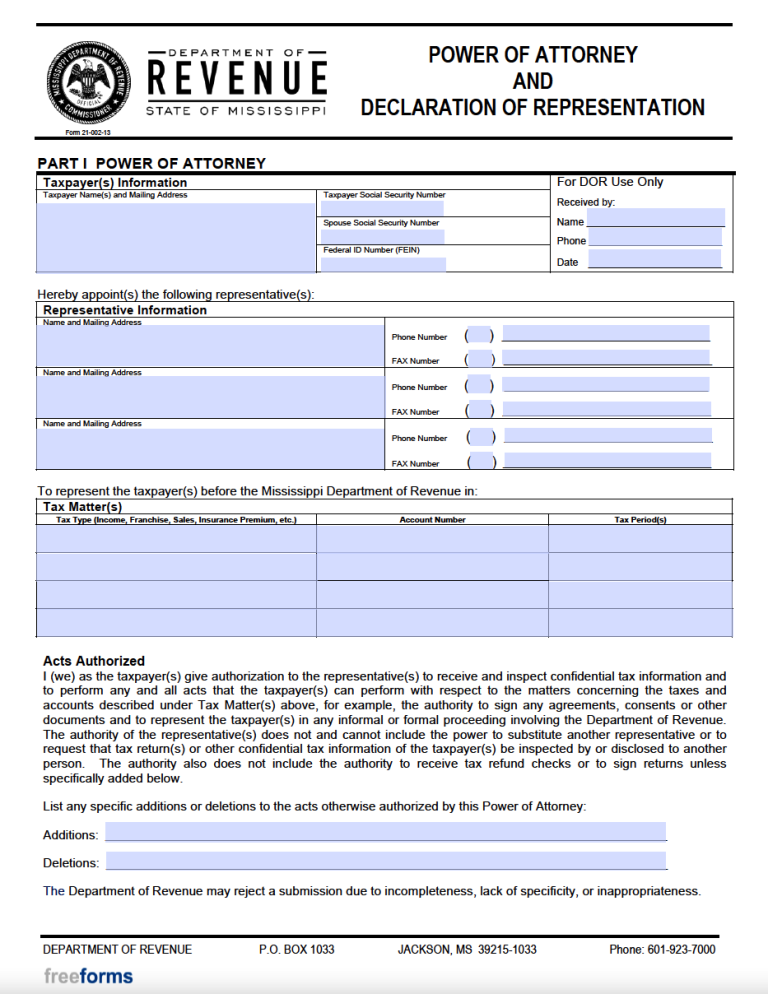

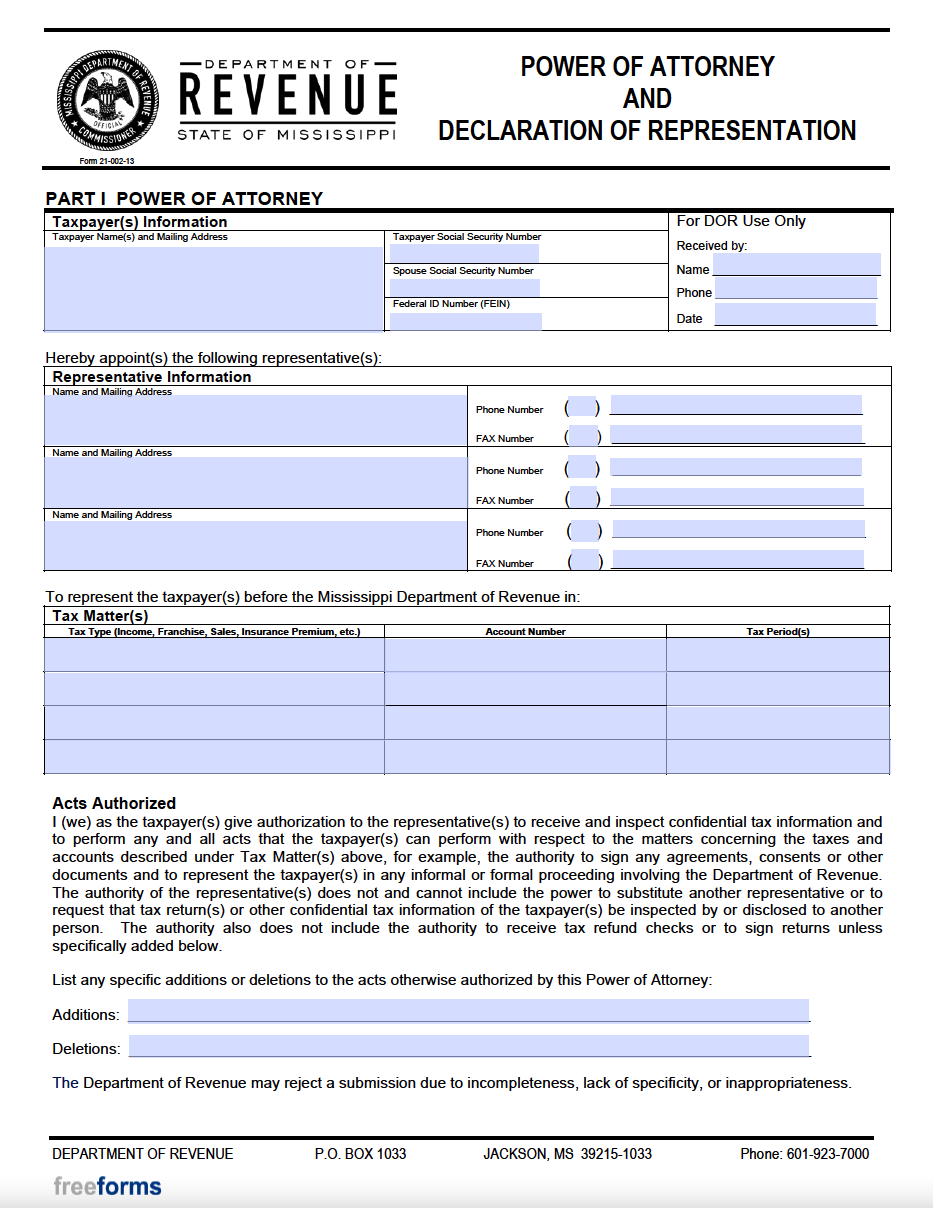

The Mississippi Tax Power of Attorney (Form 21-002) is the Department of Revenue’s official form for delegating personal tax affairs to another individual or entity. So if a taxpayer decides that they would like a third (3rd) party, such as a CPA, to file on their behalf, they can legally arrange this by completing and submitting this form as instructed. The primary sections will necessitate the information of the taxpayer themselves, their representation, and the matters that will be handled for them. Following the addition of these details, the principal party will have to sign the instrument along with their representative(s) to secure a binding document.

Laws

Statute – By signing this document, the principal certifies under oath that all the data recorded is accurate and that they have the legal right to endorse the form as the taxpayer (or in the place of the taxpayer) and understand that this instrument is being signed under penalty of perjury (§ 27-3-83(5)).

Signing Requirements – Must be signed by the taxpayer(s) and their representative(s).

Related Forms

Request for Copies of Tax Returns (Form 70-698)

Request for Copies of Tax Returns (Form 70-698)

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments