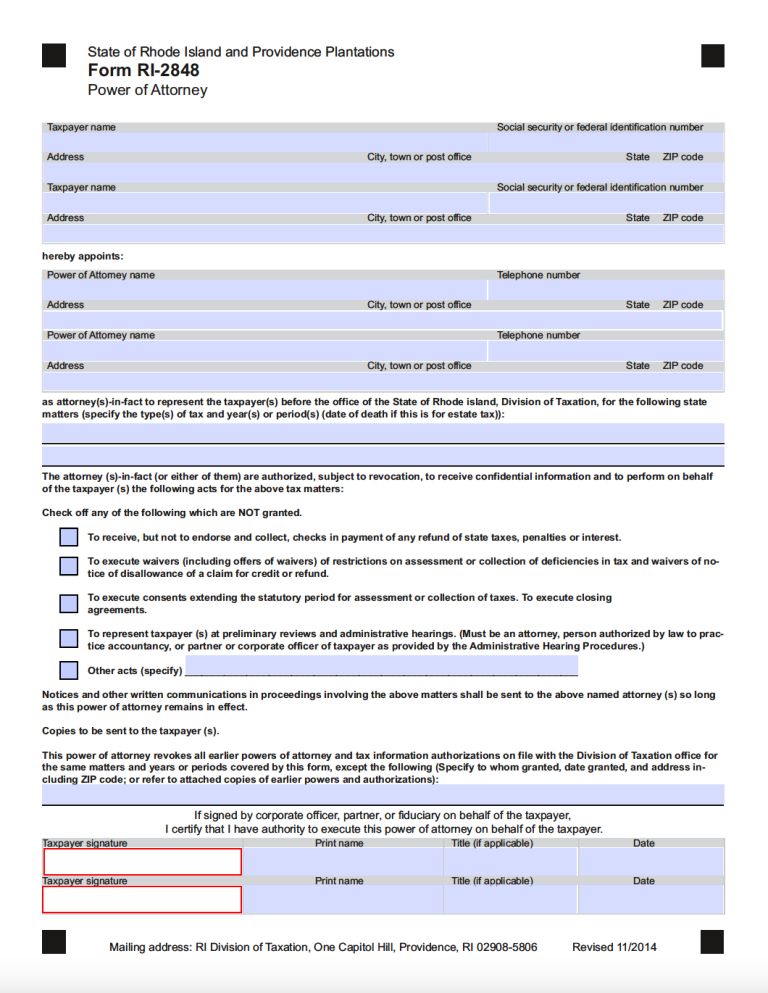

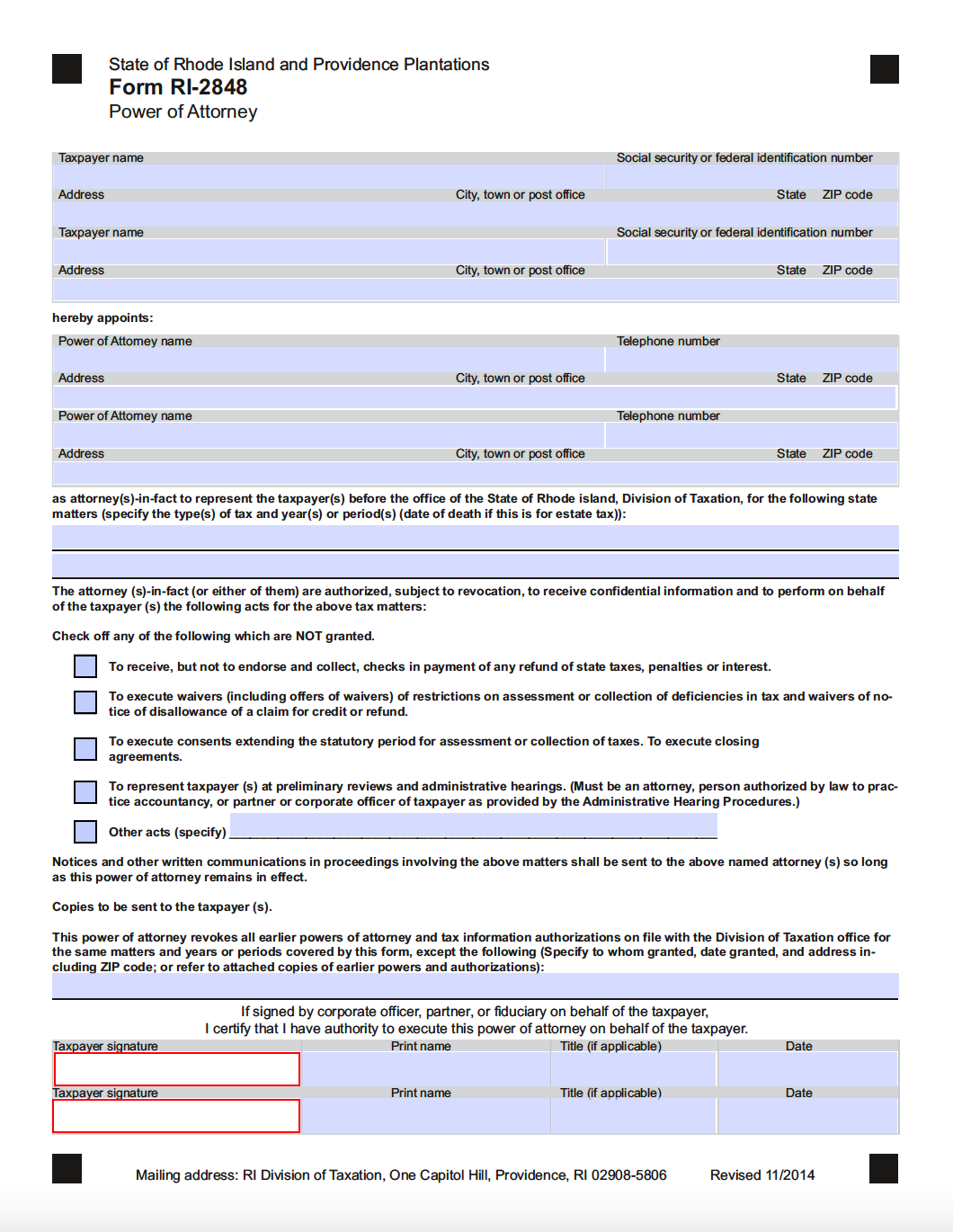

The Rhode Island Tax Power of Attorney is a state-issued registry that indicates the instituted preference for a lawyer or tax expert to manage communication and actions concerning state taxes. Professional representation is a standard procedure for many people that want their tax return(s) completed by an experienced individual. When hiring a specialist, the issuance of permissions to speak and act on behalf of the principal party is necessary for the state of Rhode Island Division of Taxation to recognize the bestowed agency. Finalize the filing as requested with the current names and contact information of the declarant and designated agent. Endorsements can then be performed with the supervision of either a notary public or two (2) witnessing parties before submitting.

Laws

Statute – Rhode Island Short Form Power of Attorney Act (§ 18-16)

Definition – § 18-16-2

Signing Requirements – To properly establish valid agency, the form must be notarized by a licensed professional or corroborated by two (2) suitable witnesses (§ 18-16-2).

How to File

Filing can be initiated by preparing the form with the requested information on the taxpayer or business, designated representative, and desired allocated privileges. All necessary signatures must be recorded, and then the paperwork can be submitted by mail to the following address:

RI Division of Taxation

1 Capitol Hill

Providence, RI 02908-5806

It is recommended to mail the document in ahead of time, allowing for approval on the state level before representation can legally commence.

Other Versions

Tax Power of Attorney (Form RI-2848) (Previous Edition)

Download: Adobe PDF

Related Forms

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments