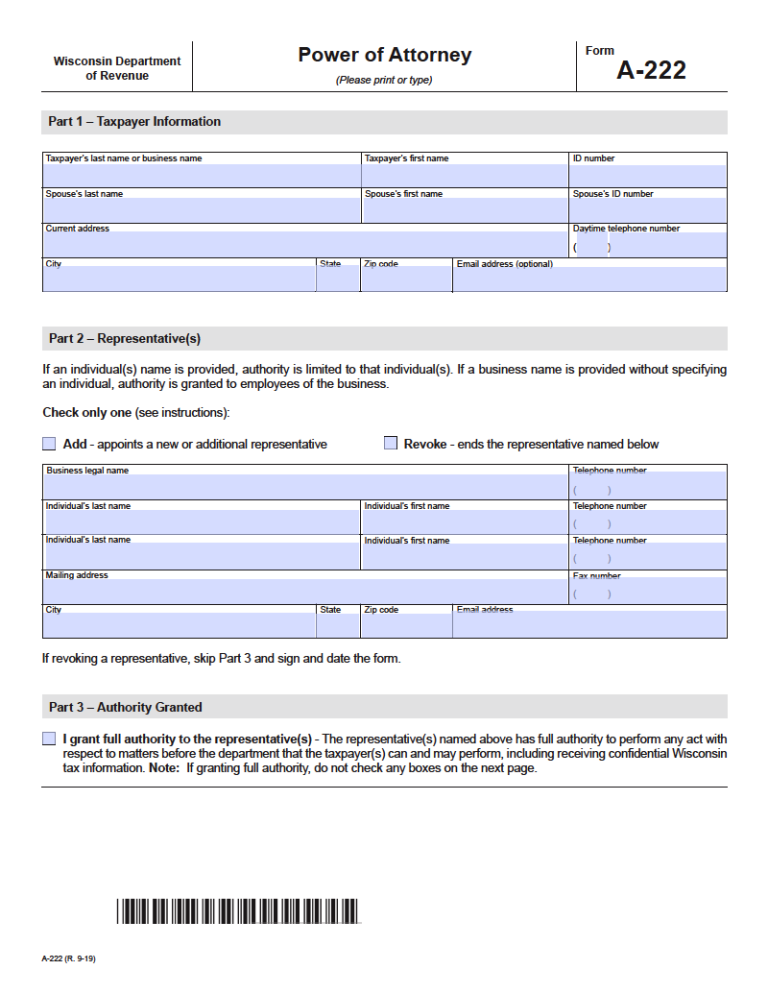

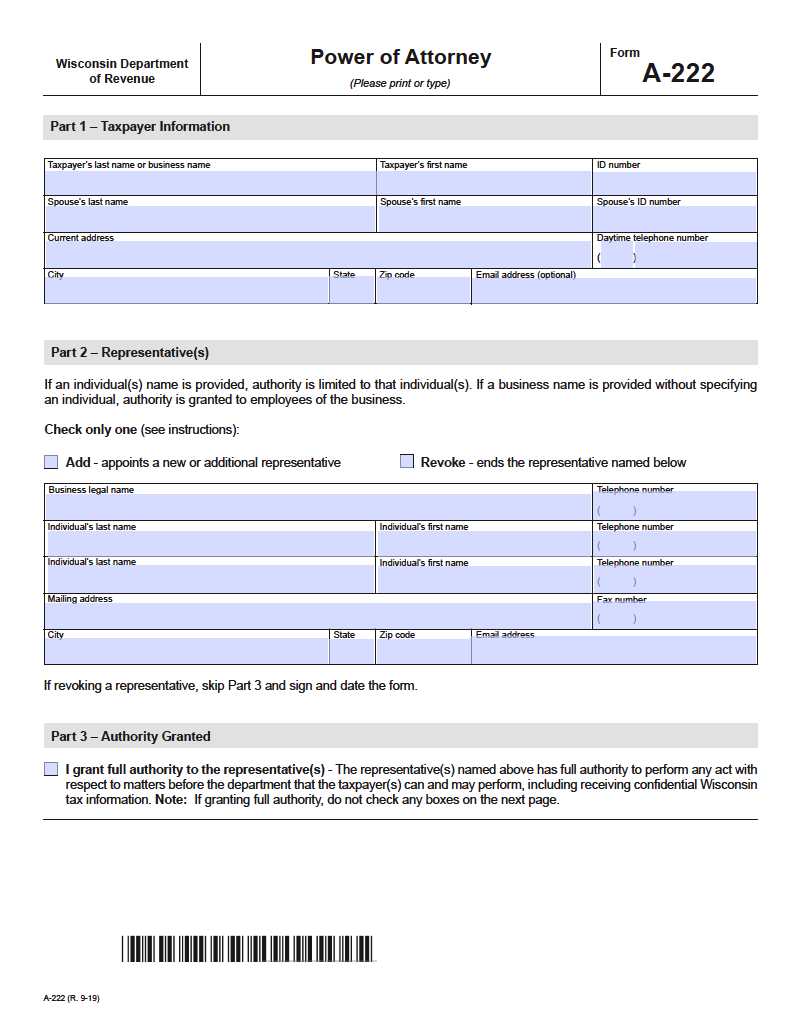

The Wisconsin Tax Power of Attorney authorizes a selected representative to communicate with the state’s revenue department and make tax decisions for another person. The paperwork is made accessible to provide tax professionals with the privileges required to submit tax filings, issue adjustments, and speak with tax agency officials. The legal contract specifies limited or broad powers to be granted to the agent by way of their choosing, allowing the principal to designate which controls to be offered. The form provided by the Wisconsin government (Form A-222) can be used on the state level and does not require notarization to be certified authentic. Revocation of permissions given to the attorney-in-fact can be initiated by filing a new Form A-222 to revoke with required endorsements. Additionally, the federal form supplied by the Internal Revenue Service (Form 2848) can be used in place of the Wisconsin state-issued power of attorney, with the supplemental stipulation that a licensed notary must verify it.

Laws

Statute – Uniform Power of Attorney for Finances and Property – § 244-01 – 244-64

Definition – § 244-56

Signing Requirements – Form A-222 provided by the state of Wisconsin will not need notarization for submission. For those that elect to use the federal IRS Form 2848 instead, the document will need to be notarized.

Other Versions

IRS Federal Tax Power of Attorney Form 2848

IRS Federal Tax Power of Attorney Form 2848

Download: Adobe PDF

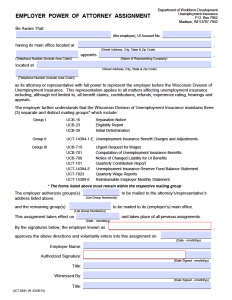

Wisconsin Employer Power of Attorney Assignment Form

Wisconsin Employer Power of Attorney Assignment Form

Download: Adobe PDF

Additional Resources

- Wisconsin Department of Revenue – Changes to Power of Attorney Law

- Wisconsin Department of Revenue – Wisconsin Tax Power of Attorney Form A-222 Instructions

Related Forms

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments