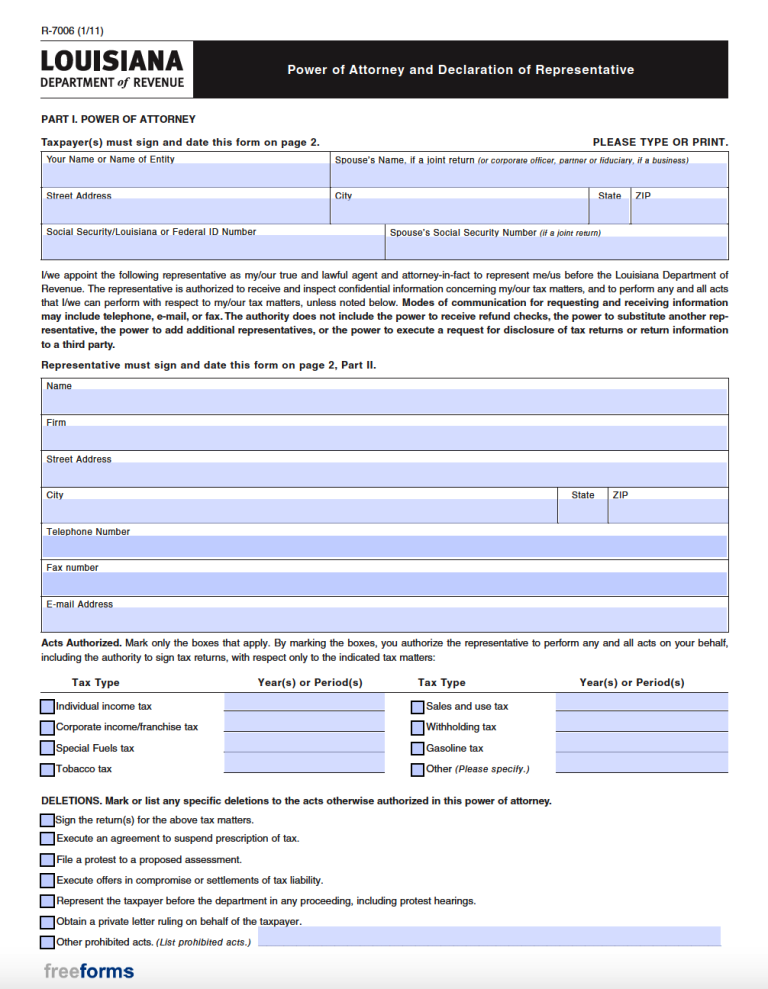

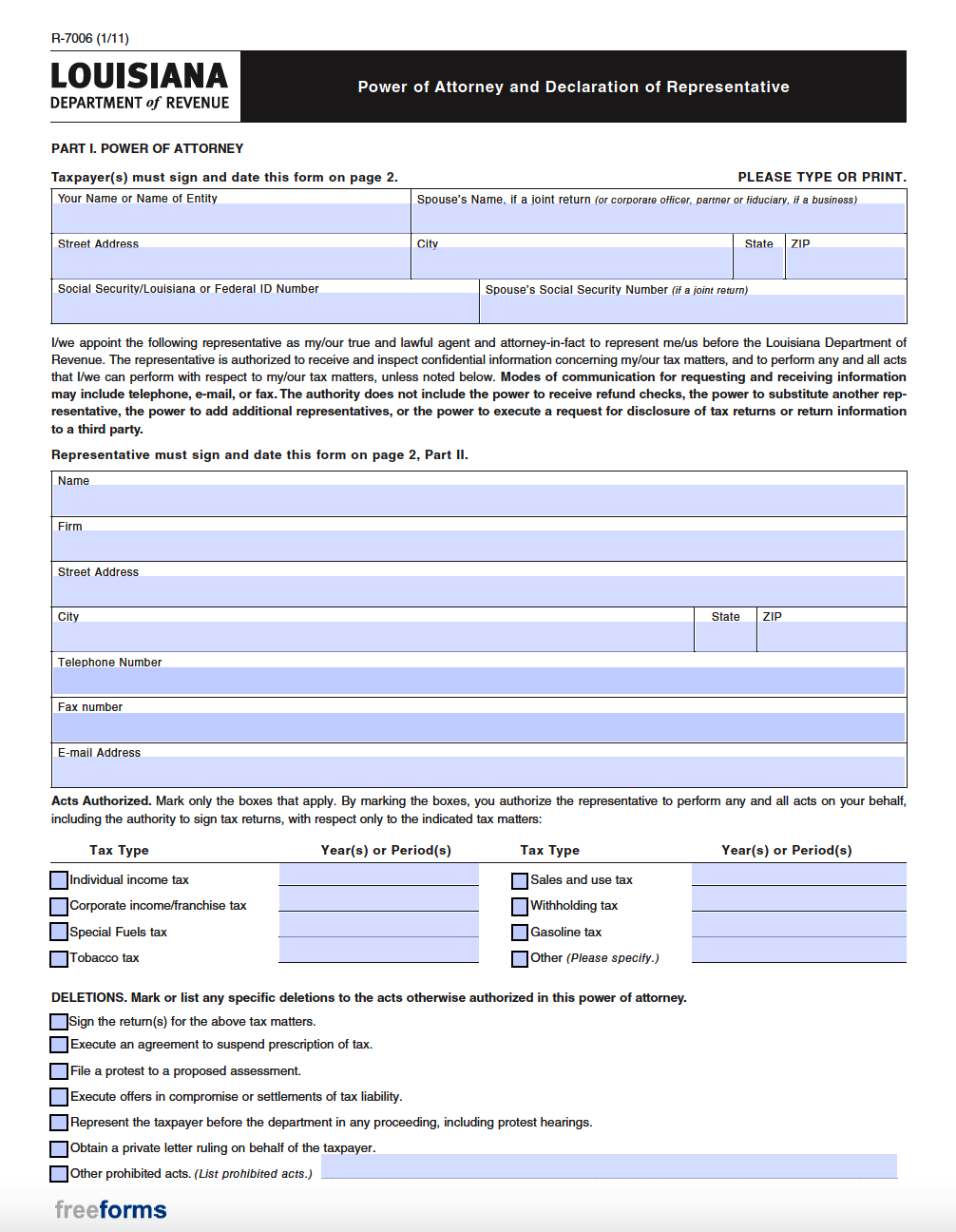

The Louisiana Tax Power of Attorney is a legal instrument that was developed by the Louisiana Department of Revenue. Its goal is to allow residents of the state to appoint a representative to handle tax-related affairs on their behalf. So, if someone wishes to delegate certain obligations to their accountant, they can effectively do so by the implementation of this form. All that is necessary to complete this document is for the taxpayer to indicate which parties are involved, what functions their representative will have access to, and the supplementation of each participating party’s signature.

Laws

Statutes – Louisiana Civil Code – Chapter 2. Mandate

Definition – “A mandate is a contract by which a person, the principal, confers authority on another person, the mandatary, to transact one or more affairs for the principal.” (§ 2989)

Signing Requirements – The taxpayer and their representative must sign the form.

Related Forms

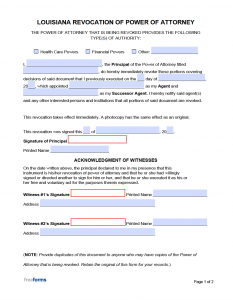

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Tax Information Disclosure Authorization (Form R-7004)

Tax Information Disclosure Authorization (Form R-7004)

Download: Adobe PDF

Instructions: Adobe PDF

Comments