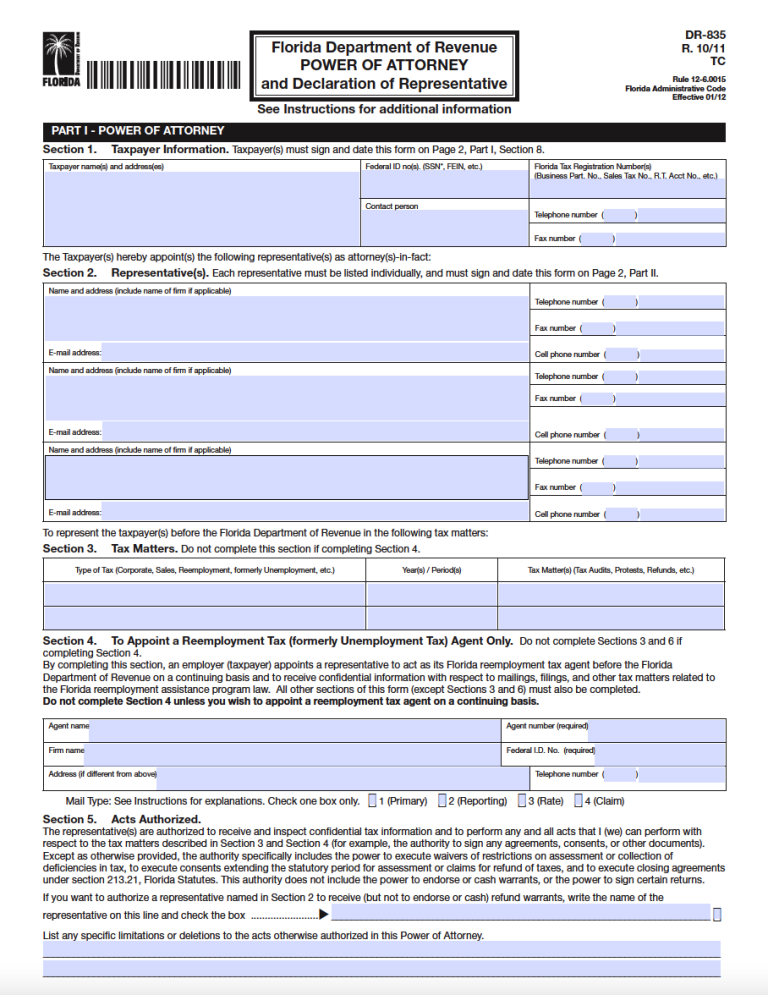

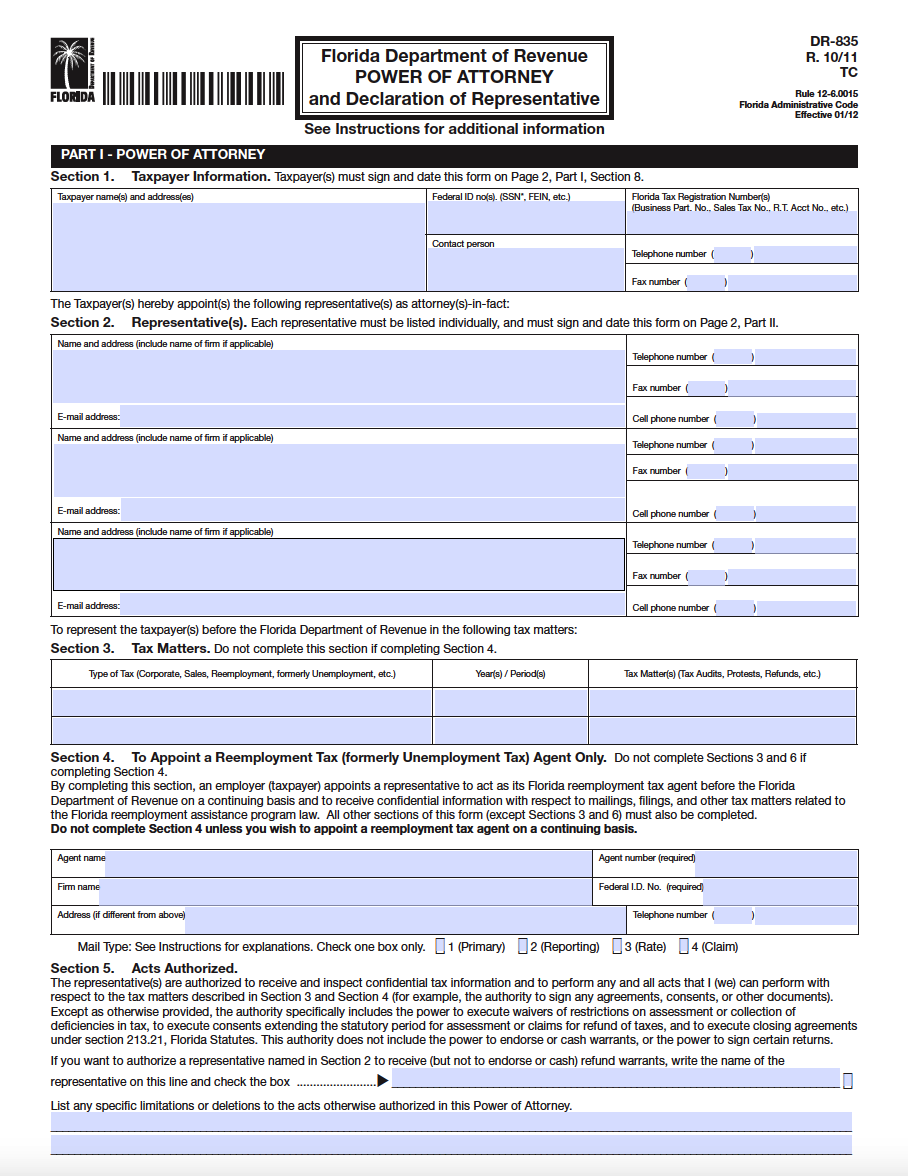

The Florida Tax Power of Attorney is the formal conveyance of powers associated with an individual’s (or business’s) state & federal tax liabilities. If an individual/business wishes to hire the services of a tax professional, they may want to consider carrying out this document in order for their representative to attain the ability to access needed documents and sign certain forms in their name. If this seems appealing, the taxpayer should be ready to supply the instrument with their personal information, their representative’s information, and their preferences concerning the authority that is to be granted for certain tax matters. Once the guidelines have been established, both parties should review the document and sign it appropriately.

Laws

Statute – § 709.2201

Definition – § 709.2102(9)

Signing Requirements – This document necessitates the signatures of the taxpayer(s) and representative(s).

Additional Resources

Florida Department of Revenue – Tax Power of Attorney (Form DR-835) Instructions

Related Forms

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

General (Financial) Power of Attorney

General (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Limited (Special) Power of Attorney

Limited (Special) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF

Comments