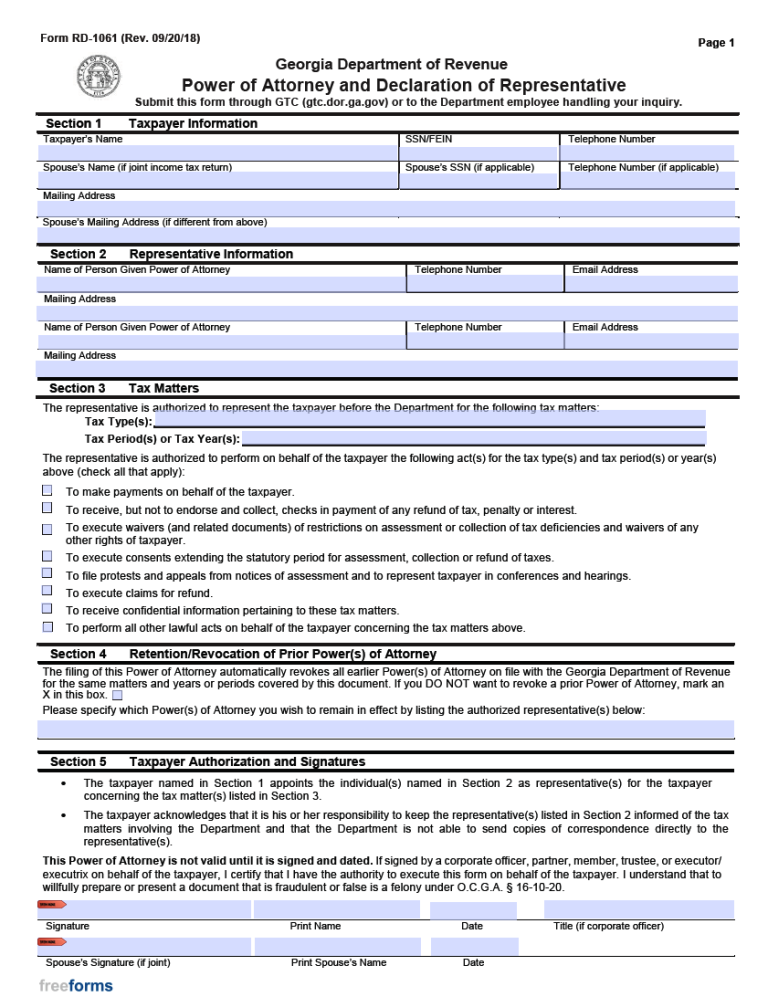

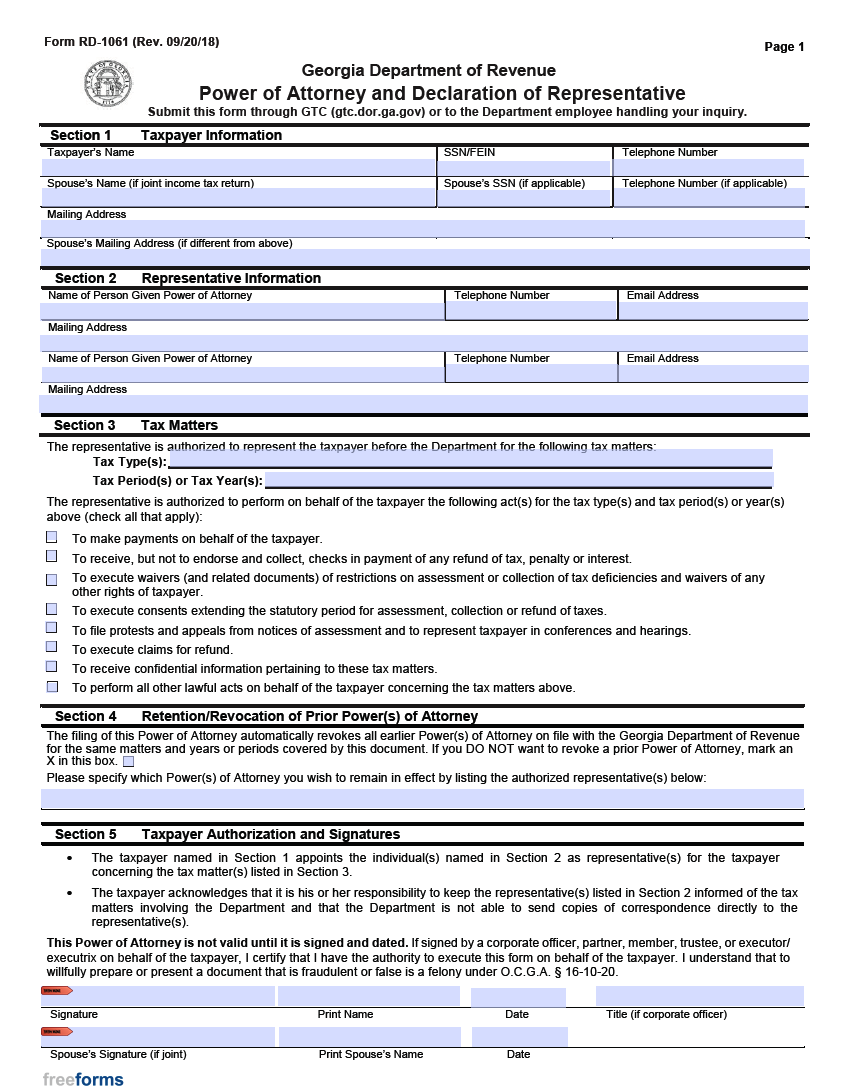

The Georgia Tax Power of Attorney (Form RD-1061) is a government form offered to the citizens of the state so that they may appoint a third (3rd) party to take care of certain tax matters. Basically, this form can authorize the taxpayer’s representative to receive & sign confidential paperwork, pay tax-related debts, and execute filings in their name. Once the parties have been named and the powers selected, the principal (taxpayer) must sign the instrument along with their representative to finalize the form (review the signing requirements below to ensure a valid document).

Laws

Statute – § 10-6B-55

Definition – § 10-6B-2(7)

Signing Requirements – Necessitates the acknowledgment of a notary public unless the representative accepting the authority is licensed to practice as an:

- Attorney-at-Law

- Certified or Registered Public Accountant

- Agent of the Internal Revenue Service

Additional Resources

- Georgia Department of Revenue – 3rd Party Authorizations for Resolving a Tax Issue

Related Forms

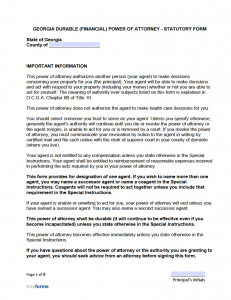

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

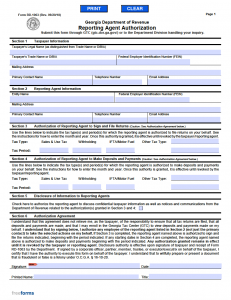

Reporting Agent Power of Attorney (Form RD-1063)

Reporting Agent Power of Attorney (Form RD-1063)

Download: Adobe PDF

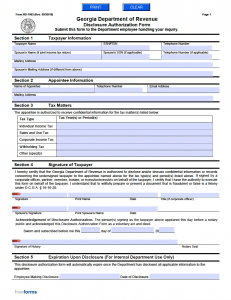

Tax Disclosure Authorization (Form RD-1062)

Tax Disclosure Authorization (Form RD-1062)

Download: Adobe PDF

Unemployment Insurance Tax Power of Attorney

Unemployment Insurance Tax Power of Attorney

Download: Adobe PDF

Comments