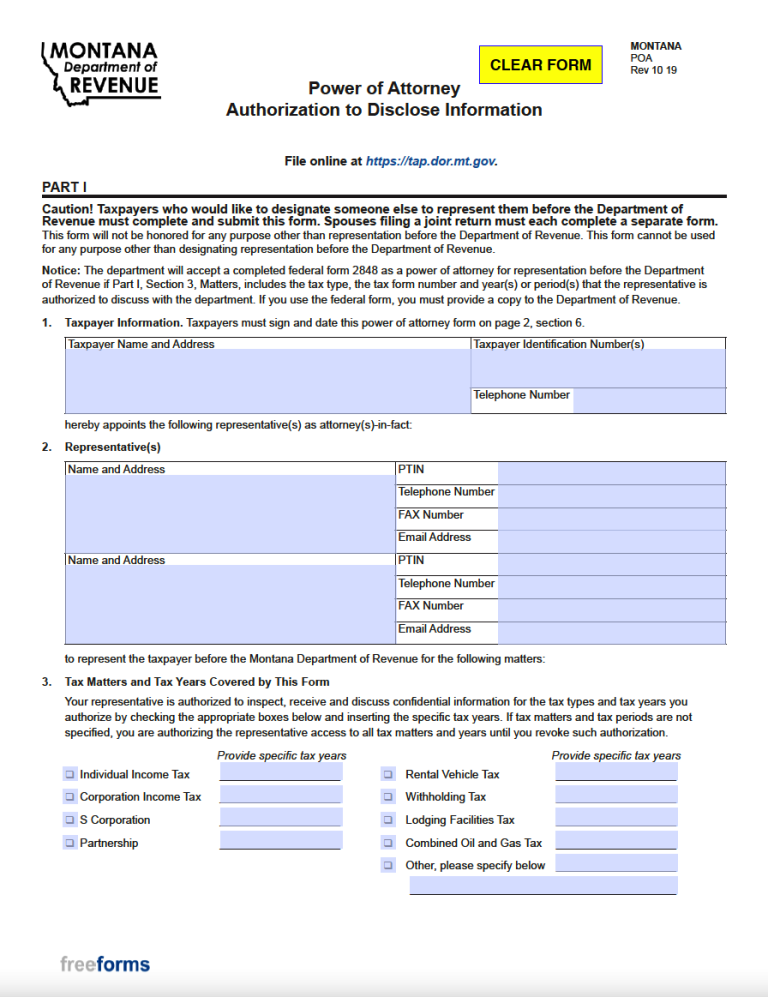

The Montana Tax Power of Attorney is the Montana Department of Revenue form used to authorize representation concerning an individual or company’s official state tax matters. The document essentially permits an attorney, accountant, or other nominated representative to sign, communicate, and submit on behalf of the taxpayer. The formal understanding is standard practice for those that wish to administer complicated tax issues to a specialist.

Laws

Statute – Title 72, Chapter 31, Part 3: Montana Uniform Power of Attorney Act

Definition – § 72-31-351

Signing Requirements – Effectively issuing the powers will necessitate all associated taxpayers and authorized agents to sign in the appropriate areas.

How to File

Submitting the paperwork can be performed by either filing on Montana’s Online TransAction Portal or by delivering via one of the following methods:

By Mail:

Montana Department of Revenue

309 N. Last Chance Gulch

PO Box 5805

Helena, MT 59604-5805

OR

By Fax:

(406) 444-7723

Other Versions

Tax Power of Attorney Form (Previous Edition)

Download: Adobe PDF

Additional Resources

- Montana Law Help – Power of Attorney in Montana (Financial)

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments