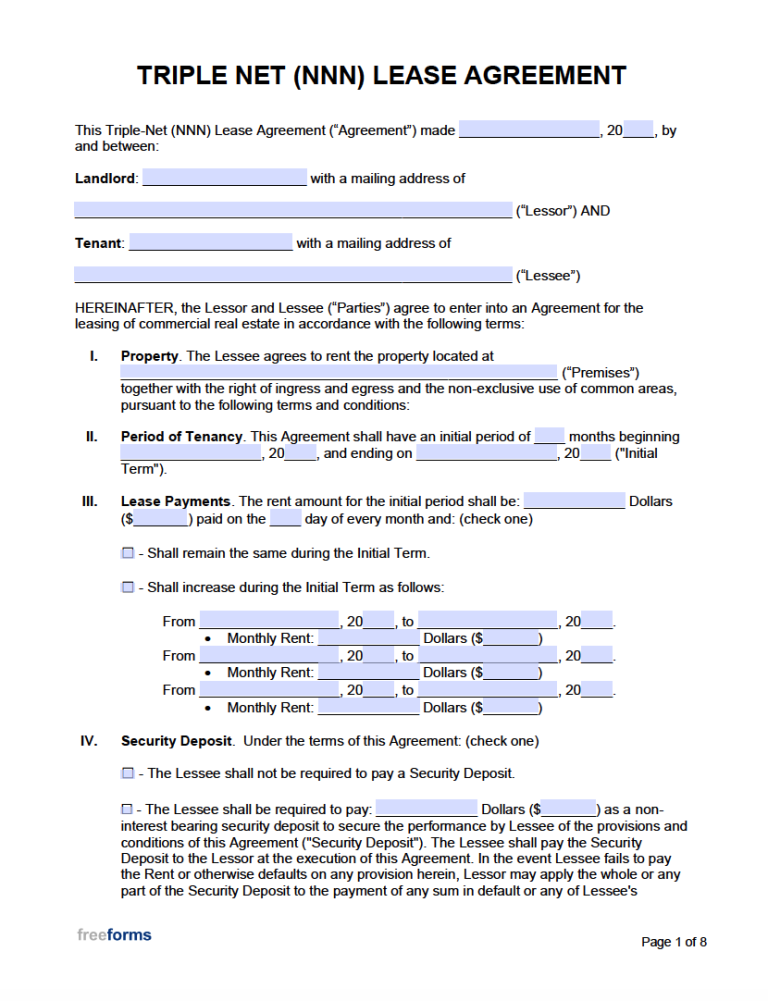

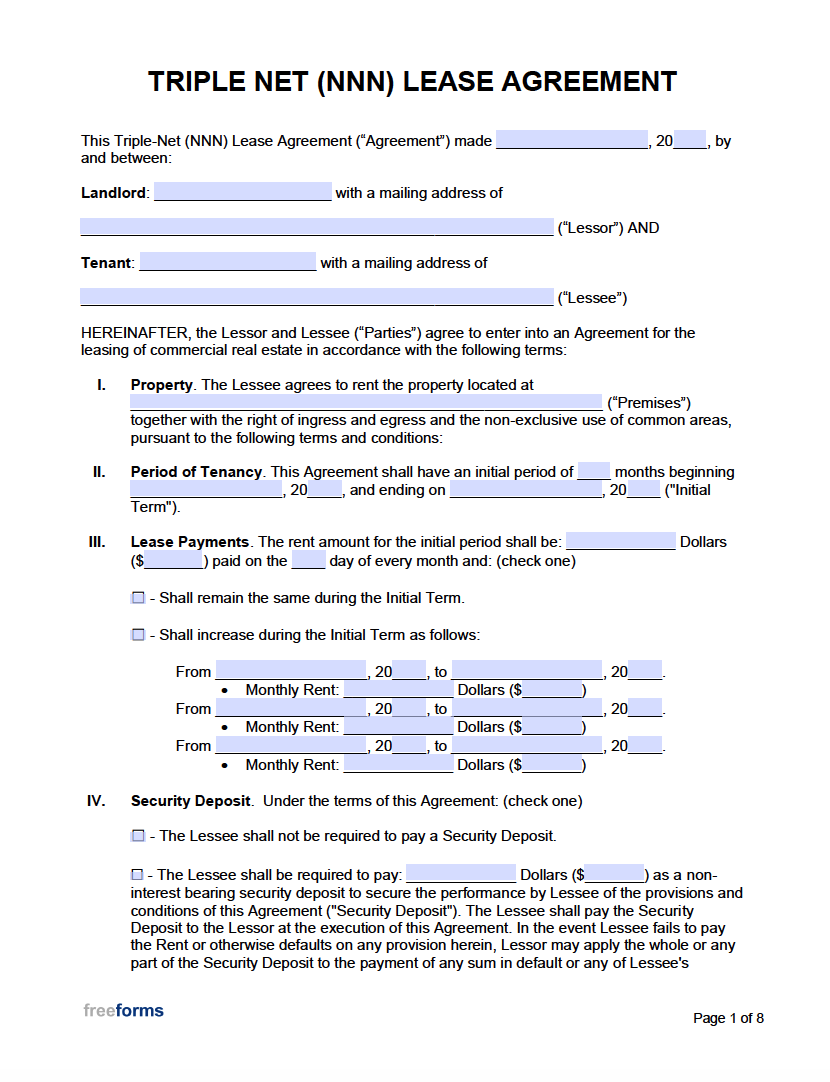

This lease should include the property’s taxes, insurance, and common area maintenance (CAM). If this format interests the individuals partaking in the exchange, they should fill out the form with the required information and be as specific as possible concerning the various elements.

After both parties have reviewed the document to make sure that the data is true and accurate, it should be signed by each participant while in the presence of a notary public. This way, the notarial agent can attest to the parties finalizing the document, and they can then verify the form by providing their seal, signature, and expiration date of their commission.

What is a Triple-Net (NNN) Lease?

A triple-net lease is an agreement where the responsibility for the majority of the expenses is assigned to the commercial tenant. In addition to rent and utilities, tenants will typically pay for taxes associated with the real estate, the insurance on the building, and the operating fees associated with the property. When engaging in this type of lease, the monthly rental cost is usually less expensive than the rates on a gross lease because the tenant is assuming more of the inherent expenses. This leasing classification is categorized as a low-risk option for landlords seeking a stable income form a property without being liable for costs normally associated with owning real estate. A net lease commonly refers to a contract where the lessee will be obligated to pay property insurance. A double-net lease is used to indicate a lease where the tenant will pay insurance on the building as well as the taxes. Triple-net leases furthermore augment the rental arrangement to include common area maintenance (CAM) costs falling on the shoulders of the lessee.

What are Common Area Maintenance Charges?

Common area maintenance fees or CAM’s are defined as expenditures associated with the upkeep of the rented space. The CAM fees that a tenant will be responsible for are to be formally outlined in the lease agreement. The standard costs associated with common area maintenance are:

- Improvements

- Administrative Salaries/Fees

- Security

- Delivery Area Maintenance

- Landscaping

- Snow Removal

- Janitorial

- City Permits and/or Legal Costs

- Required Repairs:

- Electrical

- Water/sewer

- Roofing

- Heating/Cooling Systems

- Parking Lot Pavement/Fixtures

- Painting of Interior/Exterior

Additionally, depending on the property type and leasing contract, a tenant may also be obligated to pay a pro-rata amount regarding the use of space in a mall or plaza. A pro-rata amount is a supplementary charge determined by the ratio of the area of occupancy to the entirety of the shopping center. Should the leased space account for 2,000 square feet of a 10,000 square foot property, the pro-rata share will be 20%. Revise the commercial lease for a clause referring to the provision.

What Does a Landlord Pay in a Triple-Net Lease?

Although a triple-net lease explicitly states the accounting of charges that the tenant is liable for, there may be an allocated amount that falls to the landlord. In many cases, a maximum amount that a tenant will be responsible for the duration of a leasing period in reference to common area maintenance is determined by the cap agreed-upon by the participating parties. Should a cap be instituted in the lease documentation, it will allow for the lessee to pay up to a certain amount of overhead costs at a pre-determined rate per square foot. This condition requires the lessor to pay any sum over and above the specified amount.

According to the lease particulars, triple-net (NNN) expenses are commonly paid to the owner of the property to be allocated to payments for property taxes and insurance. Should the incurred charges end up being less than anticipated, the tenant will be reimbursed for any overpayment at the end of the year.

Triple-Net vs. Gross Lease

| Lease Component | Triple-Net (NNN) | Modified-Gross | Gross |

|---|---|---|---|

| Real Estate Taxes | T | D | L |

| Property Insurance | T | D | L |

| Common Area Maintenance (CAM) | T | D | L |

| Repairs | T | D | L |

| Improvements | T | D | L |

| Utilities | T | D | D |

|

T – Tenant Pays, L – Landlord Pays, D – Determined by Lease Provisions on an Individual Basis |

|||

Triple-Net Lease Calculator

Having an understanding of how your lease rates are computed is advantageous to both the tenant and leasing owner for a commercial space. An alternative to studying the technique to utilize yourself is to make use of the Commercial Lease Calculator. If you would rather choose to estimate the amount for yourself, the process can be tabulated using the following procedure:

How to Calculate

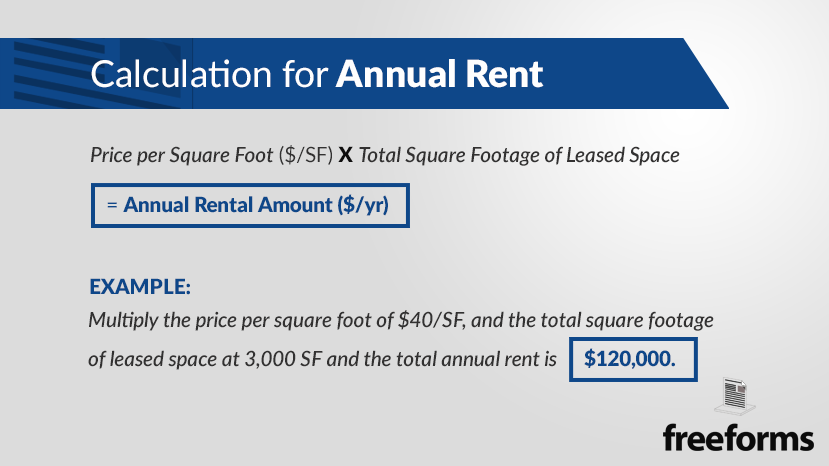

Calculation for Annual Rent

Price per Square Foot ($/SF) X Total Square Footage of Leased Space

= Annual Rental Amount ($/yr)

Example: Multiply the price per square foot of $40/SF and the total square footage of leased space at 3,000 SF, and the total annual rent is $120,000.

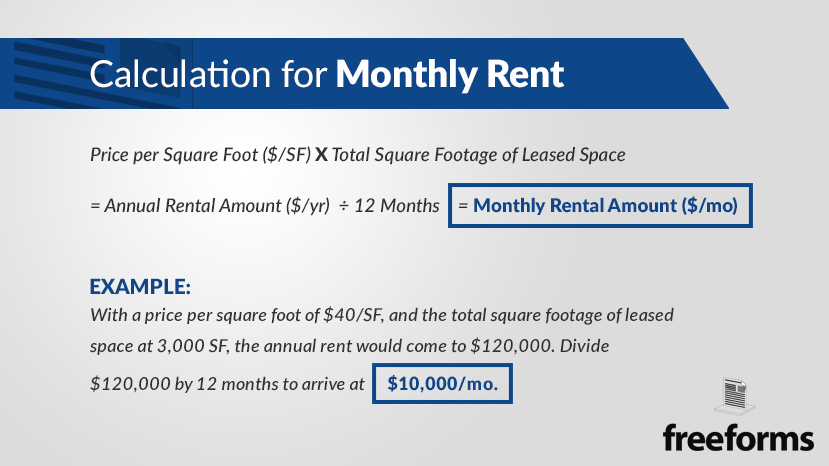

Calculation for Monthly Rent

Price per Square Foot ($/SF) X Total Square Footage of Leased Space

= Annual Rental Amount ($/yr) ÷ 12 Months = Monthly Rental Amount ($/mo)

Example: With a price per square foot of $40/SF, and the total square footage of leased space at 3,000 SF, the annual rent would come to $120,000. Divide $120,000 by 12 months to arrive at $10,000/mo.

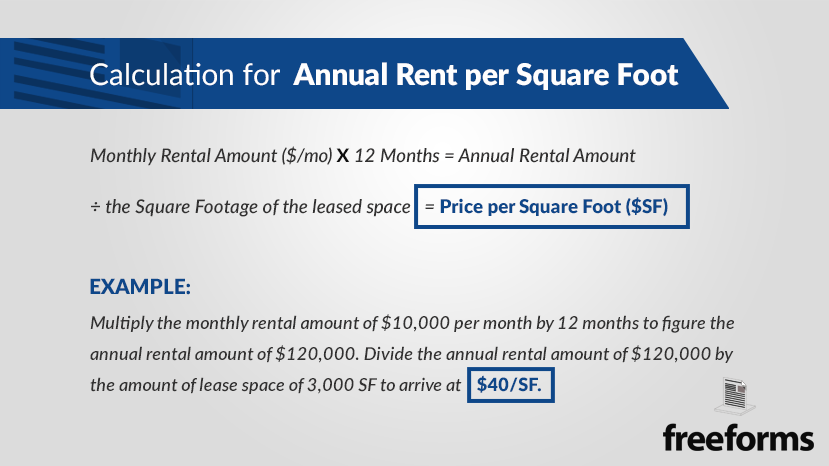

Calculation for Annual Rent per Square Foot

Monthly Rental Amount ($/mo) X 12 Months = Annual Rental Amount

÷ the Square Footage of the leased space = Price per Square Foot ($SF)

Example: Multiply the monthly rental amount of $10,000 per month by 12 months to figure the annual rental amount of $120,000. Divide the annual rental amount of $120,000 by the amount of lease space of 3,000 SF to arrive at $40/SF.

Comments