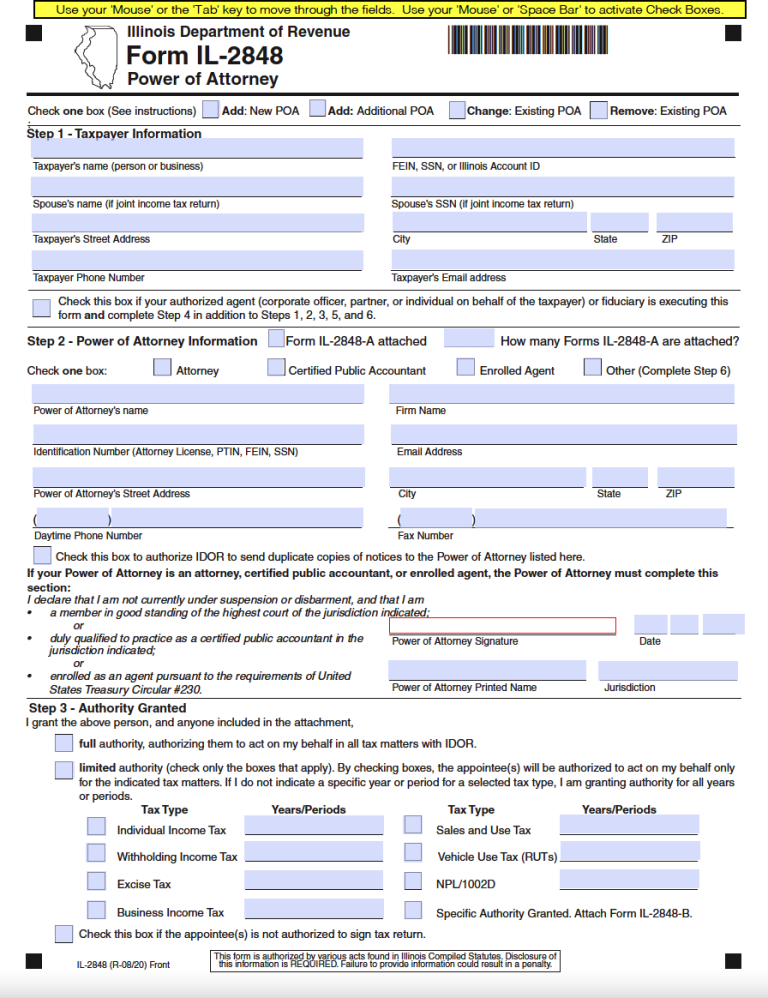

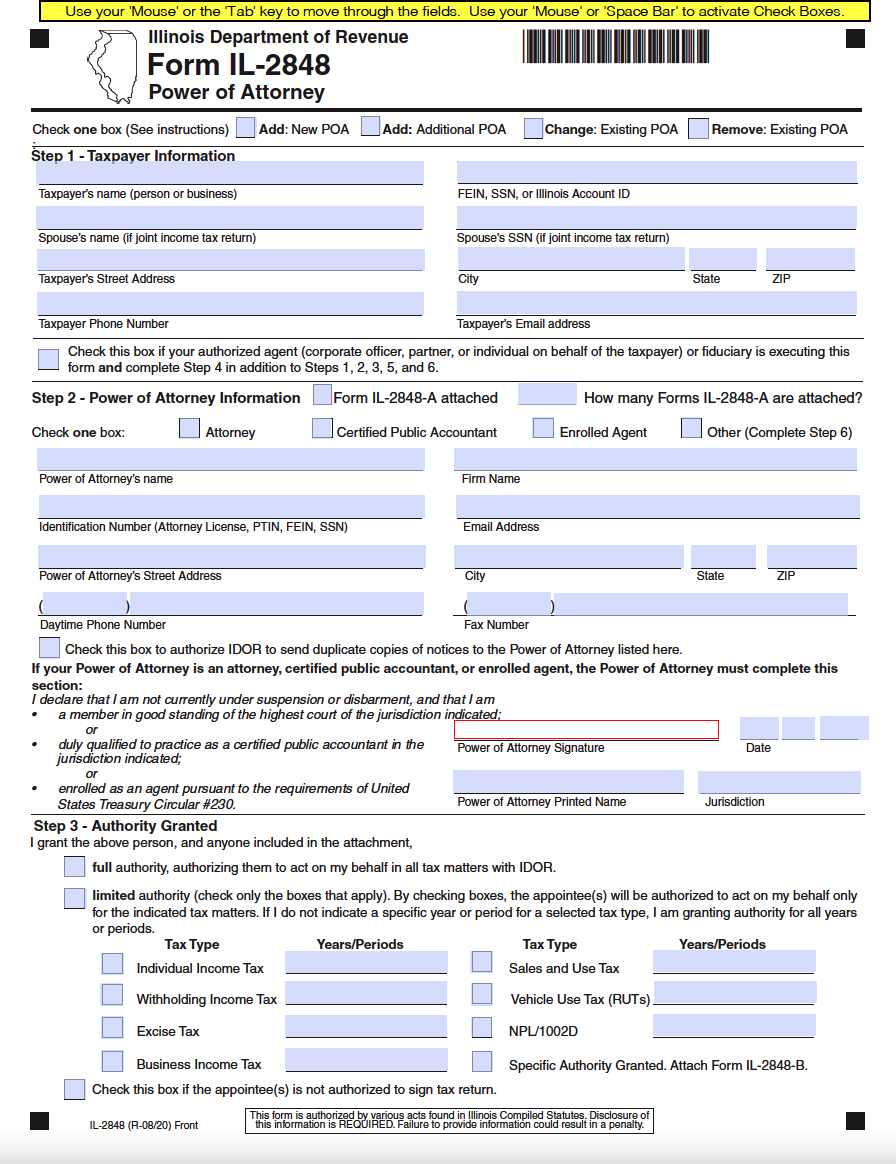

The Illinois Tax Power of Attorney (Form IL-2848) is the appropriate road to take when designating an individual or an accounting firm to execute tax duties on your behalf. This particular form was actually created by the state of Illinois to assist residents with the process of appointing a third (3rd) party to handle these types of affairs. To better understand the components of this document, interested parties should review the content within to ensure that it is suited to their needs. If this is something that you want to follow through with, you should be prepared to supply the personal data of yourself & the attorney-in-fact, choose which functions the agent will have access to, and sign in the presence of two (2) witnesses or a notary public.

Laws

Statute – Tax Matters (755 ILCS 45/3-4(i))

Definition – “Agency” means the written power of attorney or other instrument of agency governing the relationship between the principal and agent or the relationship, itself, as appropriate to the context, and includes agencies dealing with personal or health care as well as property. An agency is subject to this Act to the extent it may be controlled by the principal, excluding agencies and powers for the benefit of the agent. (755 ILCS 45/2-3(a))

Signing Requirements – Acknowledgment of Two (2) Witnesses or a Notary Public

Additional Resources

Illinois Department of Revenue – Form IL-2848 Instructions

Related Forms (4)

Notice of Fiduciary Relationship (Form IL-56)

Notice of Fiduciary Relationship (Form IL-56)

Download: Adobe PDF

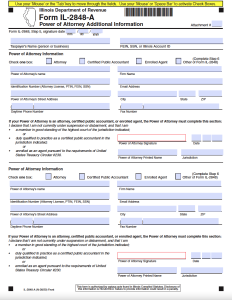

Power of Attorney Additional Information (Form IL-2848-A)

Power of Attorney Additional Information (Form IL-2848-A)

Download: Adobe PDF

Power of Attorney for Electronic Processing (Form IL-2848-E)

Power of Attorney for Electronic Processing (Form IL-2848-E)

Download: Adobe PDF

Power of Attorney Specific Authority Granted (Form IL-2848-B)

Power of Attorney Specific Authority Granted (Form IL-2848-B)

Download: Adobe PDF

Comments