How to Register a Vehicle

Once you have purchased your new vehicle, you have up to 30 days to have it registered. Visit your local OMV(Office of Motor Vehicle) and be sure to bring the following items:

- The title of the vehicle.

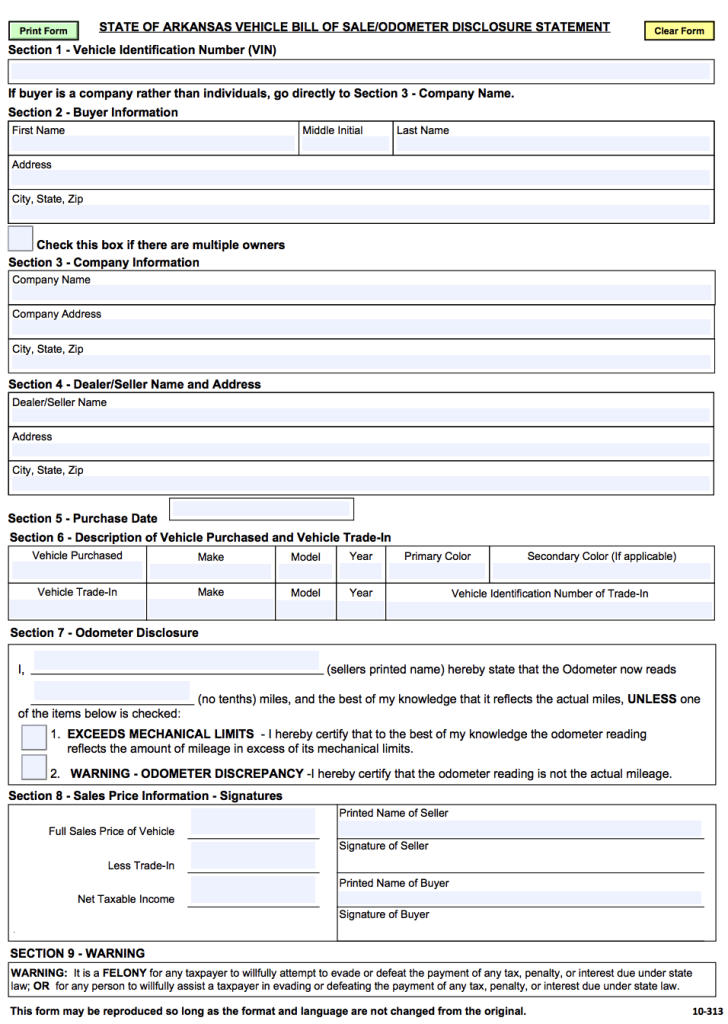

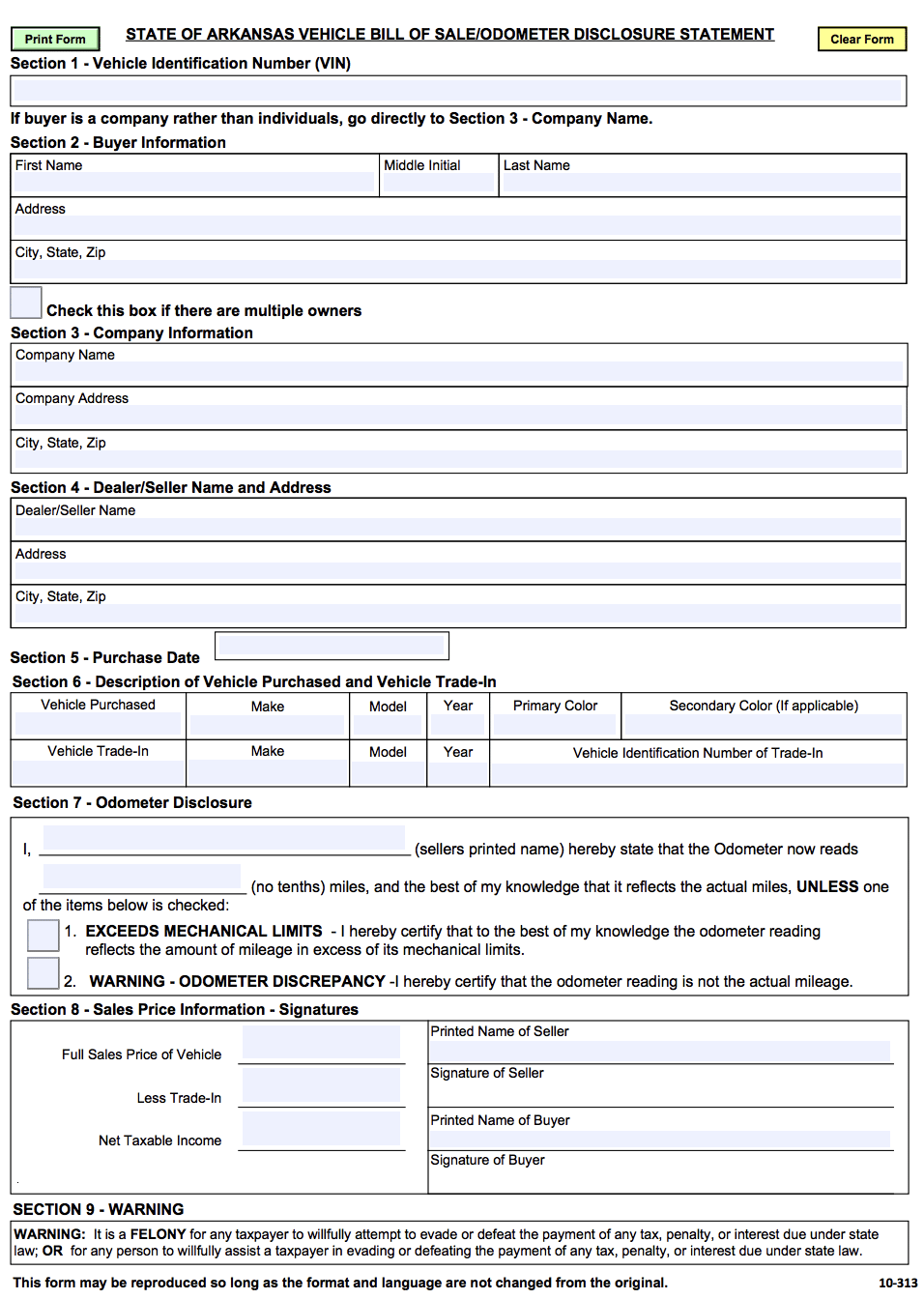

- Bill of sale (if there was no room for the seller to sign on the title).

- A Vehicle Registration Application (Form 10-381) must be completed upon arrival (this application is also used for titling).

- You must provide an Odometer Disclosure Statement (If your vehicle is less than 10 years old, it can be found on the back of the title).

- Proof of VIN verification – corresponding with § 27-14-725.

- Proof the vehicle has been assessed by a certified county assessor within the present year.

- Proof that all taxes have been paid to date for the vehicle. Evidence such as a county tax collector receipt or a stamp that certifies your tax payment on your assessment papers shall qualify as sufficient confirmation.

- Proof of insurance.

- Be sure to bring sufficient funds to pay for the registration fees (prices vary by vehicle weight).

Comments