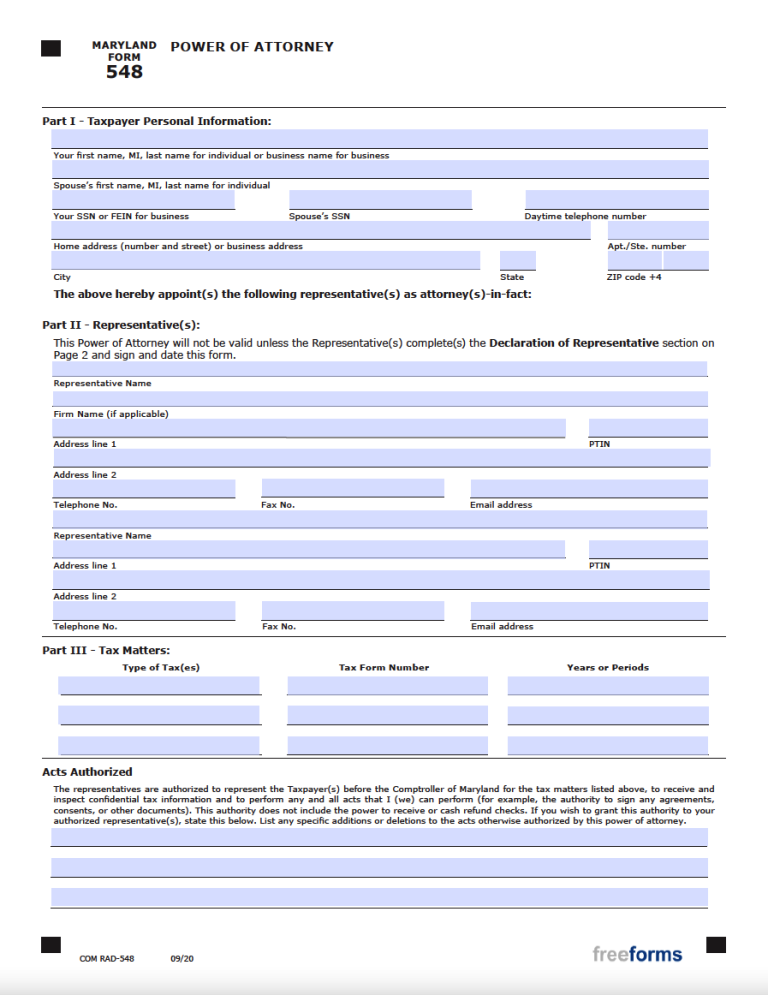

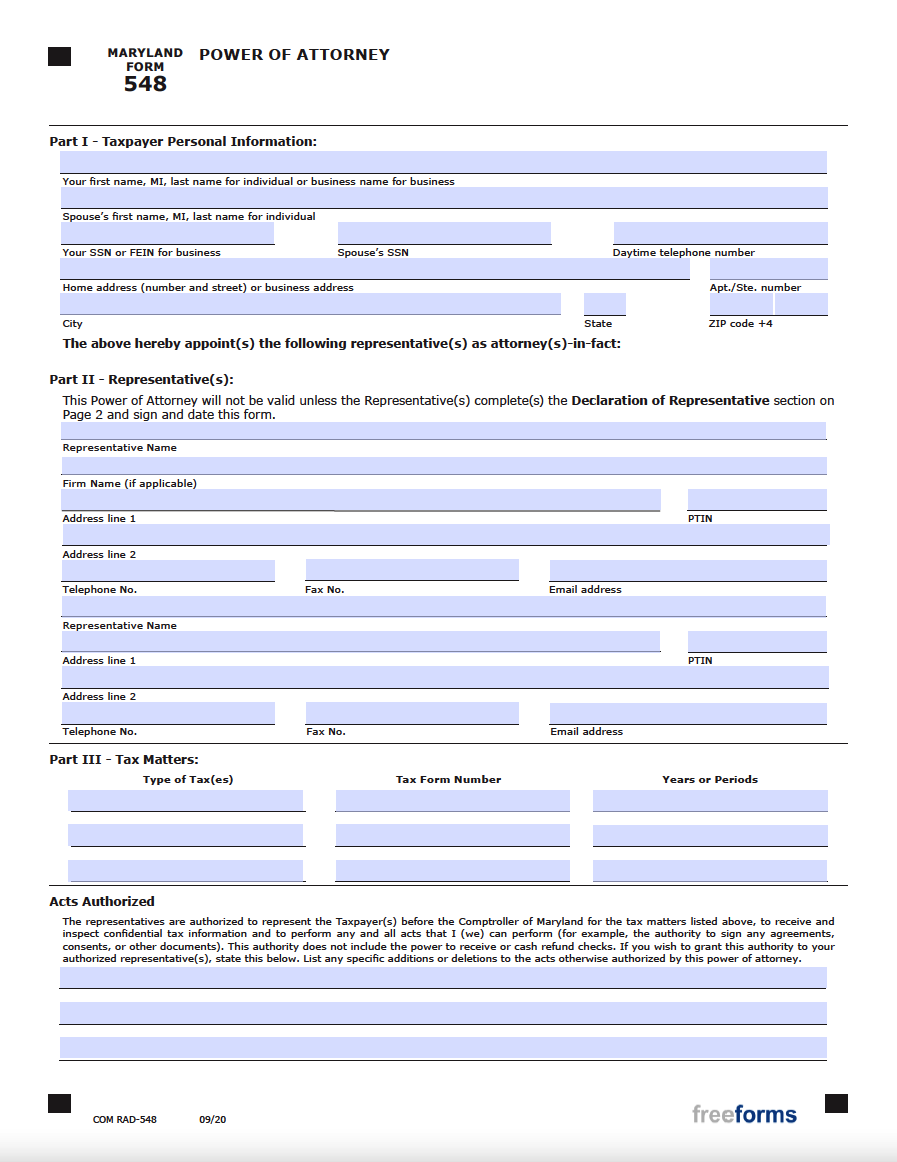

The Maryland Tax Power of Attorney (Form 548) was created by the state’s Office of the Comptroller to facilitate the conveyance of personal tax powers from one party to another. Each year, many U.S. citizens delegate their tax duties to a specialist so that they may use their expertise to file on their behalf. This form grants an agent the permission to receive confidential documents, conduct filings, and even sign paperwork in the name of the taxpayer. To achieve an active POA, the assignor will have to write in a description of both parties, the type of tax matters that they want handled, and any additional acts that will be authorized. Following the delivery of these facts, the principal is required to sign the instrument along with their appointed representation.

Laws

Statutes – Maryland Power of Attorney Act (§ 17-101 – § 17-204)

Definition – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used (§ 17-101(d)).

Signing Requirements – Requires the signatures of the taxpayer(s) and their representative(s).

Additional Resources

- Comptroller of Maryland – Tax Power of Attorney (Form 548) Instructions

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

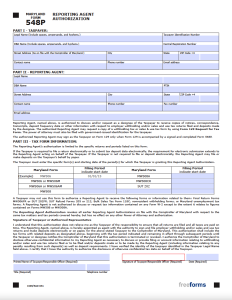

Reporting Agent Authorization (Form 548P)

Reporting Agent Authorization (Form 548P)

Download: Adobe PDF

Comments