Advance directives provide a source for a declarant to preemptively determine health care preferences for treatment and representation in the event of their possible incapacitation. Various other agreements can be set up to permit agency for one particular defined act or a broad range of actions depending on the agreement selection and how the form is completed. The relevant document can be selected that best suits the needs of the transaction to enable the attorney-in-fact to perform only the tasks required by the principal.

Laws

Statutes – Montana Uniform Power of Attorney Act (§ 72-31-301 – 72-31-367) and Montana Rights of the Terminally Ill Act (§ 50-9-101 – 50-9-111)

Definition – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 72-31-302(7)).

Signing Requirements – Power of attorney forms designed to deliver authorization(s) connected to financial holdings, tax matters, and legal affairs require a notary to corroborate all requested signatures (§ 72-31-305). Advance directives (combined medical POA/living will document) demand that two (2) witnessing parties supervise the event of endorsement by applying their respective endorsements as instructed (§ 50-9-103(1)).

Revocation – § 72-31-310 and § 72-5-502

By Type (9)

- Advance Directive (Medical POA & Living Will)

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Minor Child Power of Attorney

- Motor Vehicle Power of Attorney

- Real Estate Power of Attorney

- Revocation of Power of Attorney

- Tax Power of Attorney

Advance Directive (Medical POA & Living Will) – Incorporates a living will with a medical power of attorney to designate a patient’s choice actions and agent nomination for future health care scenarios.

Advance Directive (Medical POA & Living Will) – Incorporates a living will with a medical power of attorney to designate a patient’s choice actions and agent nomination for future health care scenarios.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment needed to affirm the arrangement will obligate that two (2) subscribing witnesses supervise the event of the document’s execution.

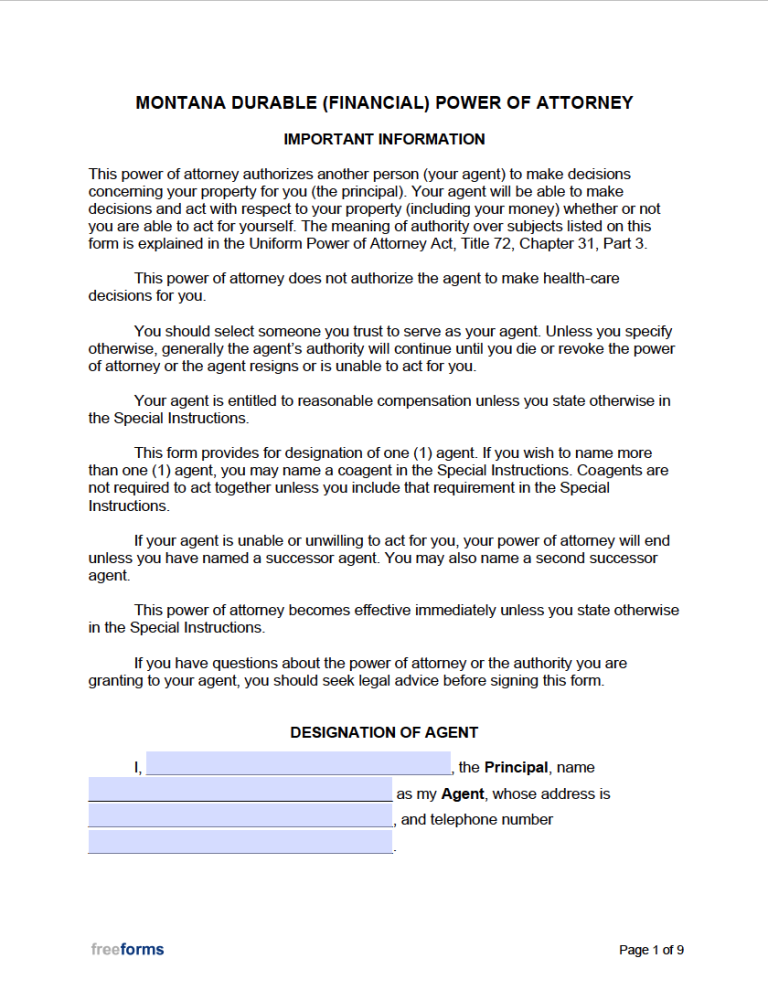

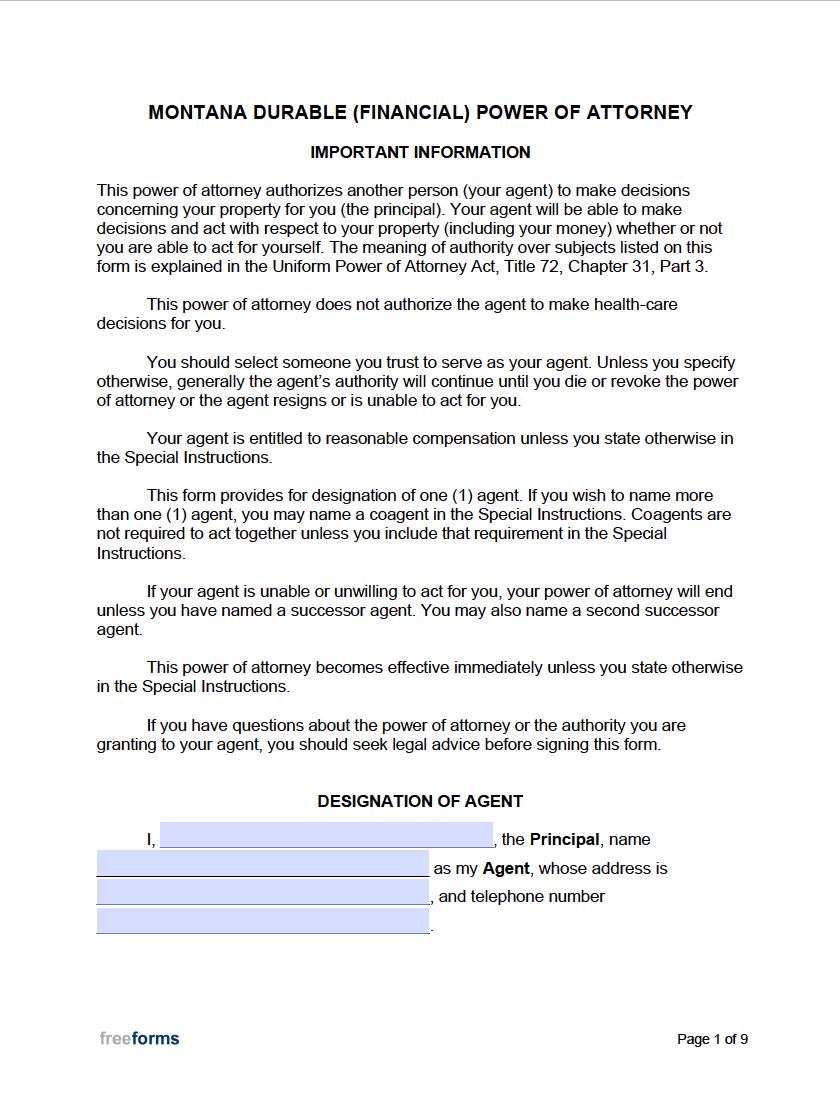

Durable (Financial) Power of Attorney – Secures a registered transfer of allocated controls from one person to another. The gained authorization(s) stand to remain active even under circumstances of the declarant’s incapacity.

Durable (Financial) Power of Attorney – Secures a registered transfer of allocated controls from one person to another. The gained authorization(s) stand to remain active even under circumstances of the declarant’s incapacity.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment from a valid notary official will be necessary to support the claim.

General (Financial) Power of Attorney – Creates agency for an individual to legally act on behalf of an issuing principal regarding financial, tax, legal and other specified matters.

General (Financial) Power of Attorney – Creates agency for an individual to legally act on behalf of an issuing principal regarding financial, tax, legal and other specified matters.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment regulations stipulate that notarization be recorded at the time of signing.

Limited (Special) Power of Attorney – Expresses an endowment of explicitly defined privileges from a declaring party to an appointed agent.

Limited (Special) Power of Attorney – Expresses an endowment of explicitly defined privileges from a declaring party to an appointed agent.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement by notary needed to confirm endorsements.

Minor Child Power of Attorney – Suffices as a contractual allowance authorizing a secondary adult temporary rights associated with parentage to take care of a child in the absence of the parent(s).

Minor Child Power of Attorney – Suffices as a contractual allowance authorizing a secondary adult temporary rights associated with parentage to take care of a child in the absence of the parent(s).

Download: PDF, Word (.docx)

Signing Requirements: The state’s annotated code mandates that the form be professionally notarized to be considered legitimate.

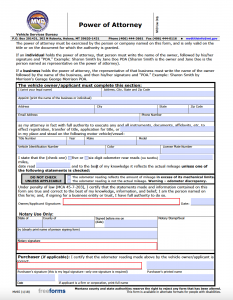

Motor Vehicle Power of Attorney – Structures a legal transcript to verify a declaring individual’s transfer of agency to a third party in regard to a vehicle.

Motor Vehicle Power of Attorney – Structures a legal transcript to verify a declaring individual’s transfer of agency to a third party in regard to a vehicle.

Download: PDF

Signing Requirements: Acknowledgment from a notary is required.

Real Estate Power of Attorney – Clarifies an understanding to grant a person the right to purchase, sell, manage, or refinance a property belonging to another.

Real Estate Power of Attorney – Clarifies an understanding to grant a person the right to purchase, sell, manage, or refinance a property belonging to another.

Download: PDF, Word (.docx)

Signing Requirements: The state of Montana legislature distinctively states that notarization must be captured to enact the contract terms.

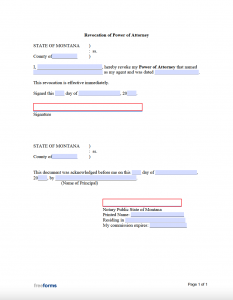

Revocation of Power of Attorney – Used to invalidate a currently instated power of attorney document at the command of a principal party.

Revocation of Power of Attorney – Used to invalidate a currently instated power of attorney document at the command of a principal party.

Download: PDF, Word (.docx)

Signing Requirements: Notary corroboration is mandatory to enforce the arrangement according to state law.

Tax Power of Attorney – Qualifies allowance of a tax professional to speak with revenue agencies and make decisions related to an individual’s taxes on the state level.

Tax Power of Attorney – Qualifies allowance of a tax professional to speak with revenue agencies and make decisions related to an individual’s taxes on the state level.

Download: PDF

Signing Requirements: Acknowledgment from all involved taxpayers and representatives are required to complete and establish the agency.

Comments