Why Is It Important to Prepare a Bill of Sale?

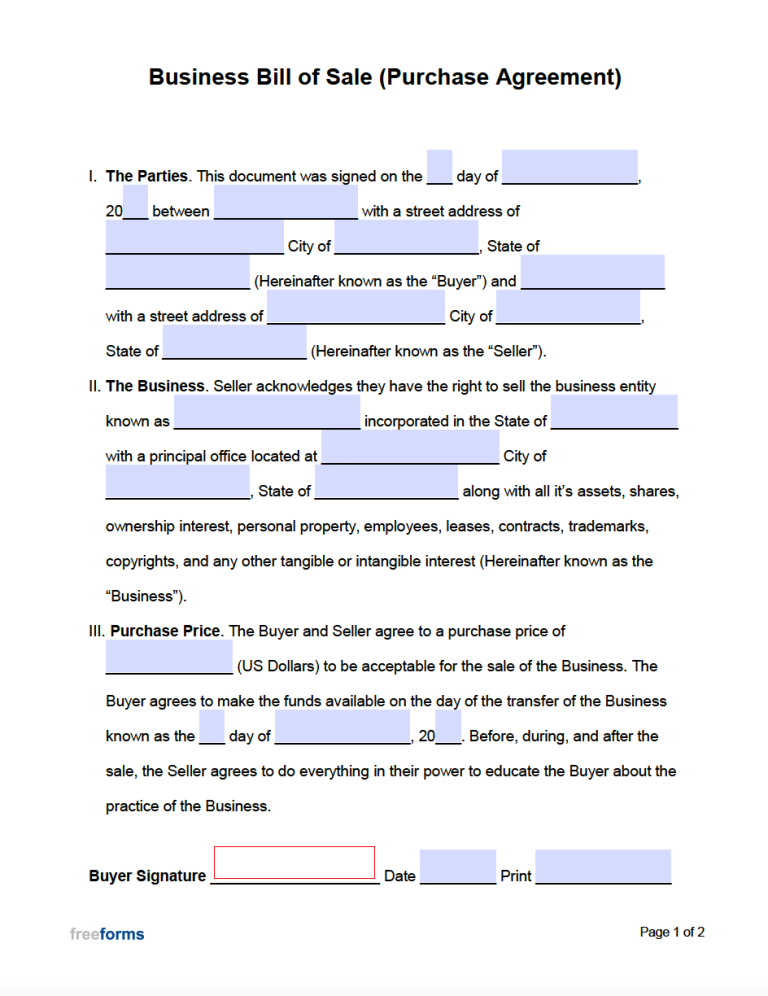

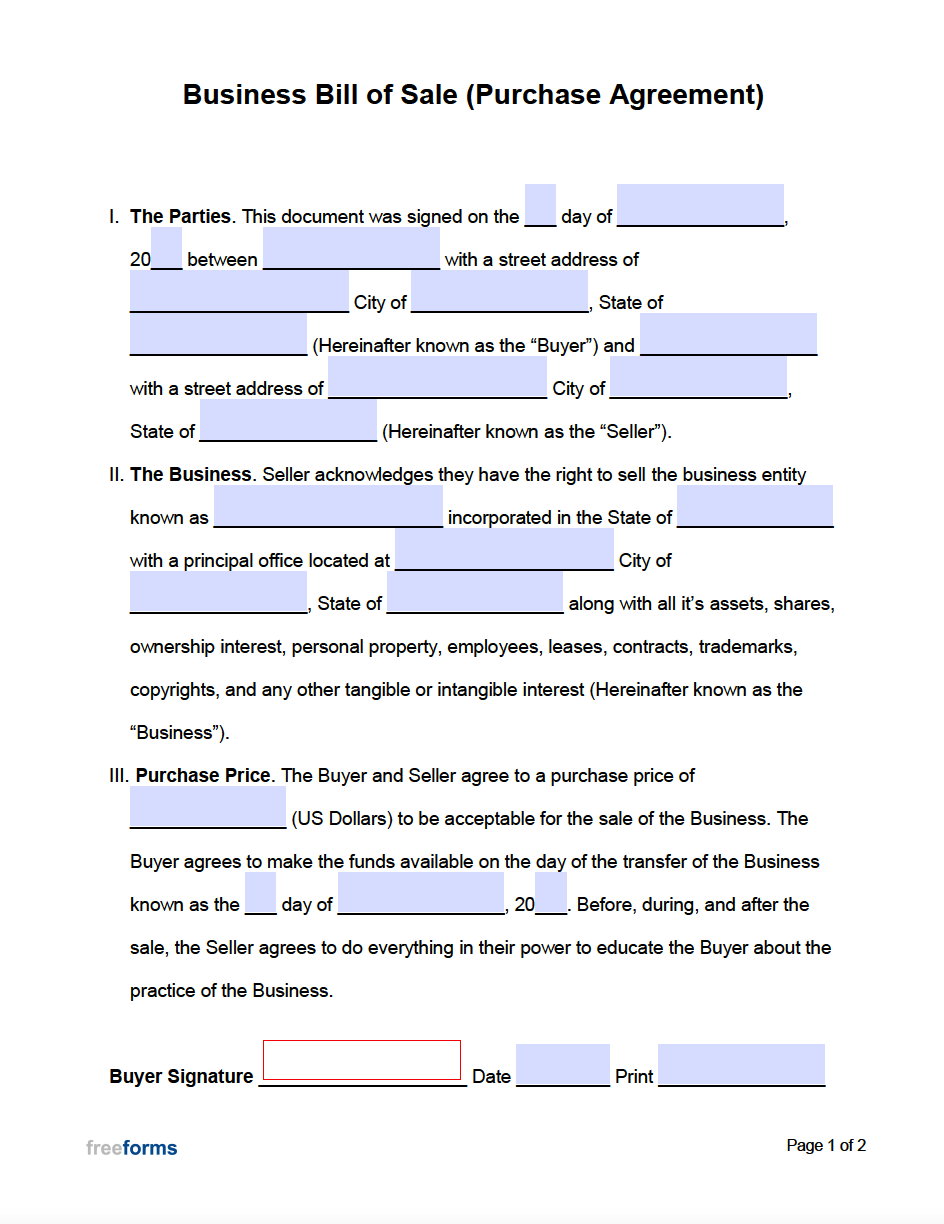

To sell a business, you must complete and execute a bill of sale to adequately demonstrate the transfer of ownership. Doing so will require the necessary permits and tax purposes. A Purchase Agreement may accompany it, which will delineate the finer points of the exchange and detail specific provisions of the contract. Selling a company is a process that, on average, can take 6 months to a year and involves several professionals to get the ball rolling.

How to Sell a Business

Step 1 – Calculate the Value of the Business

Hire an evaluation specialist to gauge a workable estimation of the value of the business. Doing so is usually determined by a number of factors, including financial performance, risk, and growth potential. Depending on the size of your business, hiring a professional to estimate the value may be worth the expense, as it can give an accurate figure that will be backed by a neutral third party. If you choose to commission a broker to oversee the transaction, they may be able to evaluate the company as well. Also, a broker can bring in buyers, advise them on seeking financing, and even vet potential buyers. If you already have a possible buyer in mind, you will not need to secure a broker for the transaction.

Step 2 – Prepare Information for Potential Buyers

Accounting Information

It is advised that you hire a licensed accountant to organize your books and prepare the following documents for possible purchasers:

- Profit and Loss Statements

- Balance Sheet

- Cash Flow Sheet

- Tax Returns (Last 3 Years)

- Bank Statements

Company Details

Arrange materials to give a snapshot of the status of the company and the field of business it corresponds to:

- Company Information Summary

- Security Reports

- Employee List

- Business Bylaws

- Media Accolades

- Evaluation Materials

- Marketing Strategy

- Competitor Research

- Operations Information

- Client Information

Legal Paperwork

You will want to gather and organize pertinent documentation and contracts that are legally required to transfer possession of the business:

- Revenue Documentation

- Profit Reports

- Expense Reports

- Non-Disclosure Agreement

- Letter of Intent

- Articles of Incorporation

- Partnership Agreement

- ROI Analysis

- Supplier Agreements

- Assignment of Licenses

- Assignment of Leases

- Stock Status

- Asset Acquisition Statement

Step 3 – Market the Business to Prospective Buyers

Promoting the sale of your business can be accomplished by creating an advertisement to post in the business classifieds. Whether you post in your area newspaper, online, or both, you want to include the business type, location, and purchase price. Consider including photos of the business location(s) to give a face to the name and any company details that may attract a buyer. When posting an ad online, many business-specific sites can help you reach a broader range of prospective buyers, such as BizBuySell, BizQuest, and Business Exits.

Step 4 – Meet With Prospective Buyers and Close the Sale

Once potential buyers show interest, schedule a meeting to promote the sale and highlight the value that the business could bring to an investor. After agreeing, you will want to retain the assistance of an attorney to look over offers, contracts, and agreements to ensure that they are in order and to protect your interests. You can arrange with the buyer to determine a realistic closing date, discuss the contract terms, and reassign the associated leases and assets. Bring the completed bill of sale form and legal documents to finalize and sign the business.

Comments