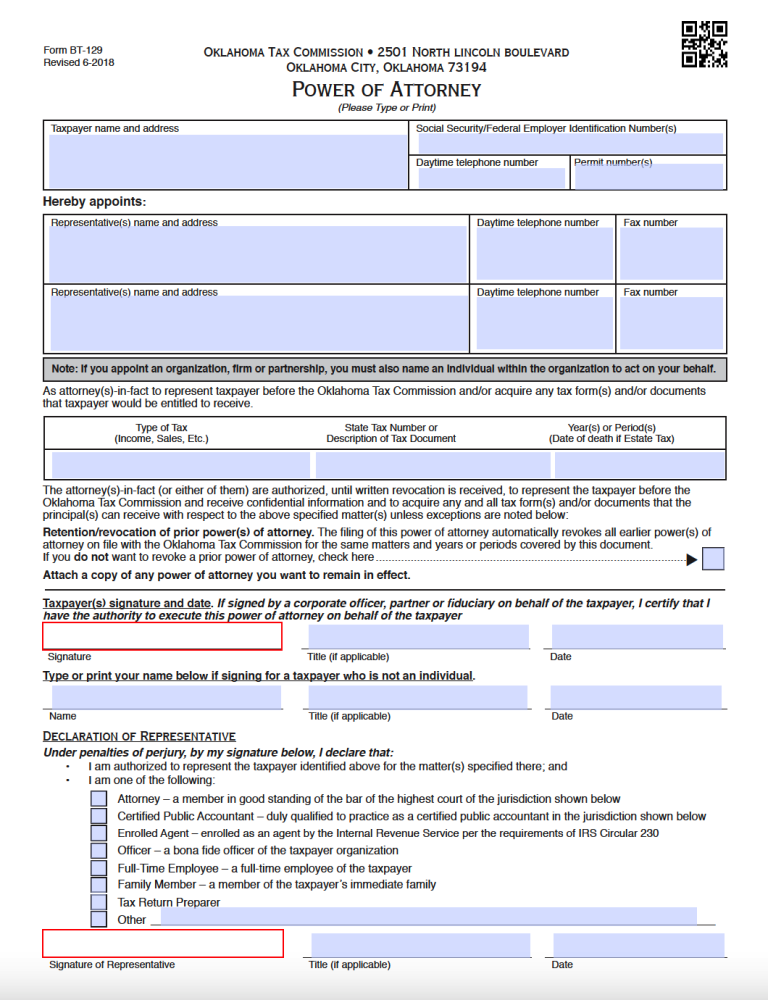

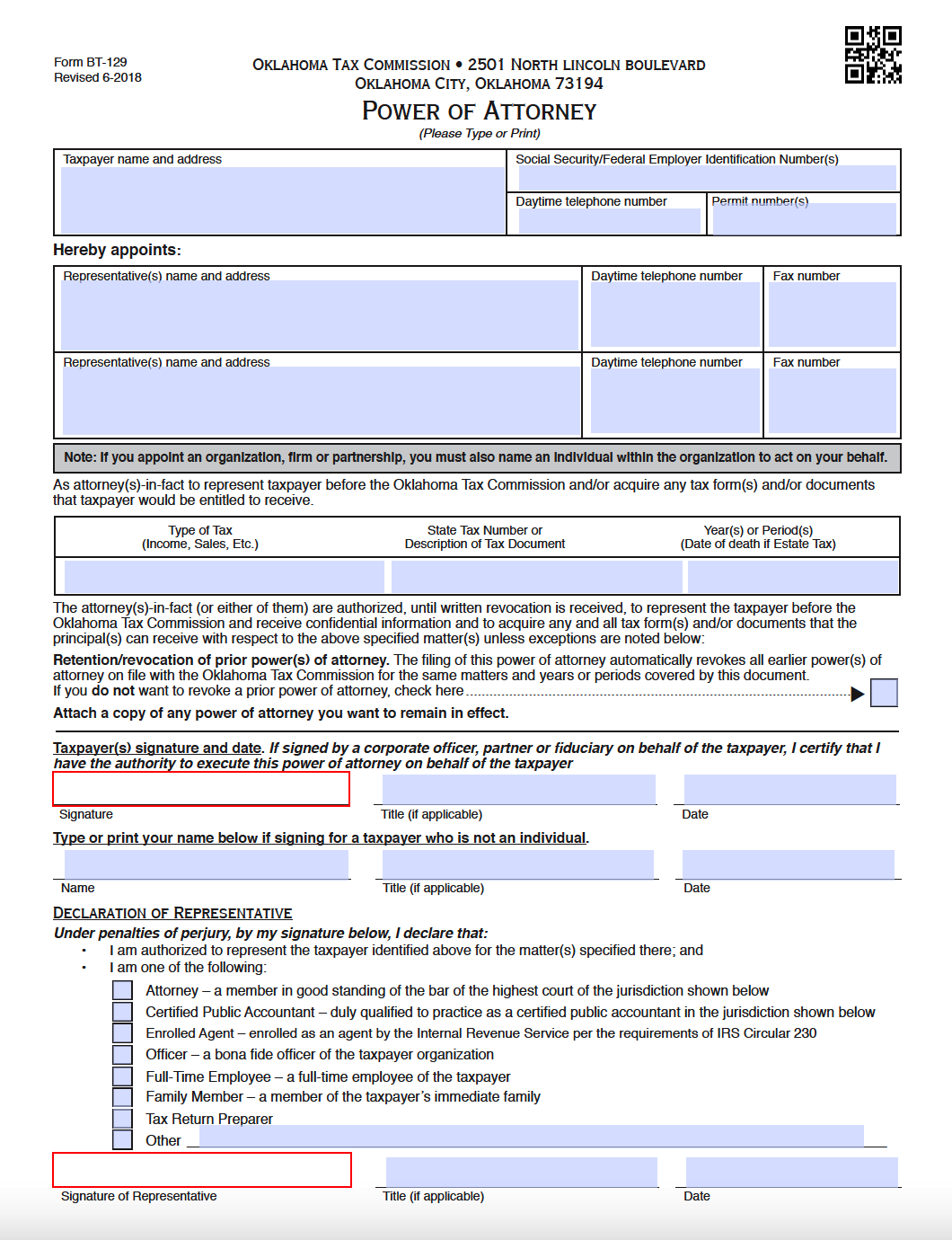

The Oklahoma Tax Power of Attorney is an Oklahoma government-issued document that confirms and identifies representation for an individual (or business entity) concerning state tax matters. The implemented form secures agency rights to initiate the arrangement and record the event for those who want an expert to handle their taxes. Fill the form with the indicated information on the taxpayer(s) and designated agent(s), including the associated tax id number, names, addresses, phone numbers. Declaration of the attorney-in-fact’s professional specialty or relation to the principal must also be provided in the provided space prior to the paperwork’s execution.

Laws

Signing Requirements – Taxpayer(s) and appointed agents must supply their signatures to the form before sending it to the Oklahoma Tax Commission for approval.

How to File

To properly administer the effective creation of the issued POA, it must be registered with the state of Oklahoma. Submission can be carried out electronically by taking advantage of the Oklahoma Taxpayer Access Point online service, or the paper form can be delivered by mail or in-person at the following address:

Oklahoma Tax Commission

300 N Broadway Ave

Oklahoma City, OK 73194

For any questions related to tax documentation or completion, you can contact the area OTC office for assistance.

Other Versions

Tax Power of Attorney (Form BT-129) (Previous Edition)

Download: Adobe PDF

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments