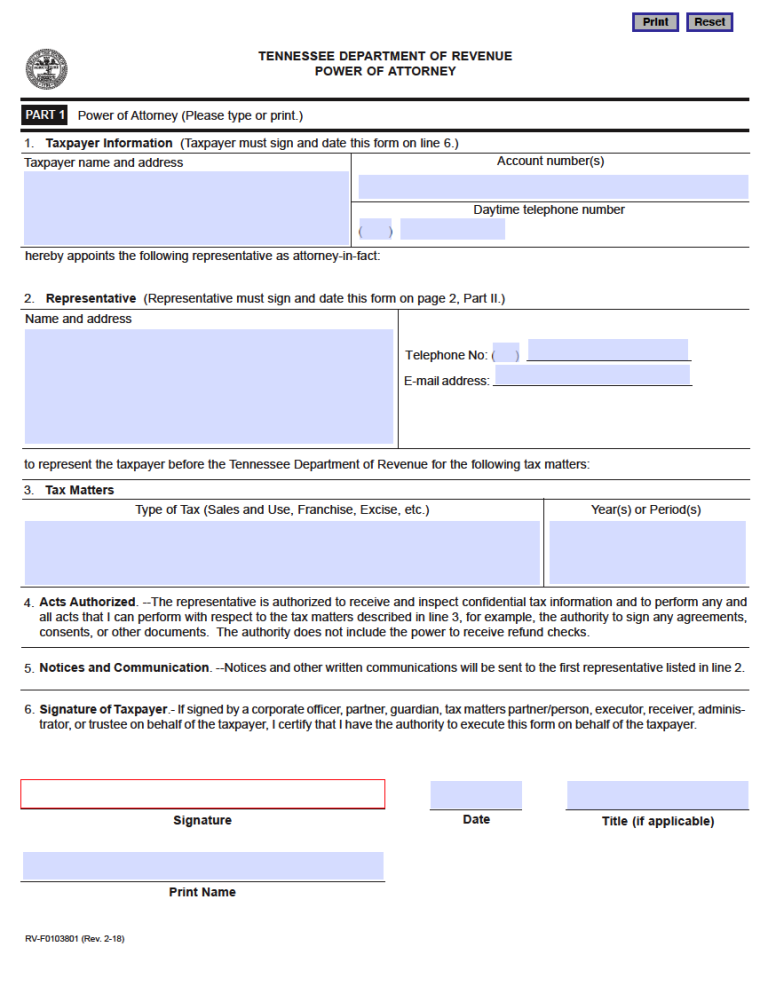

The Tennessee Tax Power of Attorney constitutes the legal affirmation to appoint a representative to handle tax issues for another individual. The provided government form will allow another person, usually a tax or law professional, the right to file, communicate, and act on behalf of the granting principal. Contained in the document is space to denote the declarant and assigned agent’s name, address, and associated tax ID number. The declarant can detail an explanation of the limited issued powers in the appropriate section of the agreement as needed. The paperwork can then be sent to the Tennessee Department of Revenue for review and acceptance.

Laws

Statute – Uniform Durable Power of Attorney Act ( § 34-6-101 – § 34-6-112)

Definition – § 34-6-109

Signing Requirements – The declarant and principal must affix their signatures to the form to indicate confirmation.

How to File

The government document can fill filled out with the prompted information regarding the taxpayer, designated agent, and allotted acts to be issued. Once the paperwork is completed and signed by both parties, it can be mailed to the following address for official submission:

Tennessee Department of Revenue

Andrew Jackson Office Building

500 Deaderick Street

Nashville, Tennessee 37242

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments