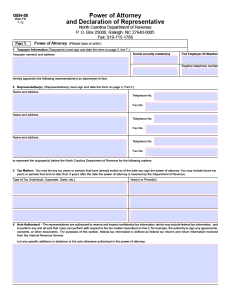

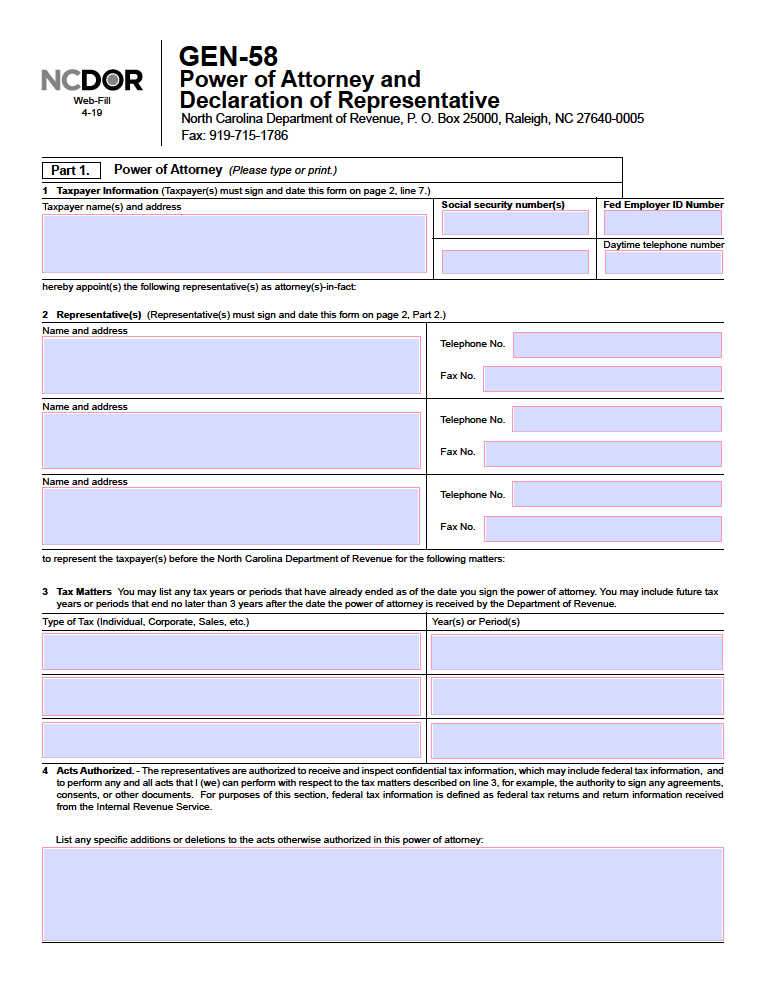

The North Carolina Tax Power of Attorney derives acknowledged approval fore a tax specialist in representing a taxpayer or business entity concerning state tax situations. The state provides the form to officially deliver agency to a tax professional to allow them the right to view confidential tax materials concerning the principal party, communicate to the associated revue department(s), and take action on the declarant’s behalf. Although a general tax filing does not require the submission of the document, it must be completed and received by the North Carolina Department of Revenue should a request be issued. This may occur if there is a need for clarification on a tax return or in cases where an audit is pending.

Laws

Definition – “Power of Attorney”- A writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 32C-1-102(9)).

Signing Requirements – Signatures from the included taxpayers must be obtained in addition to the permitted attorney-in-fact.

How to File

The form must be mailed to the indicated office address as denoted by the state’s communication request. The NC Department of Revenue’s main office address is listed below:

By Mail:

North Carolina Department of Revenue

501 North Wilmington Street

Raleigh, NC 27604

Other Versions

Tax Power of Attorney (Form GEN-58) (Previous Edition)

Download: Adobe PDF

Additional Resources

- Capital Tax and Financial – FAQs About Powers of Attorney

- NC Department of Revenue – Power of Attorney

- NC Department of Revenue – FAQs About Powers of Attorney

- NC Department of Revenue – Power of Attorney Policy

Related Forms (3)

- Durable (Financial) Power of Attorney

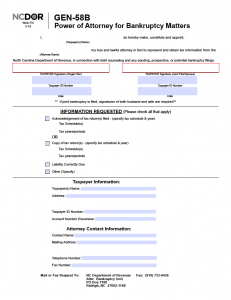

- NC Tax Power of Attorney for Bankruptcy Matters

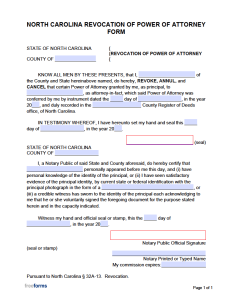

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

NC Tax Power of Attorney for Bankruptcy Matters (Form GEN-58B)

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments