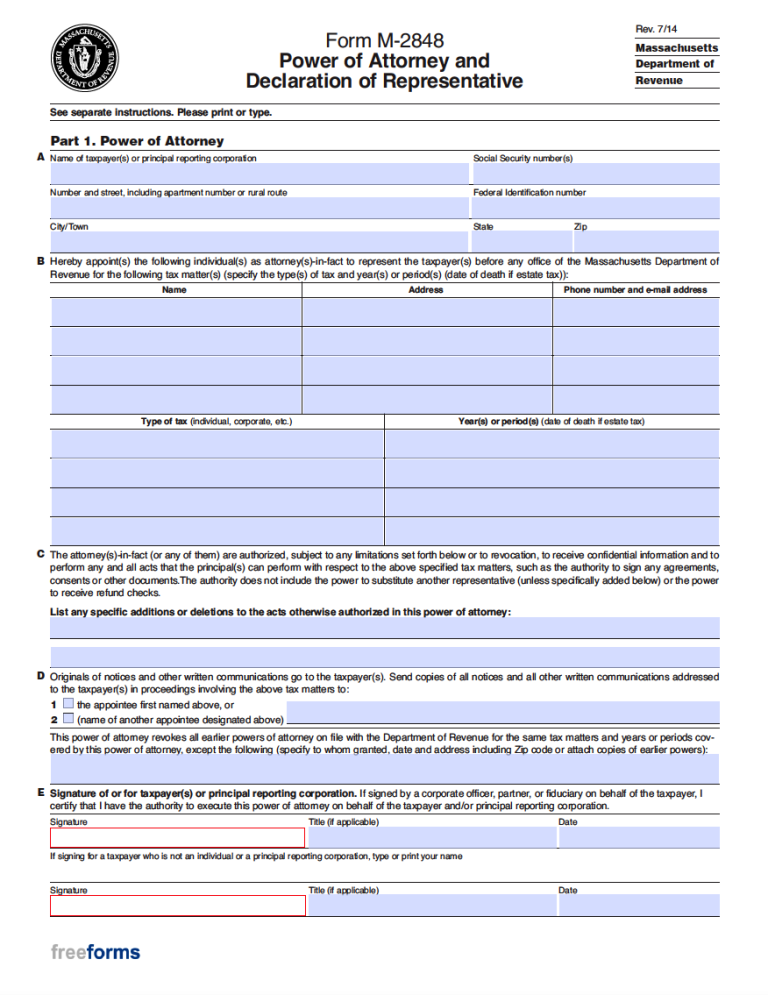

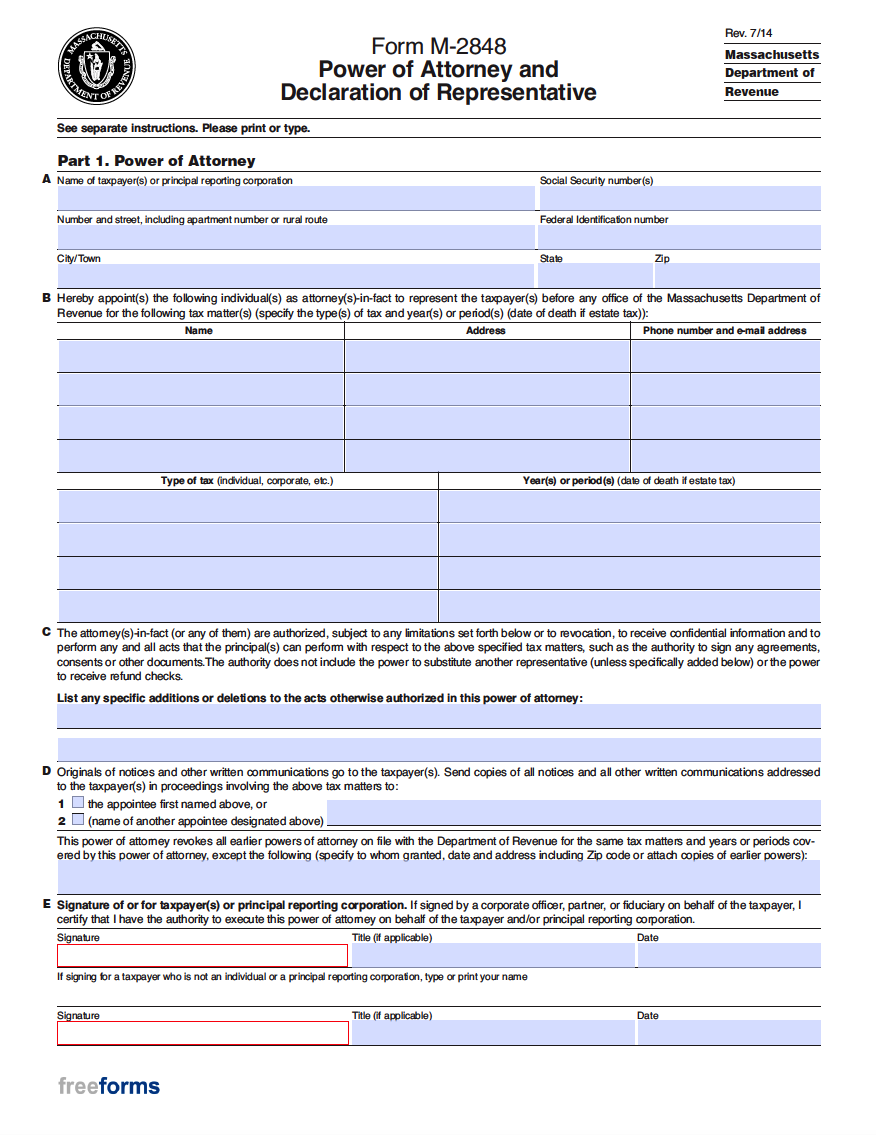

The Massachusetts Tax Power of Attorney (Form M-2848) was developed by the local Department of Revenue so that individuals within the state could appoint a representative to perform tax filings, obtain statements, and sign paperwork in their name. This is mainly accomplished by those who hire the services of a tax professional, such as an account or attorney. The execution of this document is fairly straightforward, as it simply requires the identification of each party, the types of taxes that are to be managed, and any additions or deletions to the authority granted. Following the fulfillment of each necessary section, the taxpaying party and their representative(s) must sign the instrument accordingly to confirm their role in the arrangement (the taxpayer must receive the acknowledgment of witnesses and a notary public if the agent receiving the powers is not a tax specialist).

Laws

Statute – No Legal Statute

Signing Requirements – The acknowledgment of two (2) witnesses and a notary public is demanded if the representative acquiring the authority is not an attorney, certified public accountant, public accountant, or enrolled agent.

Additional Resources

- Massachusetts Department of Revenue – Tax POA (Form M-2848) Instructions

Related Forms

Application for Abatement (Form ABT)

Application for Abatement (Form ABT)

Download: Adobe PDF

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments