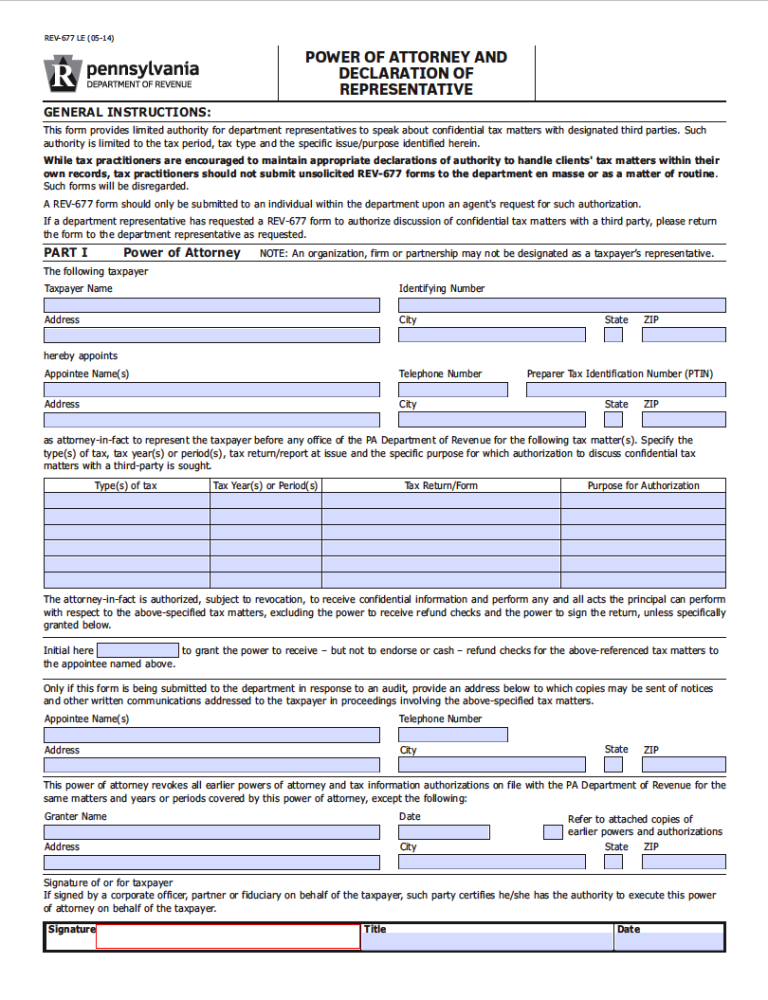

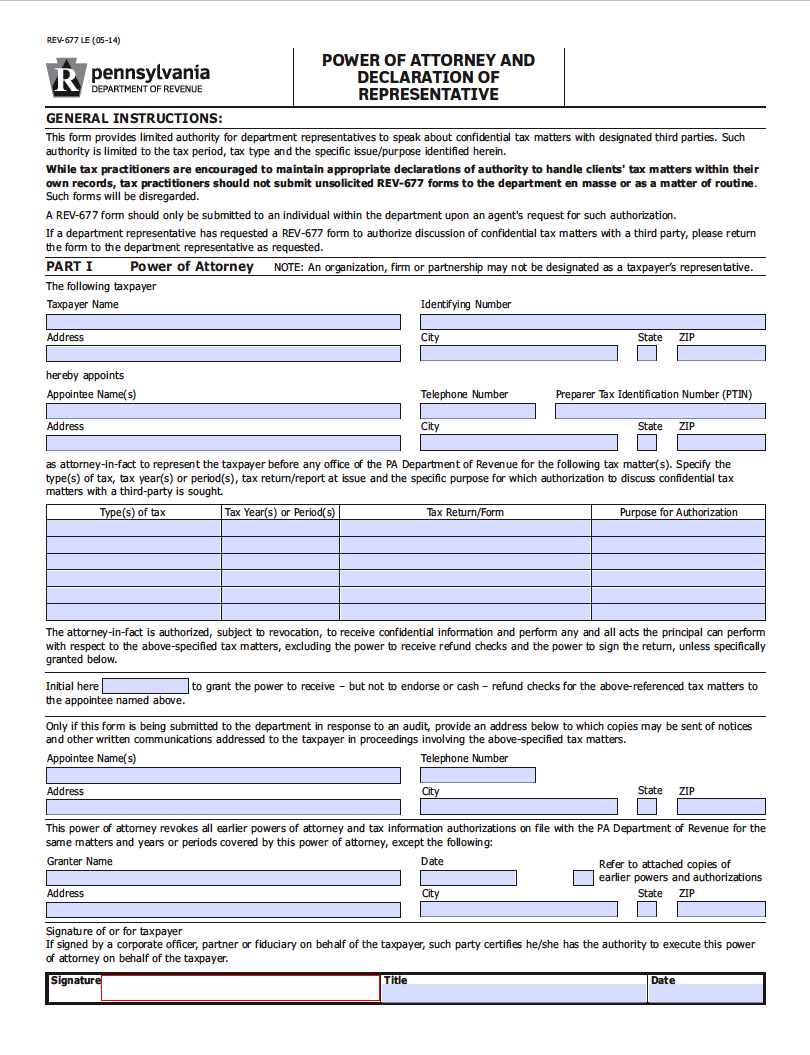

The Pennsylvania Tax Power of Attorney produces the necessary legal paperwork backing the institution of agency for a professional to handle one’s tax matters. When commissioning the services of a professional to manage communication and actions on behalf of another on the state level, the provided form is available to record all the necessary details. Complete the form with the associated information on the taxpayer and appointee along with the designated controls and sign as needed. The formal submission of the document is only required upon request from an agent at the offices of the Pennsylvania Department of Revenue.

Laws

Statutes – Pennsylvania Statutes Title 20, Chapter 56 – Powers of Attorney

Definition – § 5603(u)

Signing Requirements – Both the taxpayer and appointed agent must sign the document. If the assigned representative is not a certified public account, an attorney, or an enrolled agent, additional corroboration must take place by either two (2) witnessing parties or a licensed notary.

Other Versions

Tax Power of Attorney (Form REV-677) (Previous Edition)

Download: Adobe PDF

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

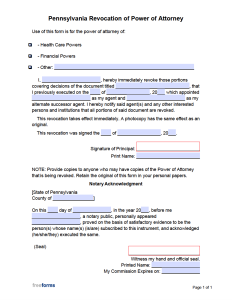

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments