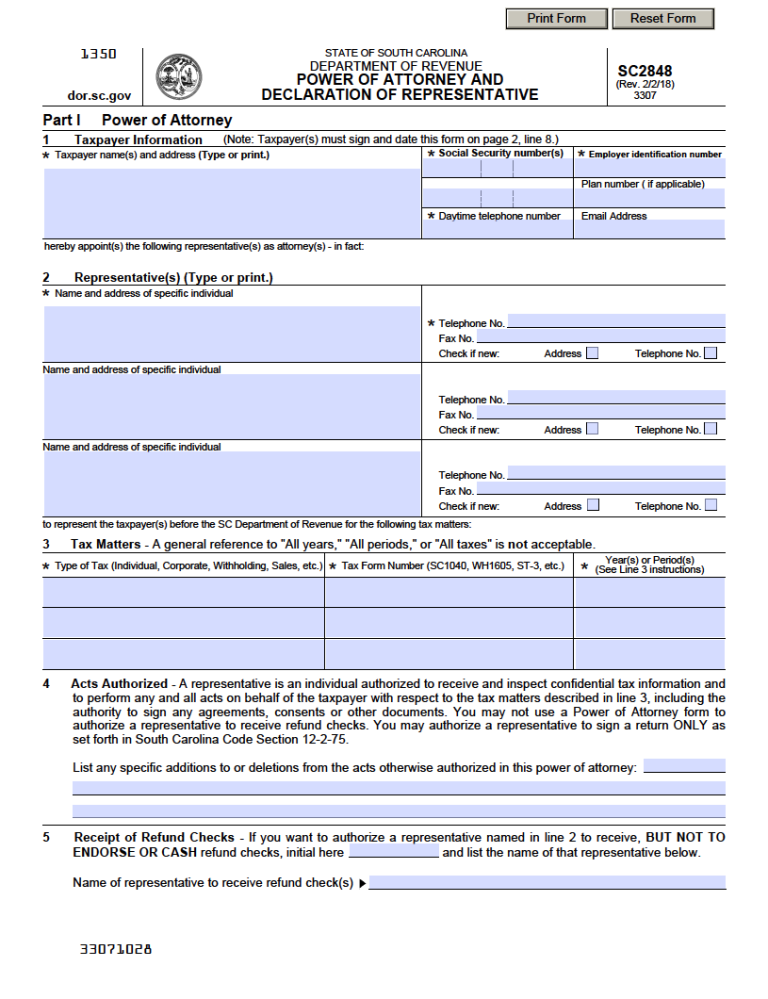

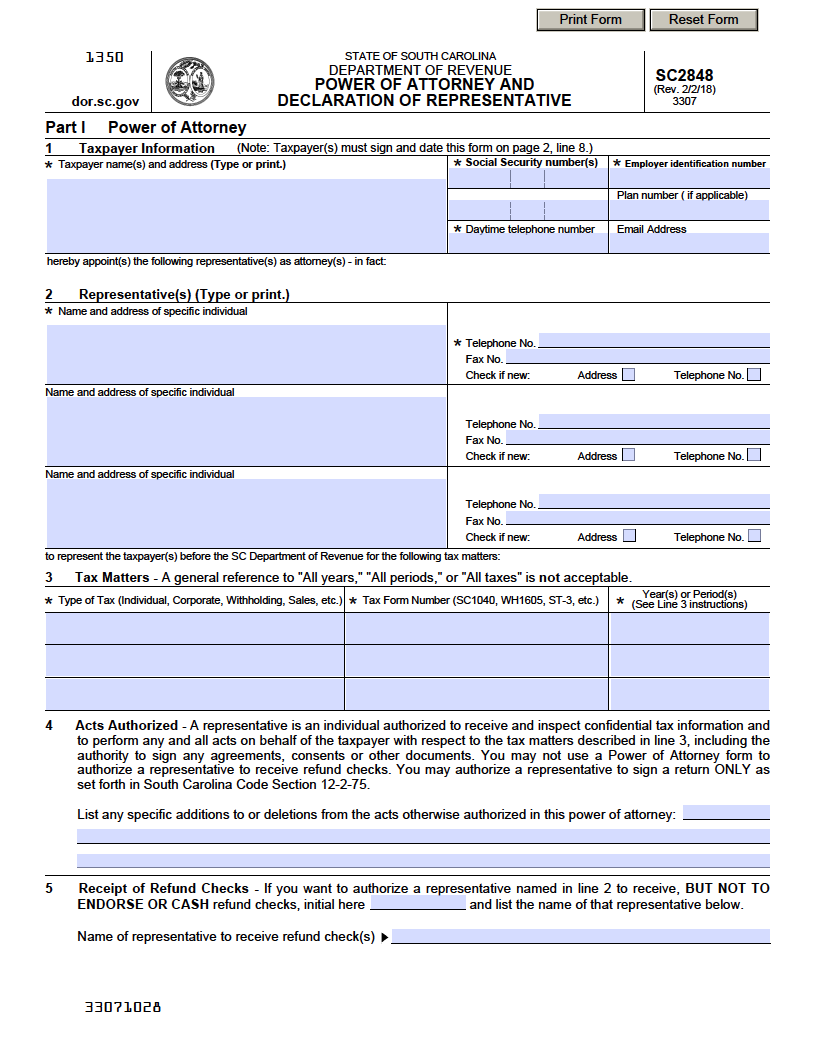

The South Carolina Tax Power of Attorney legally establishes a representative to handle tax matters on behalf of an indicated taxpayer. The form is issued for legal and tax professionals to be granted access to speak and take action for an individual to manage tax situations on the state level. Names, addresses, and contact information must be denoted within the filing along with the corresponding social security or employer identification number. Specific endowed permissions can be recorded to issue subject controls as needed or preferred by the principal party. The declarant and designated agent can execute the contract without the assistance of a notary to witness the event.

Laws

Statute – South Carolina Uniform Power of Attorney Act (§ 62-8)

Definition – “Agent” means a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact, or otherwise. The term includes an original agent, coagent, successor agent, and a person to whom an agent’s authority is delegated. An agent is a fiduciary (§ 62-8-102(1)).

Signing Requirements – The taxpayer and designated attorney are required to sign the form to authenticate the solidified arrangement in writing.

How to File

The document can be completed and signed as instructed and mailed to the following address for acceptance by the state government:

State of South Carolina Department of Revenue

P.O. Box 125

Columbia, SC 29214-0400

Alternatively, the form can also be faxed to your local taxpayer service center for approval.

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments