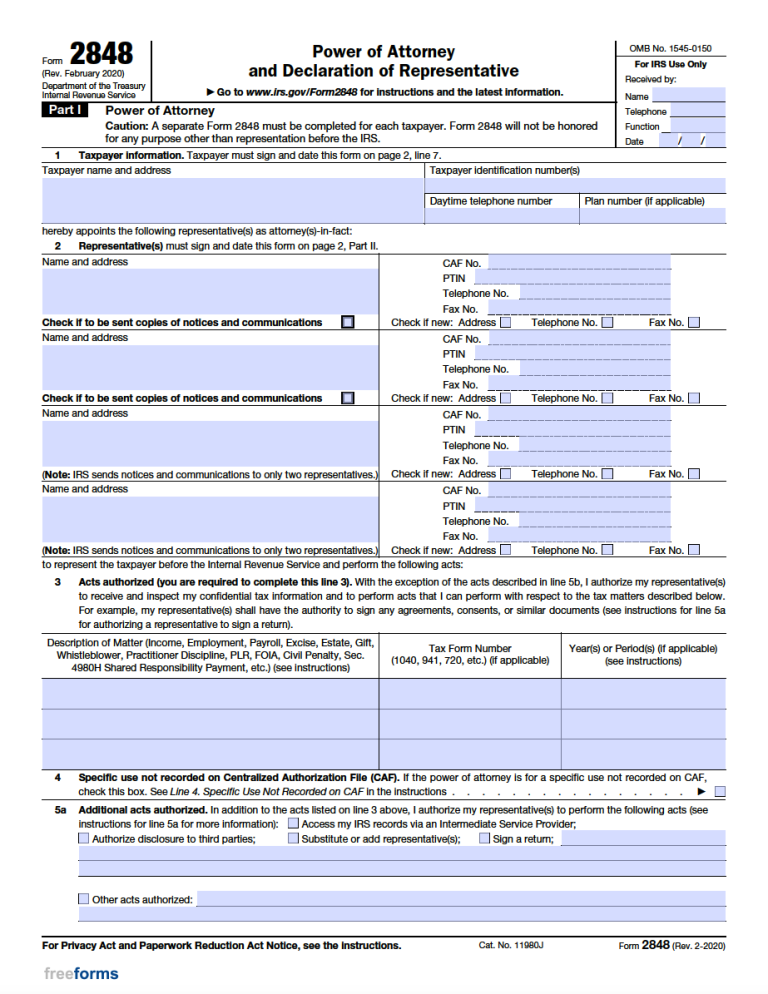

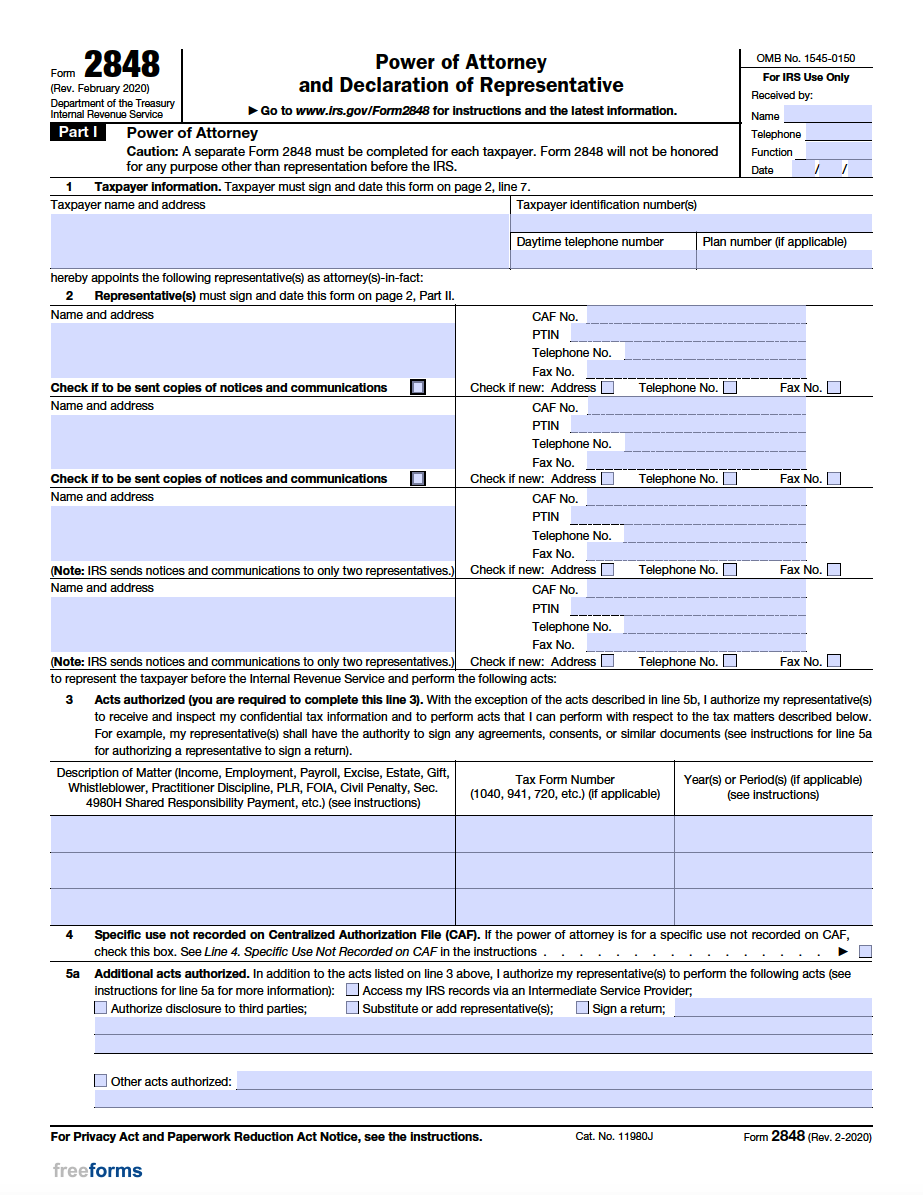

The Delaware Tax Power of Attorney (Form 2848) can be used to supply citizens with the option of appointing a representative to manage certain personal tax affairs on their behalf. Fulfilling the document’s requirements is relatively straightforward, allowing the taxpayer to allocate controls to be distributed to a designated professional. The document confirms information related to the personal identities of the taxpayer & representative, the acts being authorized, and any limitations the grantor would like to impose. Once the instrument has been customized to the principal’s liking, they may sign it along with the representative(s) to confirm the transfer of authority.

Laws

Statutes – Title 12, Chapter 49A: Durable Personal Powers of Attorney Act (§ 49A-101 – § 49A-301)

Signing Requirements – Must be signed by the taxpayer and their representative(s).

How to File

When the form has been sufficiently filled and signed as requested, it can then be submitted to the Delaware Division of Revenue. The procedure for delivery of the paperwork can be carried out as instructed by your local DDR representative. For contact information regarding the specific fax number associated with your area, call (302) 577-8200 to inquire.

Additional Resources

- Community Legal Aid Society – Delaware Powers of Attorney FAQ

- Internal Revenue Service – Form 2848 Instructions for Submission to the IRS

Related Forms (3)

- Authorization to Release Tax Information (Form 8821DE)

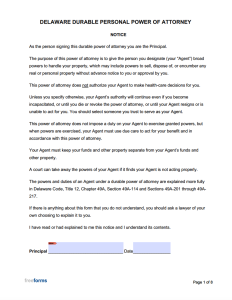

- Durable (Financial) Power of Attorney

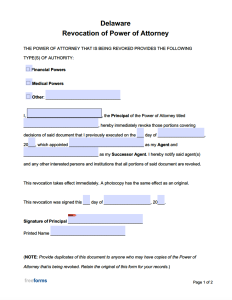

- Revocation of Power of Attorney

Authorization to Release Tax Information (Form 8821DE)

Authorization to Release Tax Information (Form 8821DE)

Download: Adobe PDF

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments