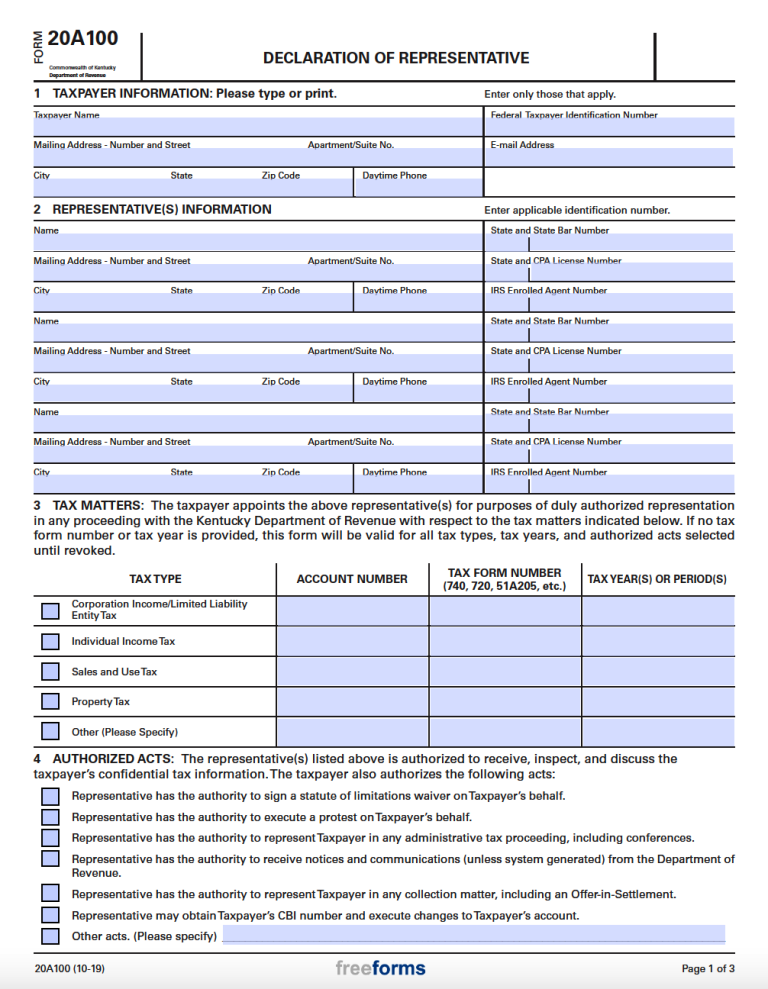

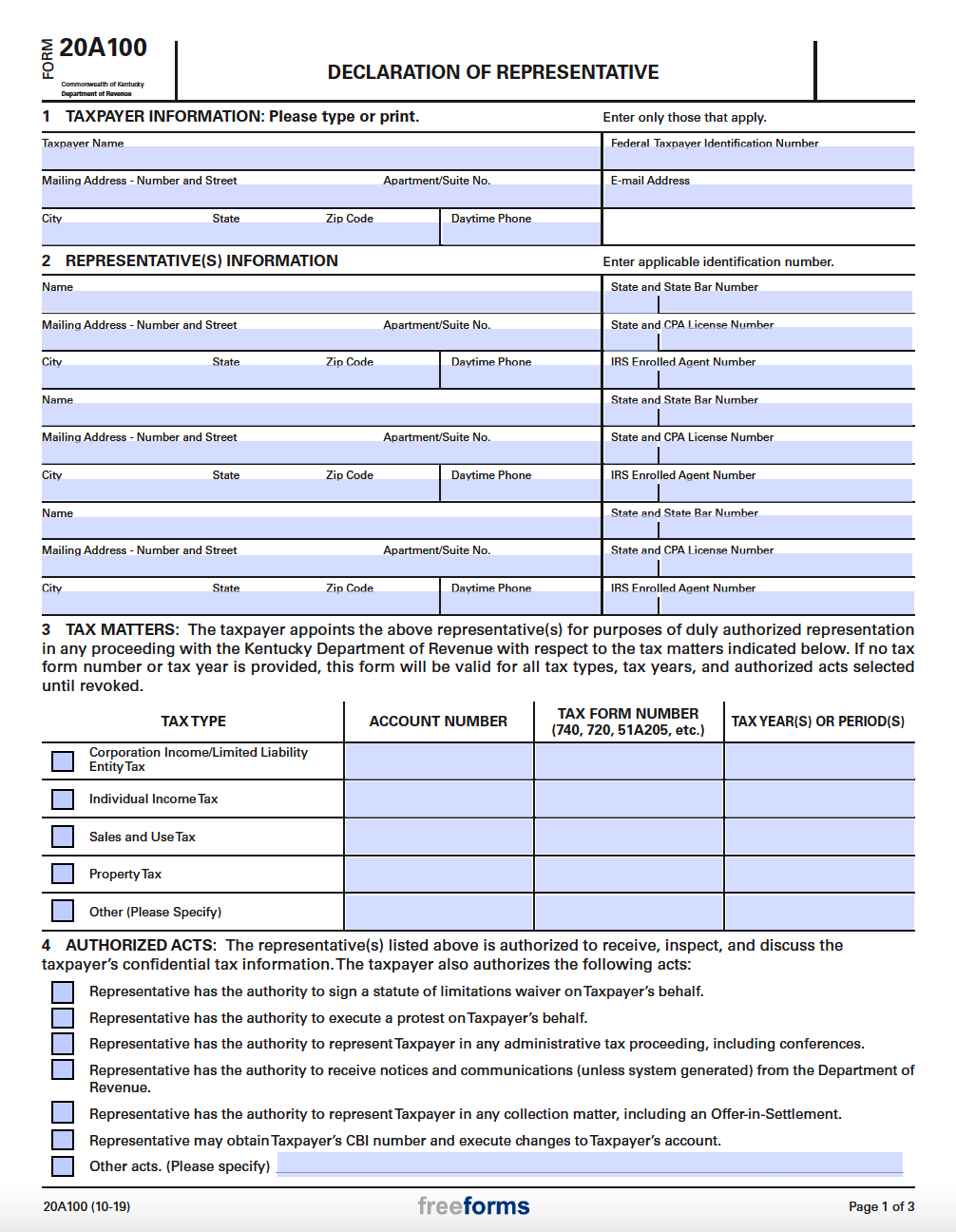

The Kentucky Tax Power of Attorney (Form 20A100), also known as the “Declaration of Representative”, is a legal form created by the state’s Department of Revenue. It serves the function of delegating tax-related powers to a third party (agent) so that they may execute any necessary actions in the name of the appointing individual (principal). The completion of this document will entail the recording of the taxpayer’s & representative’s personal information, the types of matters & acts that are to be authorized, and both parties’ signatures.

Laws

Statute – Taxes (§ 457.390)

Definition – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 457.020(7)).

Signing Requirements – Must be signed by the taxpayer and their representative(s).

Additional Resources

- Kentucky Department of Revenue – Tax POA (Form 20A100) Instructions

Related Forms

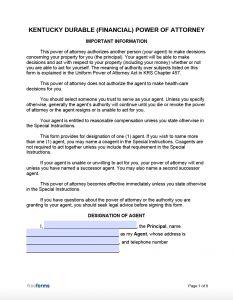

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

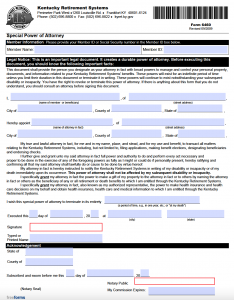

Kentucky Retirement Systems – Special POA (Form 6460)

Kentucky Retirement Systems – Special POA (Form 6460)

Download: Adobe PDF

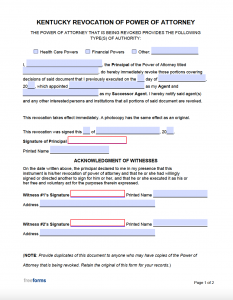

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments