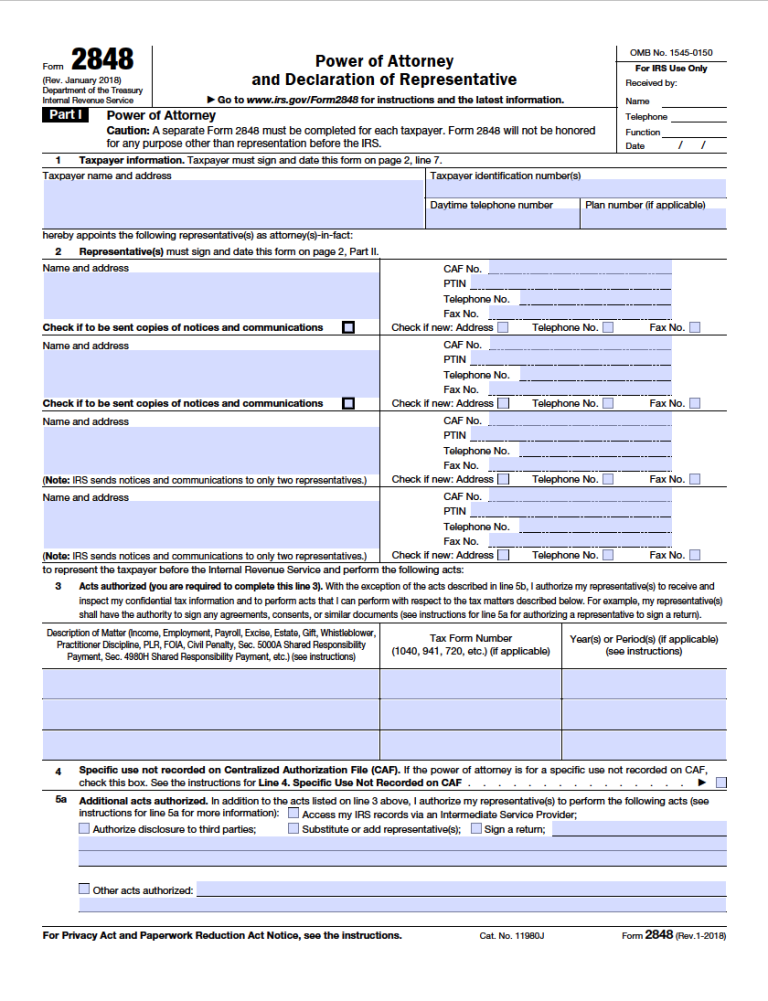

The Nevada Tax Power of Attorney sources the federally issued form granting a tax professional rights to manage an individual’s state tax matters. The Nevada Department of Taxation does not furnish a state-specific form but recognizes the provided nationally supplied governmental filing as well as unofficial power of attorney documents. Complete the registry as instructed and apply signatures of the included parties to verify the commitment. The assigned representative must be classified as a legal or tax specialist as defined in the US Code of Federal Regulations § 601.502.

Laws

Statute – Nevada Revised Statutes – Power of Attorney (Uniform Act) (§ 162A.010 – 162A.660)

Definition – § 162A.600

Signing Requirements – The individual taxpayer and appointed agent must both sign the form to activate authorization of representation.

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments