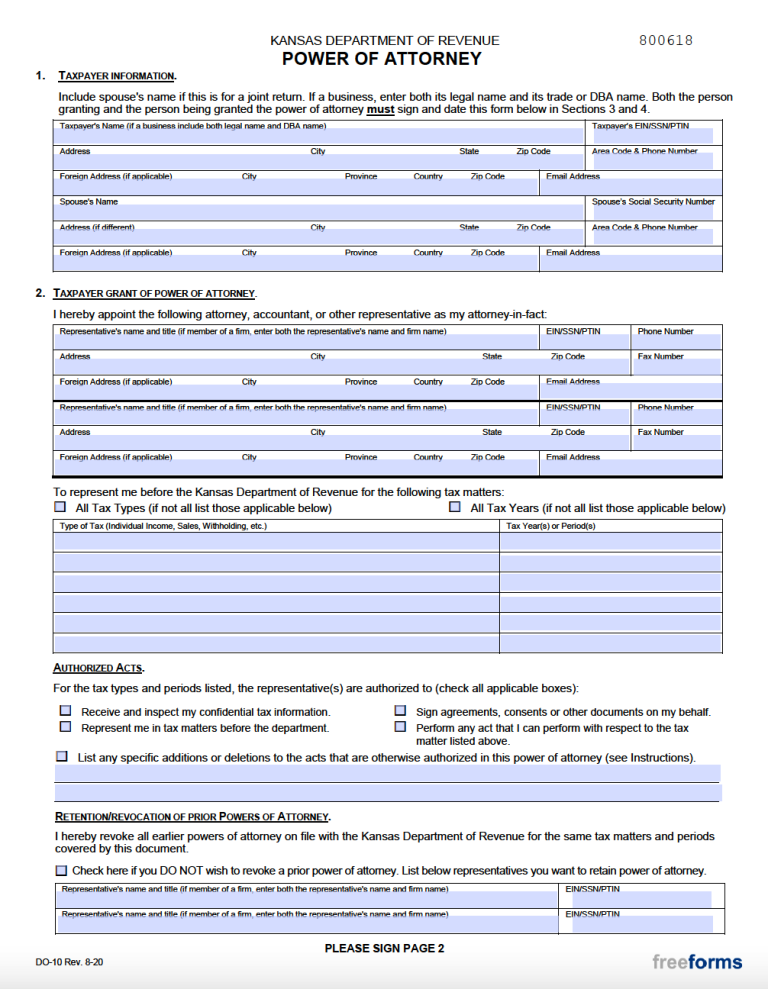

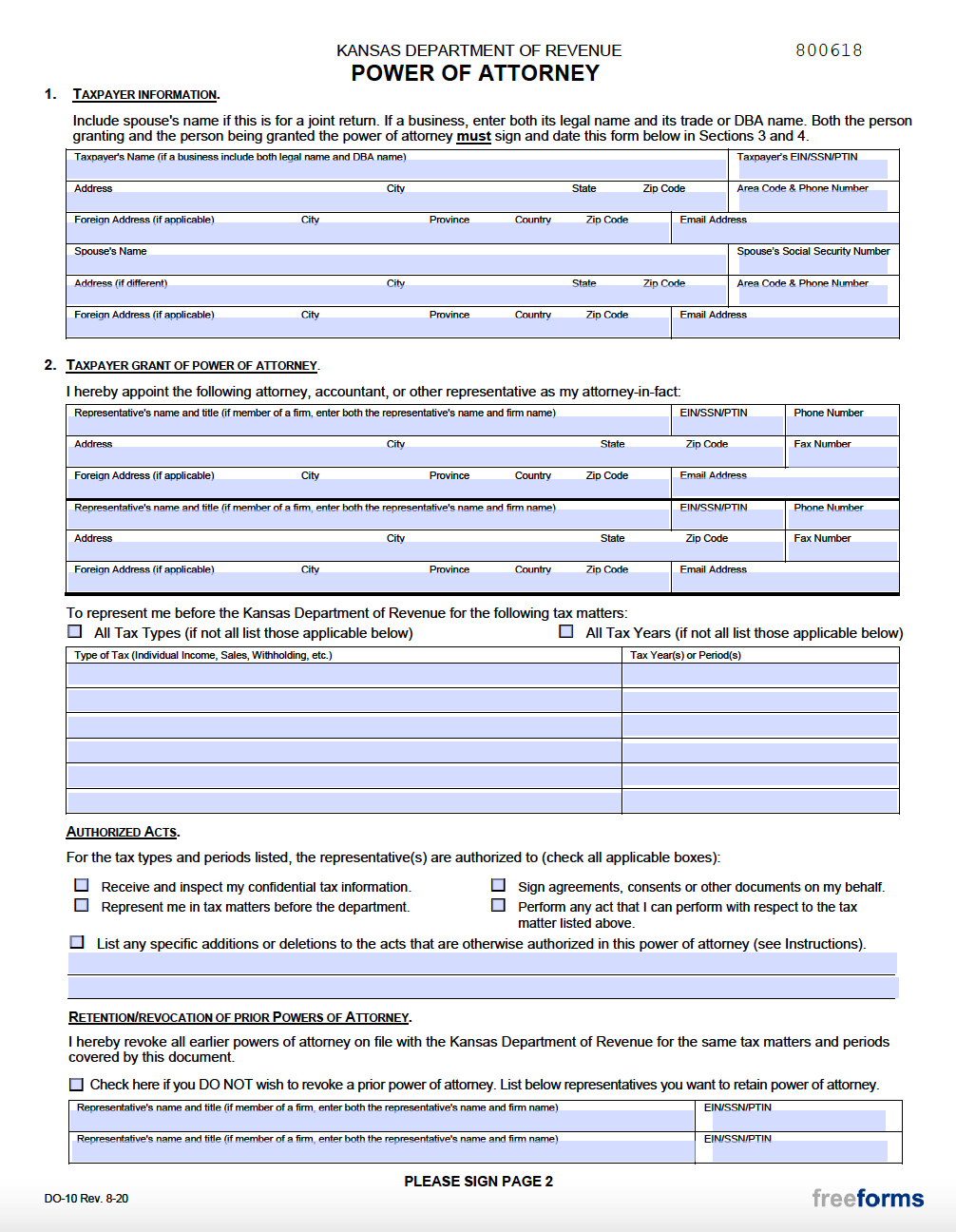

The Kansas Tax Power of Attorney (Form DO-10) is a legal document developed by the KDOR’s Taxation Division to authorize the delegation of tax dealings from one party to another. The majority of individuals who implement this form are those who prefer to have their tax obligations handled by a professional, such as an accountant or tax attorney. This instrument can provide an agent with the ability to receive confidential paperwork, sign official documents, manage tax filings, etc. To commence the relationship, the taxpayer must fill in all the required fields and endorse the form along with their appointed representatives.

Laws

Statutes – § 58-650 – § 58-665

Definition – “Power of attorney” means a written power of attorney, either durable or nondurable (§ 58-651(i)).

Signing Requirements – Necessitates the signatures of the taxpayer(s) and their representative(s).

Additional Resources

- Kansas Department of Revenue – Instructions for Power of Attorney Authorization

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments