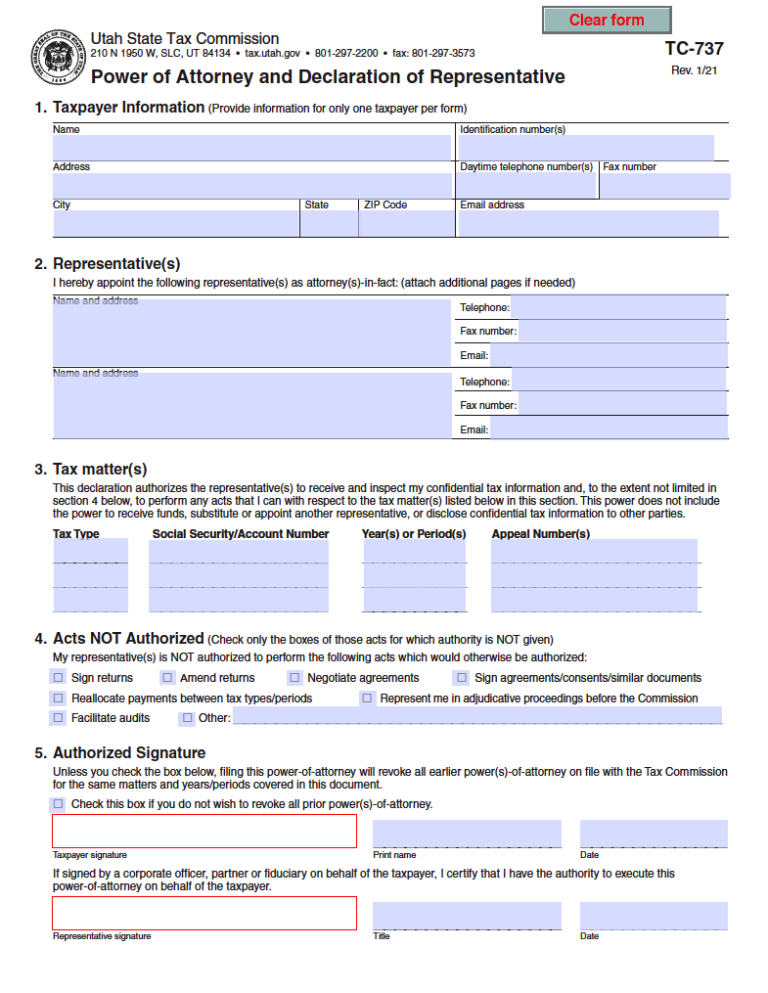

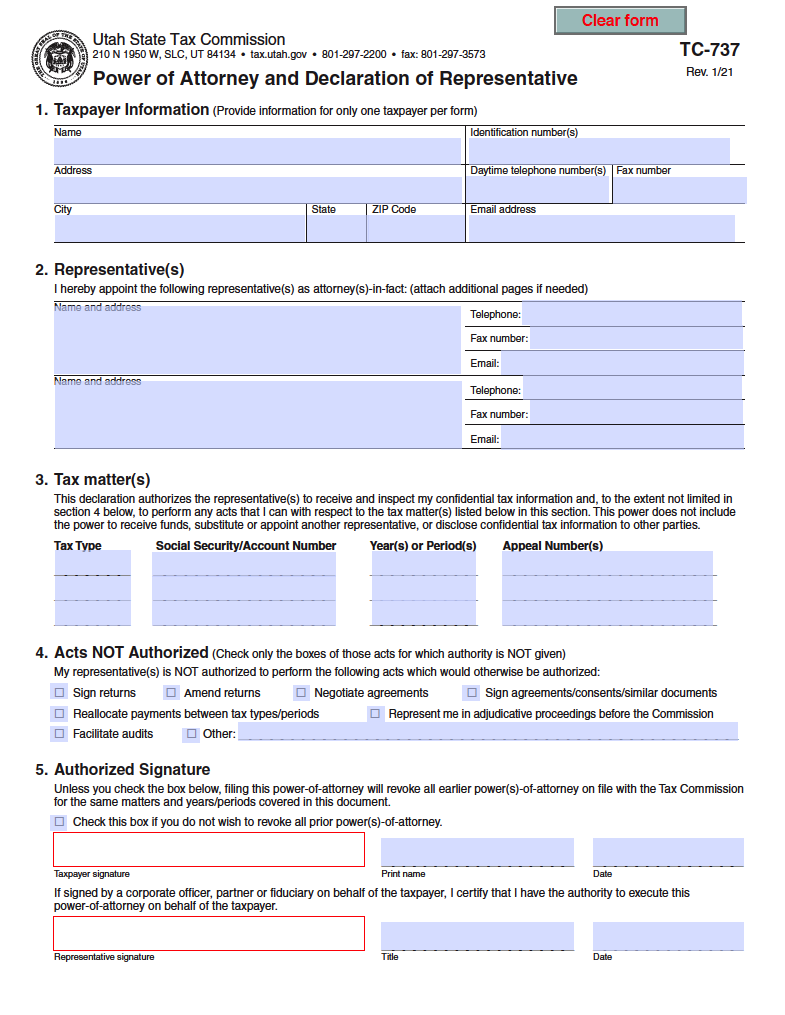

The Utah Tax Power of Attorney is a document supplied by the Utah State Tax Commission to appoint an attorney-in-fact for tax matters. The official form identifies the representative of the principal’s choosing to be designated to speak and act on their behalf concerning state taxes. Information on the individual taxpayer or business entity must be recorded as requested, along with the corresponding information on the assigned agent. The signing of the agreement by both the declarant and representative will effectively institute the arrangement.

Laws

Statute – Uniform Power of Attorney Act ( § 75-9-101 – § 75-9-403)

Definition – § 75-9-102

Signing Requirements – The principal party and confirmed attorney-in-fact must sign in the appropriate spaces to establish instated agency.

Additional Resources

- Utah State Tax Commission – Official Tax Information for Utah

Related Forms

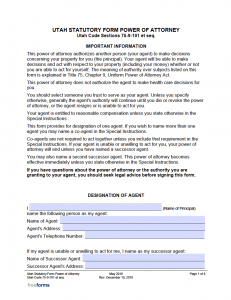

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

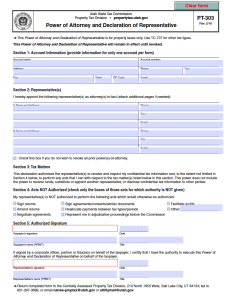

Property Tax Power of Attorney

Property Tax Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments