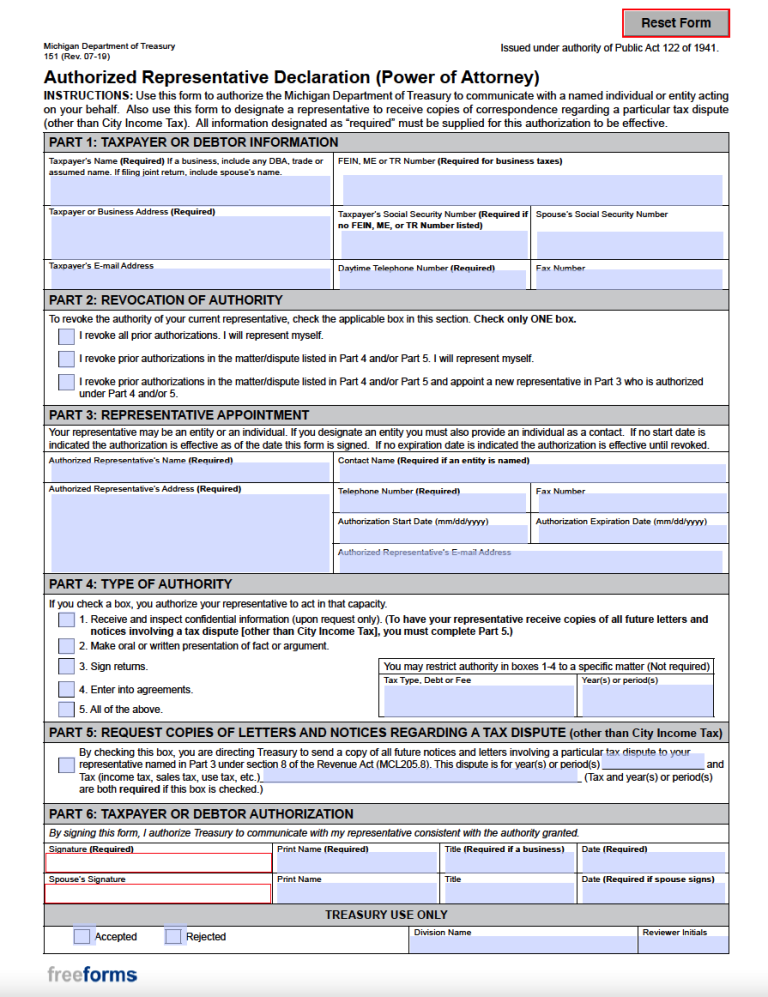

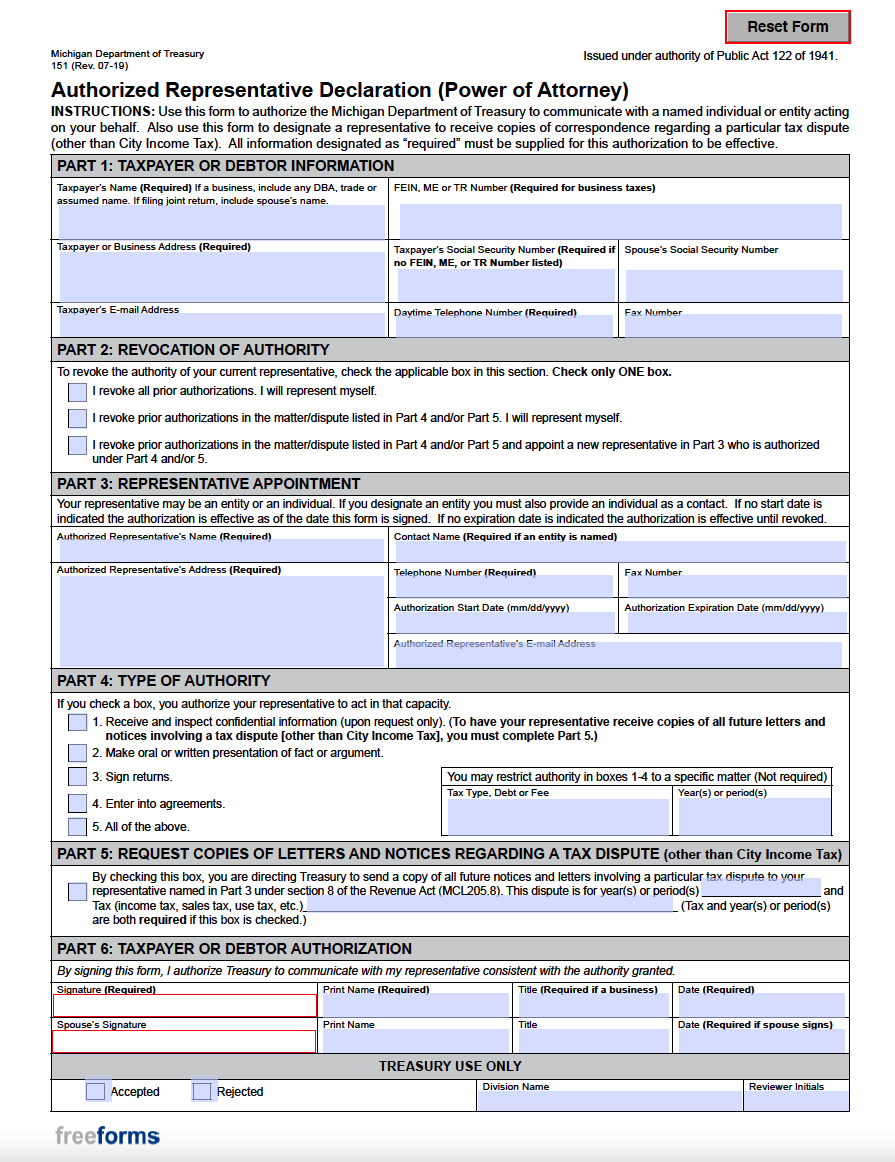

The Michigan Tax Power of Attorney (Form 151) is deployed by taxpayers who wish to assign certain personal duties to a third-party representative. Each year, numerous individuals within the state will contract the services of a tax professional such as an account or attorney to manage their current situation for them. This document will grant their agent the authority to access confidential paperwork, submit filings, and endorse forms in their name. Interested parties may accomplish this form by inputting the identities of the participants, choosing which authorities will be granted, and signing within the indicated area. Following the accomplishment of each section, executors are instructed to send the form to the corresponding division of the Michigan Department of Treasury.

Laws

Public Act – Issued under the authority of Public Act 122 of 1941.

Signing Requirements – Demands the signature of the taxpayer or debtor.

Additional Resources

- Michigan Department of Treasury – Form 151 (Part 5, Section 8) Example

- Michigan Department of Treasury – Form 151 Individual Income Tax Example

- Michigan Department of Treasury – Tax Power of Attorney (Form 151) FAQ

- Michigan Department of Treasury – Tax Power of Attorney (Form 151) Instructions

Related Forms

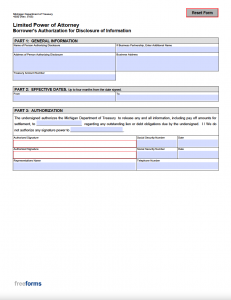

Borrower’s Authorization for Disclosure of Information (Form 4300)

Borrower’s Authorization for Disclosure of Information (Form 4300)

Download: Adobe PDF

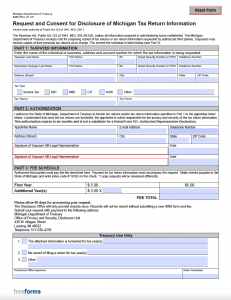

Request & Consent for Disclosure of Tax Return Information (Form 4095)

Request & Consent for Disclosure of Tax Return Information (Form 4095)

Download: Adobe PDF

Comments