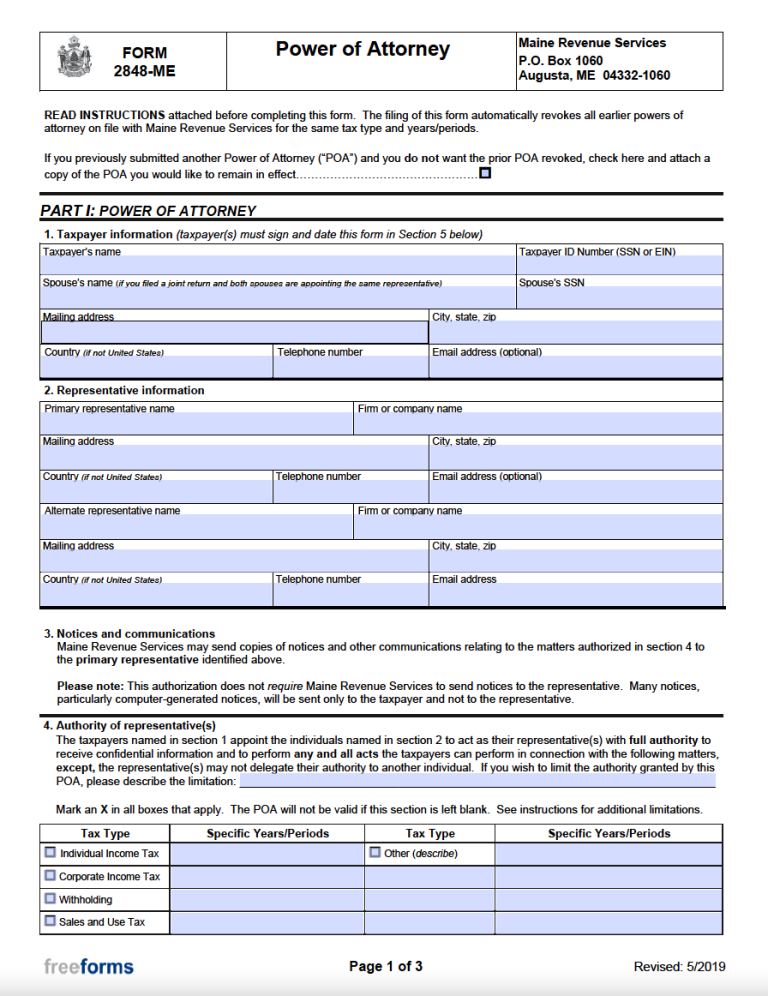

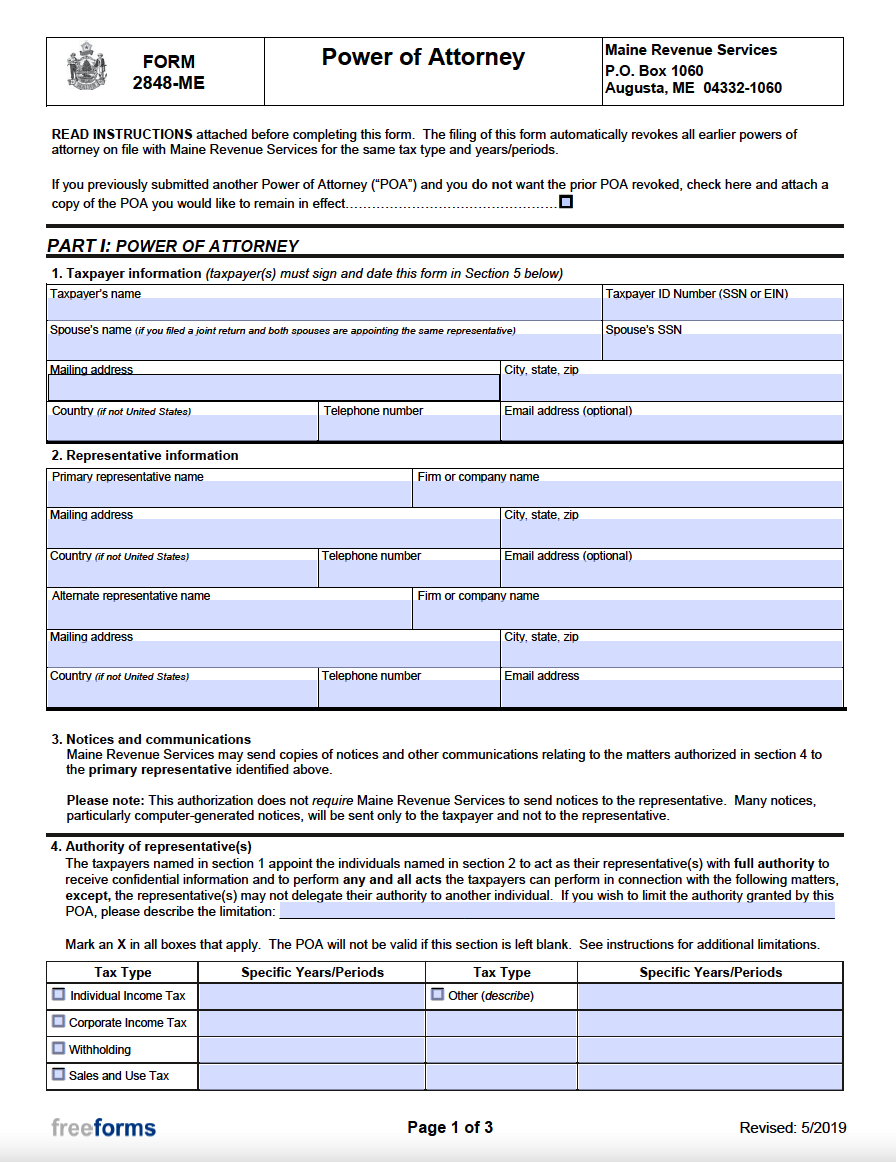

The Maine Tax Power of Attorney is a state-specific form that is solely used for the purpose of assigning personal tasks associated with one’s taxes to another person or entity. Many people around the nation depend on the services of a professional to handle their tax obligations. With this form, residents within the state of Maine can grant an accountant, attorney, or another type of agent the ability to access their personal tax documents, sign paperwork, conduct filings, etc. The implementation of this instrument relies on the taxpayer supplying the necessary information and signing it along with their representative(s).

Laws

Statute – Taxes (§ 5-946)

Definition – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used (§ 5-902(7)).

Signing Requirements – Must be signed by the taxpayer(s) and their representative(s).

Additional Resources

-

Maine Revenue Services – Tax Power of Attorney (Form 2848-ME) Instructions

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Limited Tax Power of Attorney (Form 2848-ME-L)

Limited Tax Power of Attorney (Form 2848-ME-L)

Download: Adobe PDF

Unemployment Insurance Power of Attorney (Form ME UC-28)

Unemployment Insurance Power of Attorney (Form ME UC-28)

Download: Adobe PDF, MS Word (.docx)

Comments