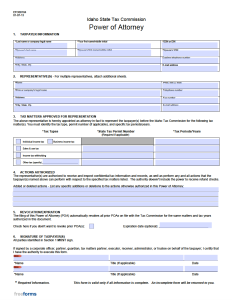

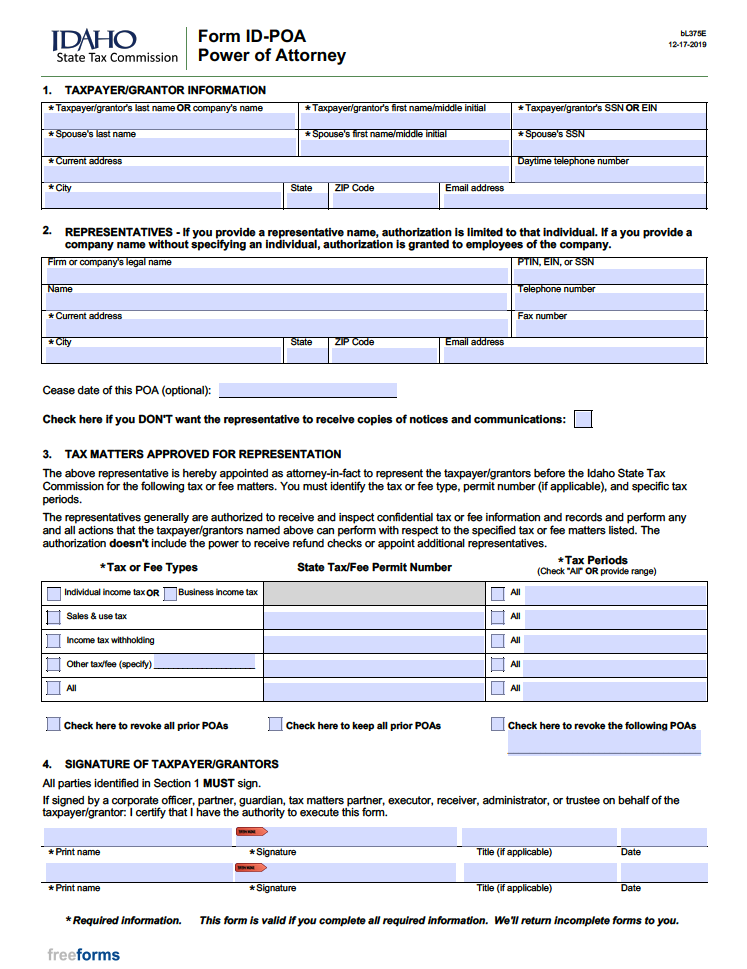

The Idaho Tax Power of Attorney is a form originated by the State Tax Commission that is often used by those wanting to assign certain duties to their accountant, attorney, or any other representative they wish to appoint. The document itself is pretty straightforward, only requesting that the issuing party provide their information as a taxpayer, their representative’s details, and the tax matters that they wish to be handled on their behalf. Following the customization of these terms, the principal (taxpayer) is required to sign the instrument as directed.

Laws

Statute – § 15-12-216

Definition – “Power of attorney” means a writing or other record which grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 15-12-102(7)).

Signing Requirements – Only requires the signature(s) of the taxpayer(s)/grantor(s).

Other Versions

Idaho Tax Power of Attorney – Previous Edition

Idaho Tax Power of Attorney – Previous Edition

Download: Adobe PDF

How to File

In order to file this document with the Idaho State Tax Commission, the executor(s) may send a completed copy (via mail or fax) to the tax office or employee that they have been in communication with. If they have not been in contact with their local department or an agent working for the state, they may simply revert to sending the document to:

Idaho State Tax Commission

PO Box 36

Boise, ID, 83722-0410

OR

By Fax to (208) 334-5364

Additional Resources

- Idaho State Tax Commission – Power of Attorney General Information

- Idaho State Tax Commission – Power of Attorney Instructions

Related Forms

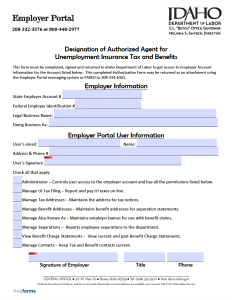

Designation of Authorized Agent for Unemployment Insurance Tax & Benefits

Designation of Authorized Agent for Unemployment Insurance Tax & Benefits

Download: Adobe PDF, MS Word (.docx)

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

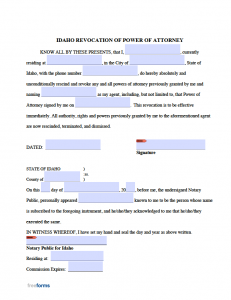

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments