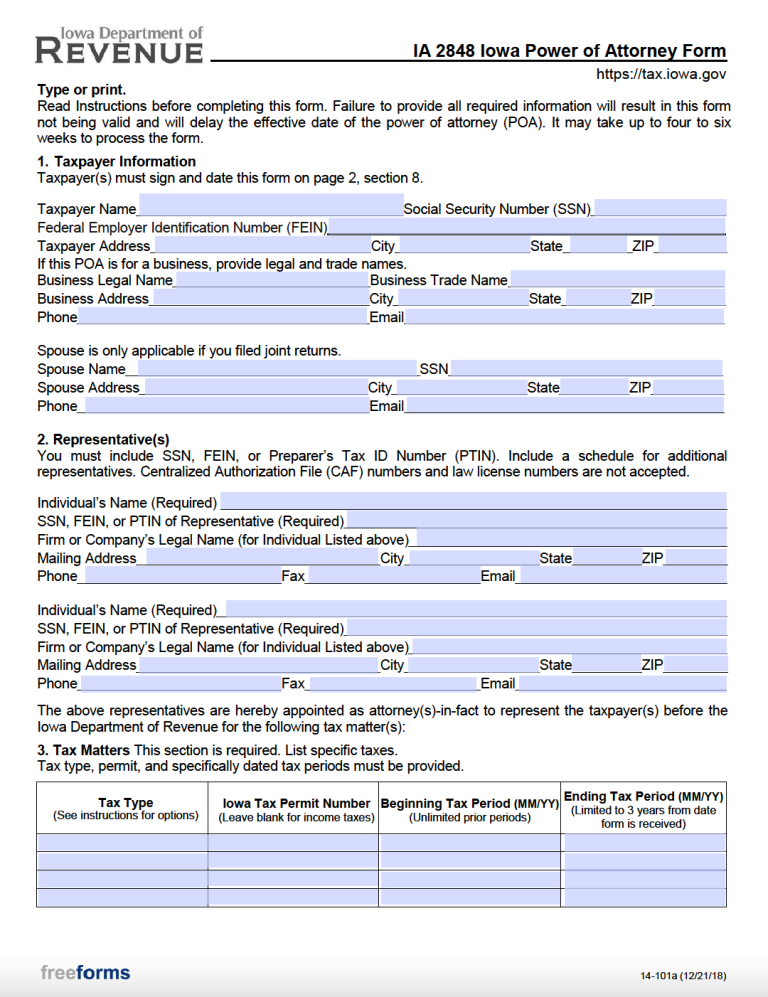

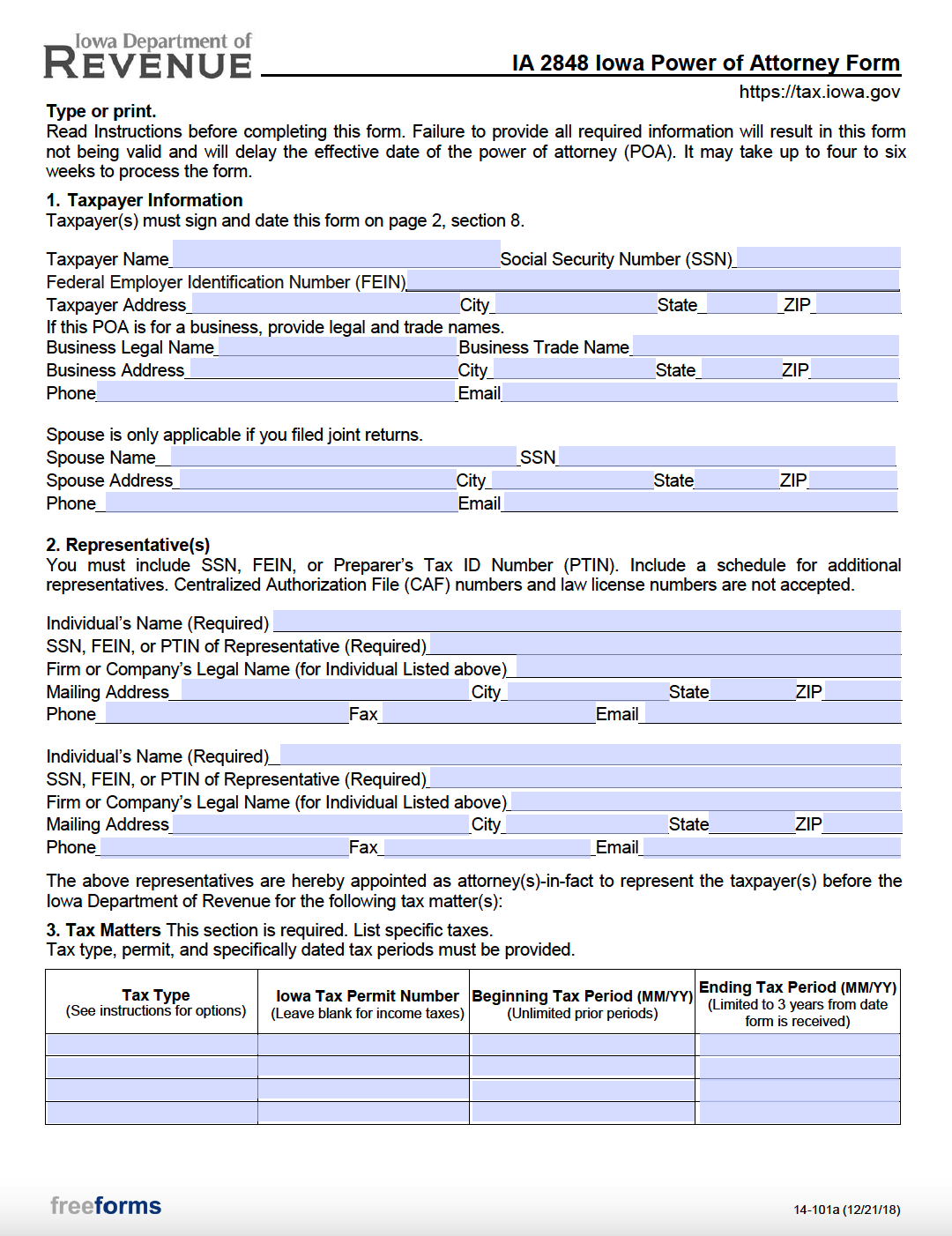

The Iowa Tax Power of Attorney (Form 14-101a) is offered to the people of the state by the local government’s Department of Revenue. Its purpose is to allow individuals to supply their representation (an accountant, attorney, or another type of agent) with the right to perform tax functions in their name. Users can limit the amount of authority given by inputting the exact type of tax matters that they want to be managed on their behalf. Apart from establishing the access that will be granted, the principal must identify every individual/entity involved, sign the document, and then send it to the corresponding department for proper registration (view the “How to File” section below for further instructions).

Laws

Statute – Taxes (§ 633B.216)

Definition – “Power of attorney” means a writing that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used (§ 633B.102(9)).

Signing Requirements – Necessitates the signature of the principal(s).

How to File

Following the completion of Form 14-101a, the taxpayer must deliver a copy of the document to the appropriate department by sending it through one of the following two (2) options:

By Mail:

Registration Services

Iowa Department of Revenue

PO Box 10470

Des Moines IA 50306-0470

OR

By Fax:

515-281-3906

Additional Resources

Iowa Department of Revenue – Tax Power of Attorney (Form 14-101a) Instructions

Related Forms

Agent Certification (Form 14-107)

Agent Certification (Form 14-107)

Download: Adobe PDF

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments