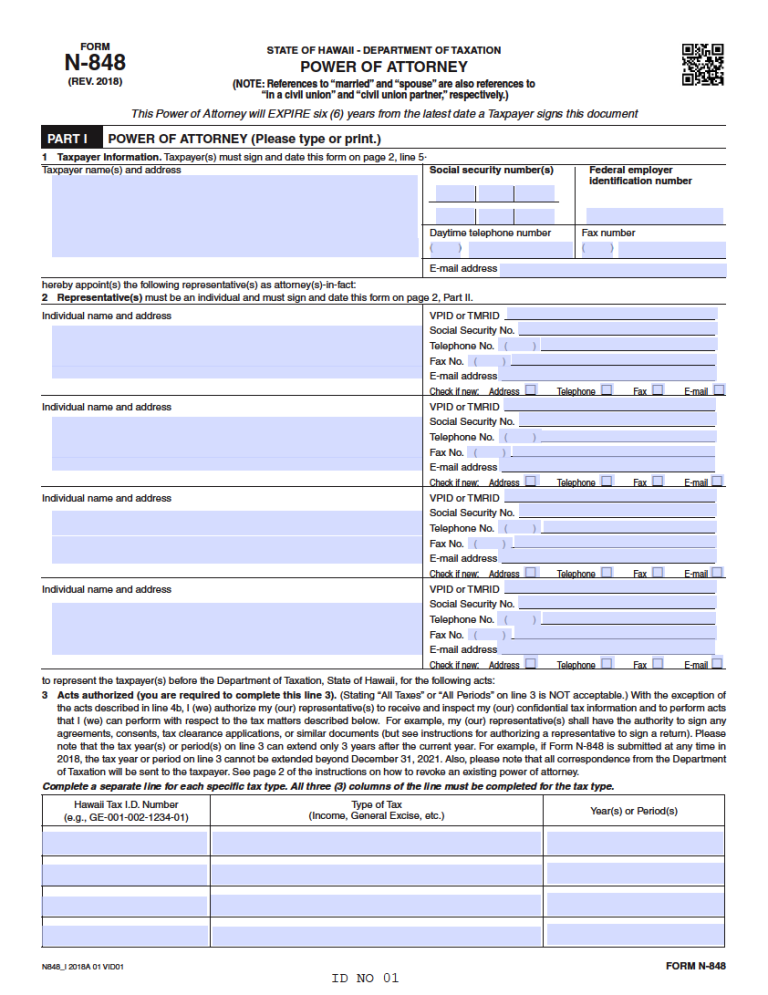

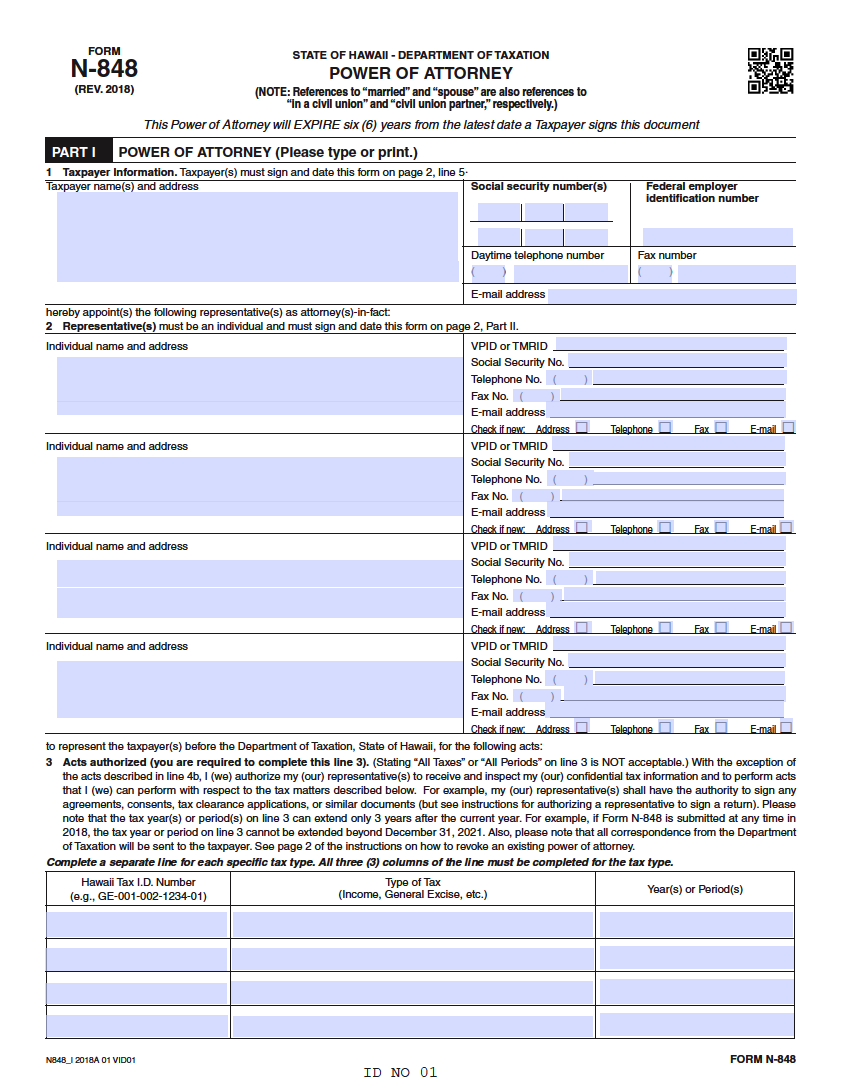

The Hawaii Tax Power of Attorney facilitates the conveyance of powers to another person/entity so that they may act on the behalf of the principal regarding tax-related issues. The majority of people carrying out this form are those who wish to grant their accountant or tax attorney the right to receive, sign, & file their personal documents. Individuals interested in this should be prepared to:

- Supply details pertaining to themselves and their representation.

- Choose which tax powers they wish to offer.

- Sign the instrument along with their agent.

Laws

Statute – § 551E‑46

Definition – § 551E-1

Signing Requirements – The taxpayer(s) and their representative(s) must sign the instrument.

How to File

Each time a taxpayer’s agent files paperwork on their behalf, they must additionally include a copy of the executed POA form if the particular document being filed requires it (e.g., a Tax Clearance Application). Individuals who have executed this instrument should mail it to:

Hawaii Department of Taxation

P.O. Box 259

Honolulu, HI 96809-0259

OR

By FAX to (808) 587-1488

(The method of sending may vary if an agent of the Department of Taxation provides the filing party with contact instructions.)

Additional Resources

Department of Taxation – Instructions for Form N-848

Related Forms

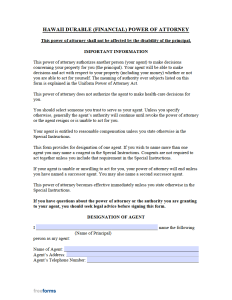

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments