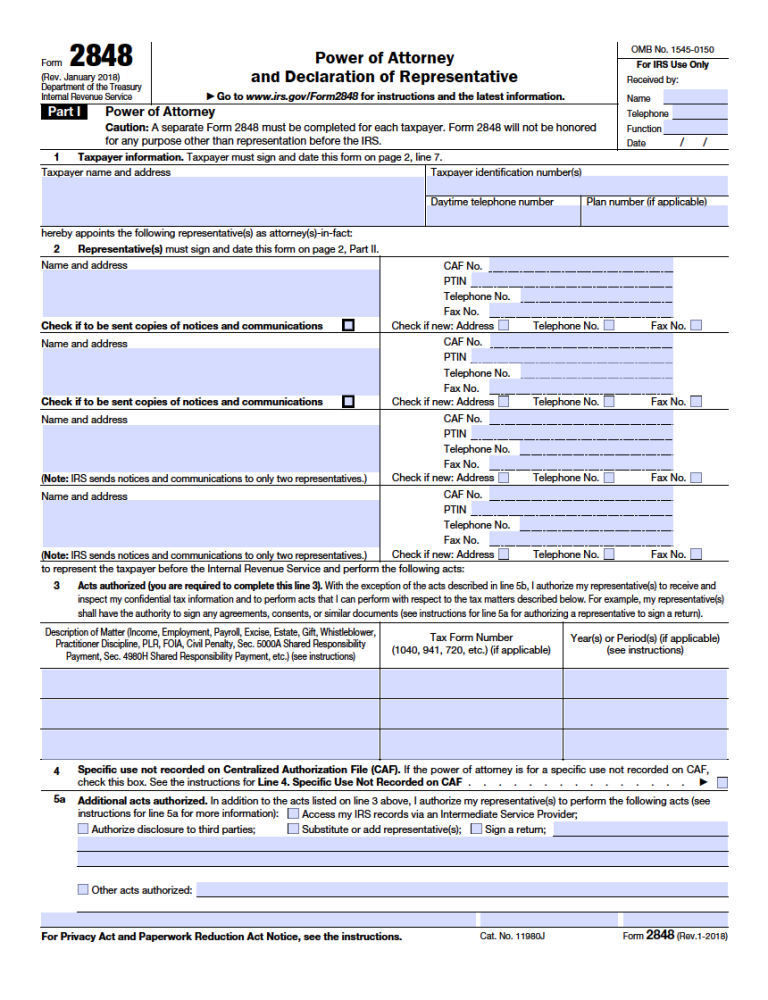

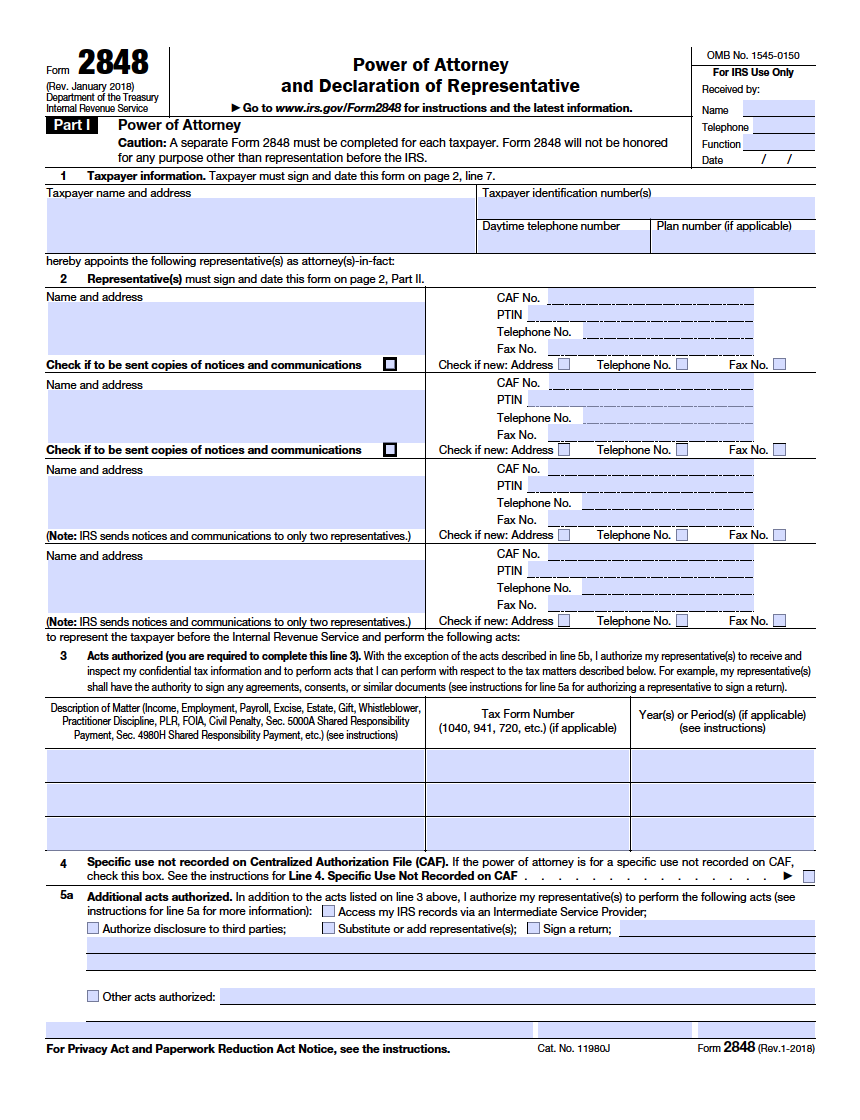

The Wyoming Tax Power of Attorney catalogs and generates an acceptance for a person or firm to represent an individual or business for the specific purpose of submitting an associated tax filing. The indicated agent to receive the right to serve as attorney-in-fact is mandated to identify as an approved representative to assume the correlated powers granted. The federal form registers the relevant information such as the names, phone numbers, and tax identification numbers of all parties and entities.

Laws

Statute – Wyoming Statutes – Uniform Power of Attorney Act (§ 3-9-101 – 3-9-403)

Authorized Representatives – A recognized representative must be identified as either an attorney, certified public accountant, enrolled agent, or enrolled actuary for federal tax submission. Other possibilities are defined as alternatives cited in 26 CFR § 601.502(b). A supplementary declaration must be attached to the power of attorney attesting to the statements documented in 26 CFR § 601.502(c).

Signing Requirements – Endorsement of the form does not necessitate a notary public’s commission, although it is recommended.

Other Versions

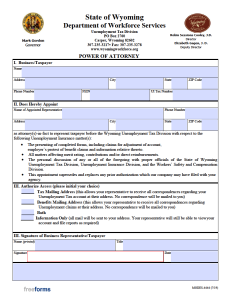

Wyoming Unemployment Tax Division Power of Attorney

Wyoming Unemployment Tax Division Power of Attorney

Download: Adobe PDF

Related Forms (3)

- Durable (Financial) Power of Attorney

- Limited Excise Tax Power of Attorney

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Limited Excise Tax Power of Attorney Form

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments