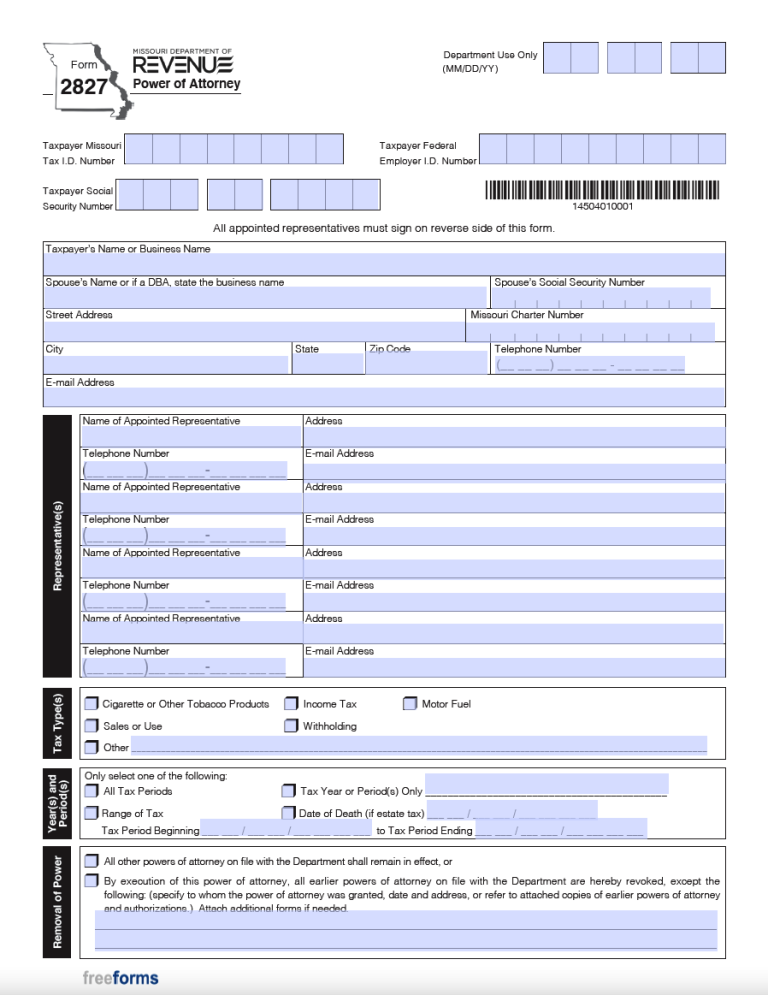

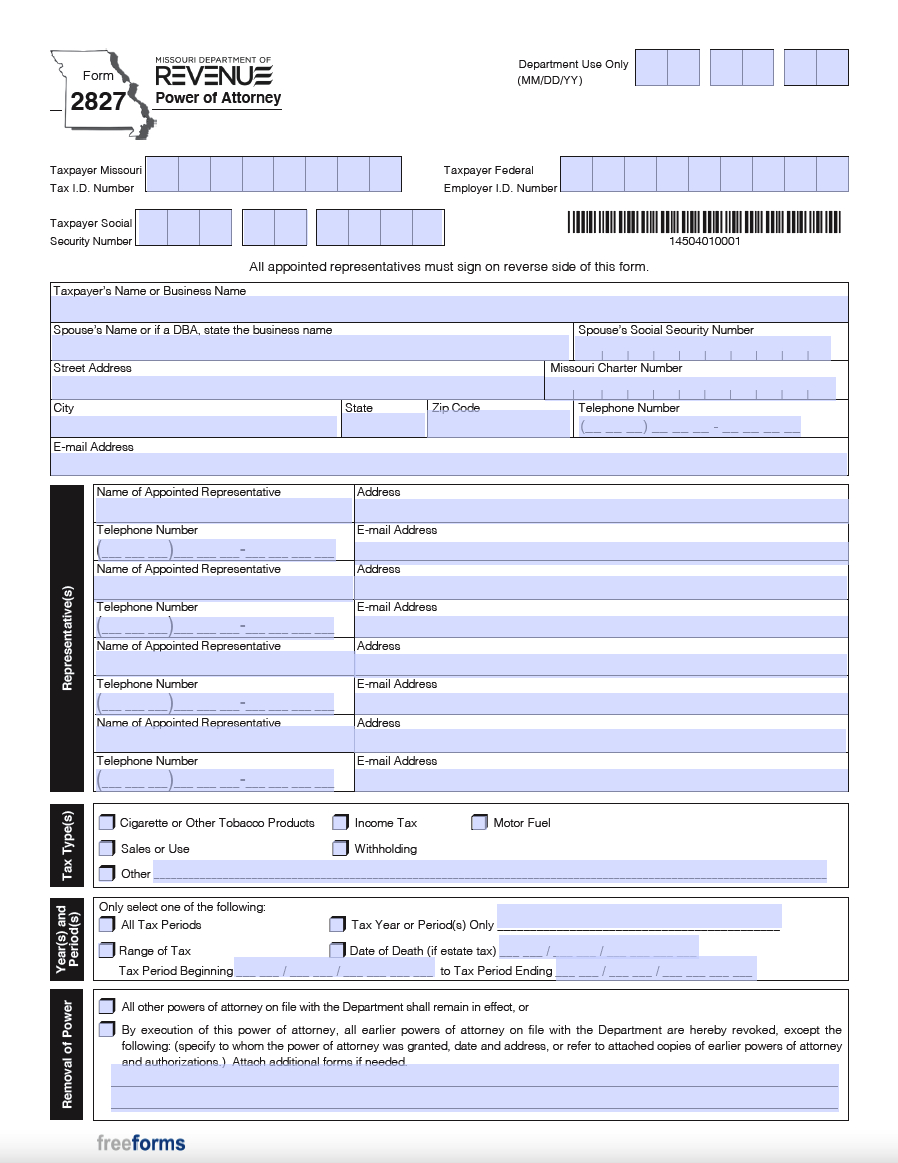

The Missouri Tax Power of Attorney (Form 2827) is an instrument used for the sole purpose of assigning tax matters to a representative. When delegating such affairs to another party, it is necessary to document the terms so that the Department of Revenue is aware of the arrangement. This form requires taxpayers to record pertinent information concerning themselves, their representation, and the types of tax duties that will be performed on their behalf. After recording the necessary information, all participating individuals will be required to sign the instrument in order for it to go into effect.

Laws

Code – 12 CSR 10-41.030

Definition – “Power of attorney”, a written power of attorney, either durable or not durable (§ 404.703(8)).

Signing Requirements – Signatures of the taxpayer(s) and their representative(s).

Other Versions

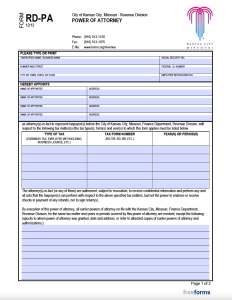

Kansas City Version (Form RD-PA)

Kansas City Version (Form RD-PA)

Download: Adobe PDF

Related Forms

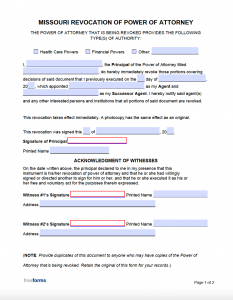

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

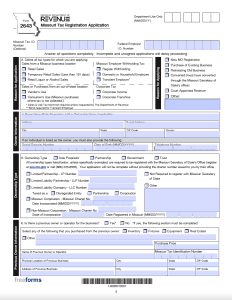

Tax Registration Application (Form 2643)

Tax Registration Application (Form 2643)

Download: Adobe PDF

Comments