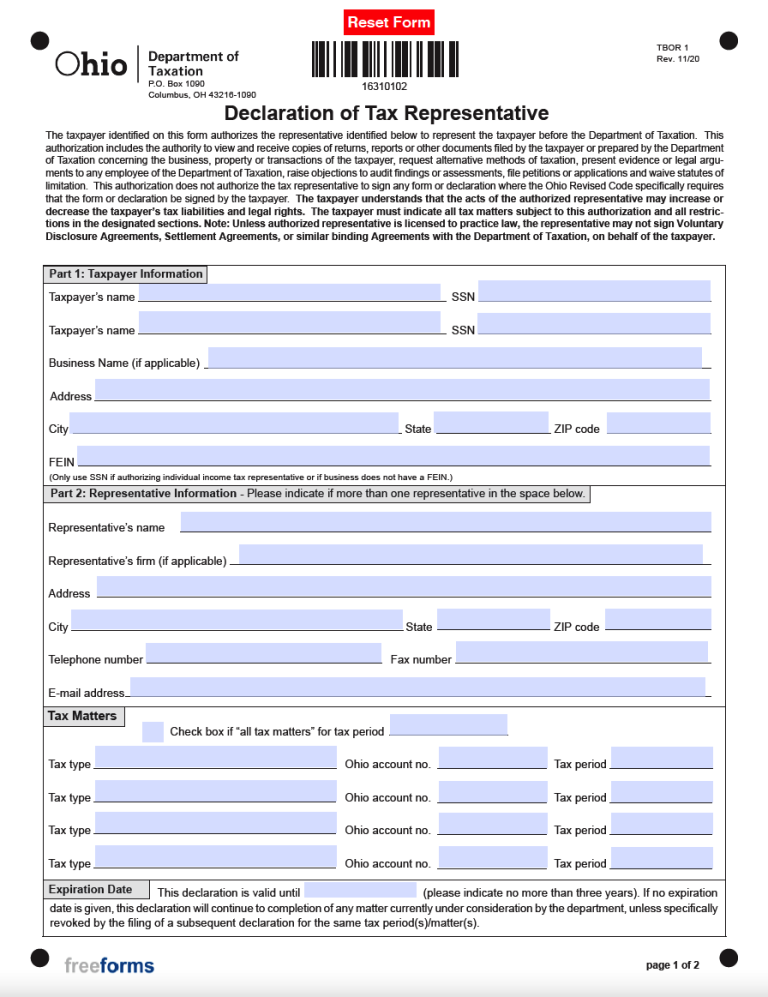

The Ohio Tax Power of Attorney (Form TBOR 1) is a suitable avenue to take as a resident of the state when you would like to outsource certain tax obligations to a third (3rd) party (accounting firm, tax attorney, IRS agent, etc.). All that the form requires is the information of the taxpayer (principal), their representative (attorney-in-fact), and the tax matters that they would like handled. Once the document has been filled out accordingly, the final step will obligate that all participating parties sign the instrument as directed.

Laws

Statute – § 1337.57

Definition – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 1337.22(G)).

Signing Requirements – Necessitates the signature of the principal (and their spouse if applicable).

Related Forms (3)

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

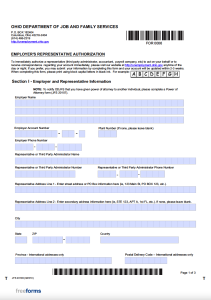

Employer’s Representative Authorization (Form JFS 20106)

Employer’s Representative Authorization (Form JFS 20106)

Download: Adobe PDF

Power of Attorney for Real Property Tax Exemption Application (DTE Form 24P)

Power of Attorney for Real Property Tax Exemption Application (DTE Form 24P)

Download: Adobe PDF

Comments