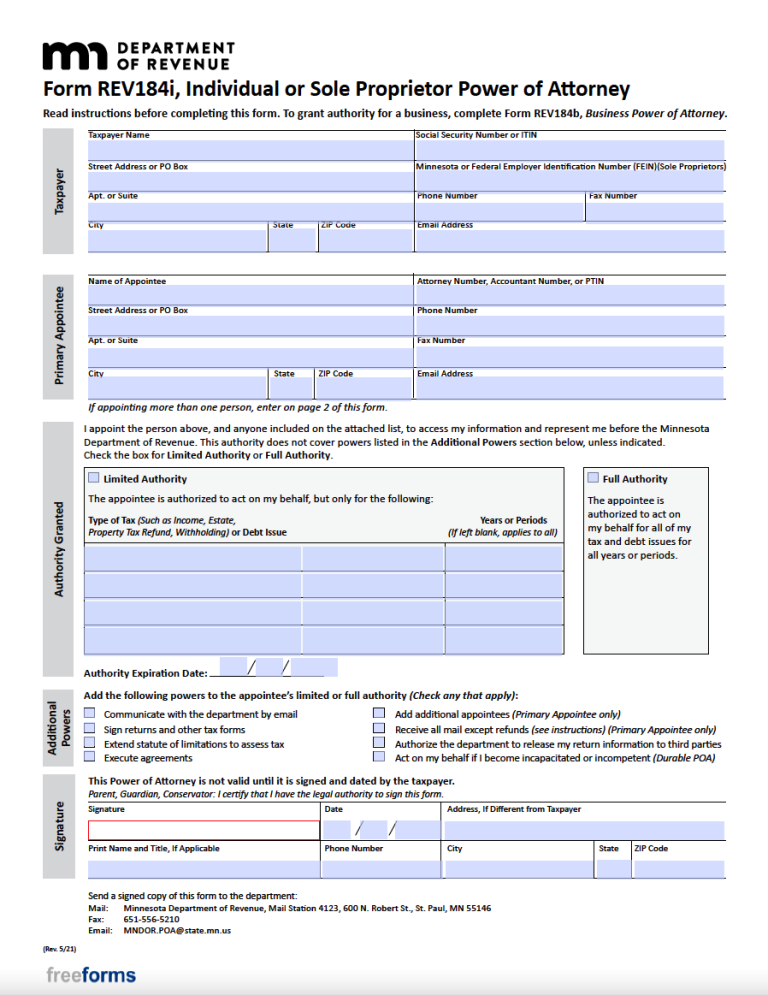

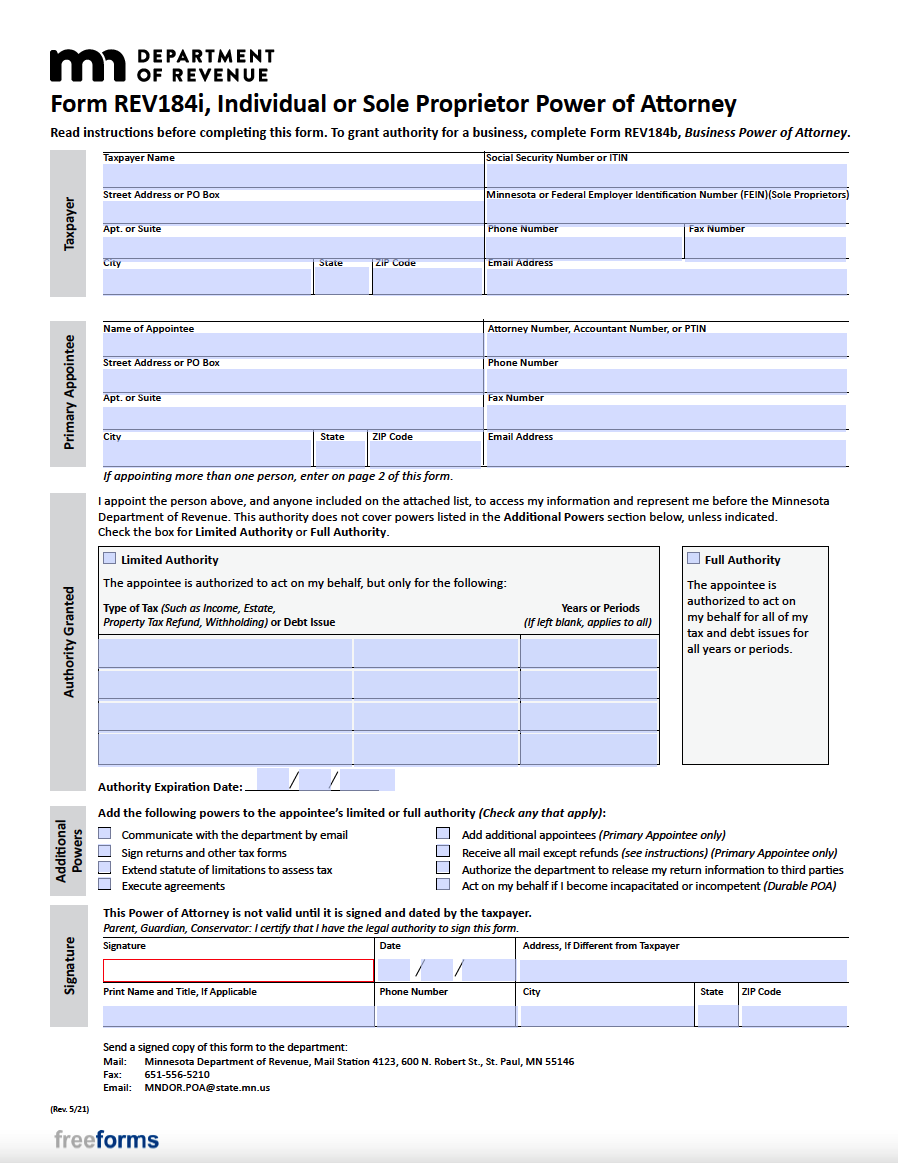

The Minnesota Tax Power of Attorney (Form REV184i) is designated for individuals and sole proprietors who would like to delegate certain tax matters to a person or entity of their choice. This particular form was issued by the Department of Revenue to assist locals in the process of authorizing their accountants, attornies, or other alternative agents to conduct such affairs in their name. All that is necessitated for a binding document is the information regarding the taxpayer & their appointee, the types of authority that will be delivered, and the signature of the granting party. (For further information, please read the state’s instructions on how to file this form.)

Laws

Statute – Records, Reports, and Statements (§ 523.24(13)(2))

Signing Requirements – Only demands the signature of the taxpayer authorizing the conveyance of powers.

Other Versions

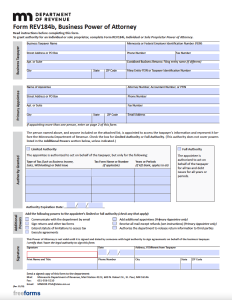

Minnesota Tax Power of Attorney for Business (Form REV184b)

Minnesota Tax Power of Attorney for Business (Form REV184b)

Download: Adobe PDF

Additional Resources

- Department of Revenue – Income Tax Short Course Manual (Chapter 6)

- Department of Revenue – Tax Power of Attorney (Form REV184i) Instructions

- MNCPA – Examining the New Minnesota Power of Attorney Document

Related Forms (6)

- Authorization to Release Business Tax Information (Form REV185b)

- Authorization to Release Individual or Sole Proprietor Tax Information (Form REV185i)

- Email Authorization (Form REV187)

- Request for Copy of Individual Tax Return (Form M100)

- Revocation of Tax Power of Attorney (Form REV184r)

- State Assessed Property Email Authorization (Form REV188)

Authorization to Release Business Tax Information (Form REV185b)

Authorization to Release Business Tax Information (Form REV185b)

Download: Adobe PDF

Authorization to Release Individual or Sole Proprietor Tax Information (Form REV185i)

Authorization to Release Individual or Sole Proprietor Tax Information (Form REV185i)

Download: Adobe PDF

Email Authorization (Form REV187)

Email Authorization (Form REV187)

Download: Adobe PDF

Request for Copy of Individual Tax Return (Form M100)

Request for Copy of Individual Tax Return (Form M100)

Download: Adobe PDF

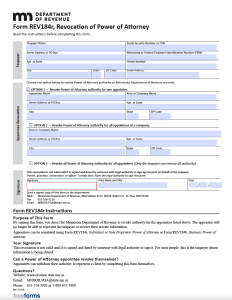

Revocation of Tax Power of Attorney (Form REV184r)

Revocation of Tax Power of Attorney (Form REV184r)

Download: Adobe PDF

State Assessed Property Email Authorization (Form REV188)

State Assessed Property Email Authorization (Form REV188)

Download: Adobe PDF

Comments