The Colorado State Tax Power of Attorney is supplied by the Department of Revenue and helps residents convey tax powers to their representation. The party issuing the authority has the choice of providing their agent with a sweeping power that includes all tax-related matters or designating a more specific area of their tax liabilities. Once the principal has listed the identity of their agent and selected the tax powers that they wish to deliver, they may proceed by signing the instrument along with their representation to confirm the details of the arrangement.

Laws

Statute – Colorado Revised Statutes – Uniform Power of Attorney Act (§ 15-14-701 – 15-14-745)

Definitions – § 15-14-739

Signing Requirements – To be signed by the taxpayer (and their spouse if applicable) and the representative receiving the powers.

How to File

The government form must be filled out in its entirety to be considered for acceptance by the Department of Revenue. Upon completion, the document can be submitted either via the state’s taxpayer portal, Colorado Revenue Online, or dispatched using the postal service (or private shipping company) using the following physical address:

By Mail:

Colorado Department of Revenue

PO Box 17087

Lincoln, NE 80217-0087

Other Versions (4)

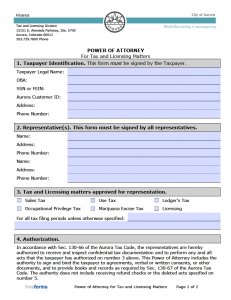

- City of Aurora Version

- City & County of Denver Version

- Colorado Springs Version

- Colorado State Tax Information Authorization or Power of Attorney

Download: Adobe PDF

City & County of Denver (For Division Administered Tax Matters)

City & County of Denver (For Division Administered Tax Matters)

Download: Adobe PDF

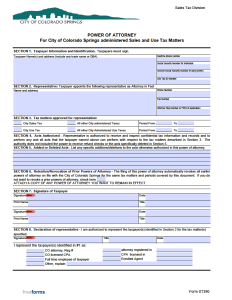

Colorado Springs Version (For Administered Sales and Use Tax Matters)

Colorado Springs Version (For Administered Sales and Use Tax Matters)

Download: Adobe PDF

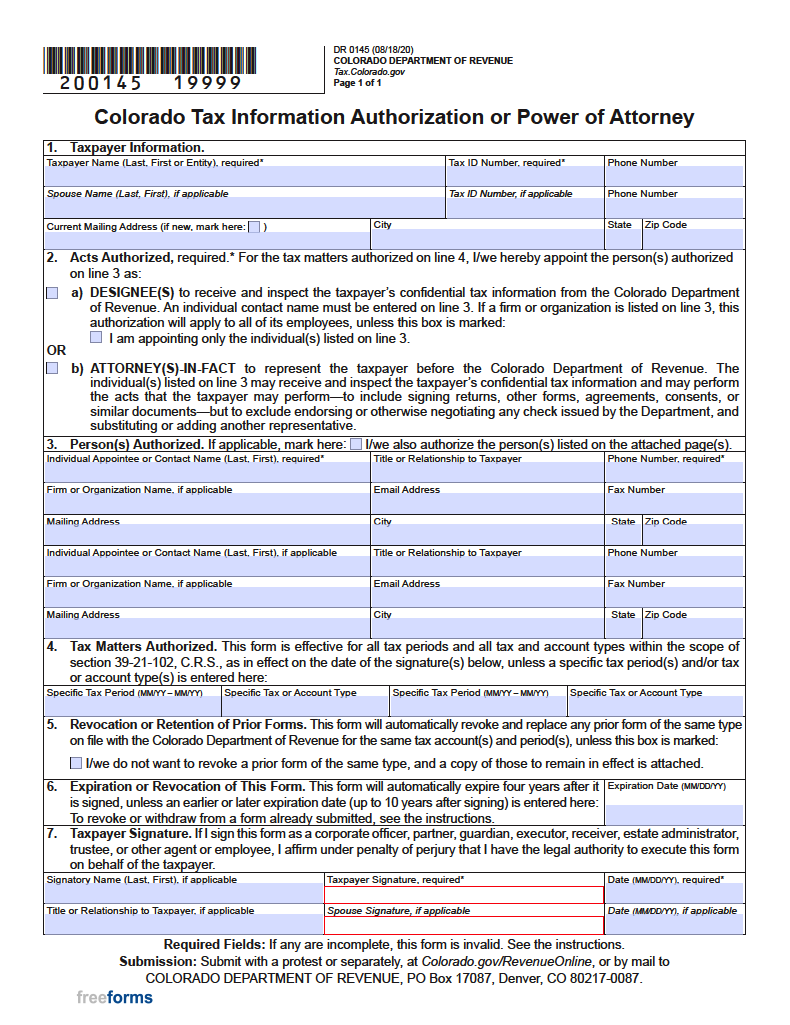

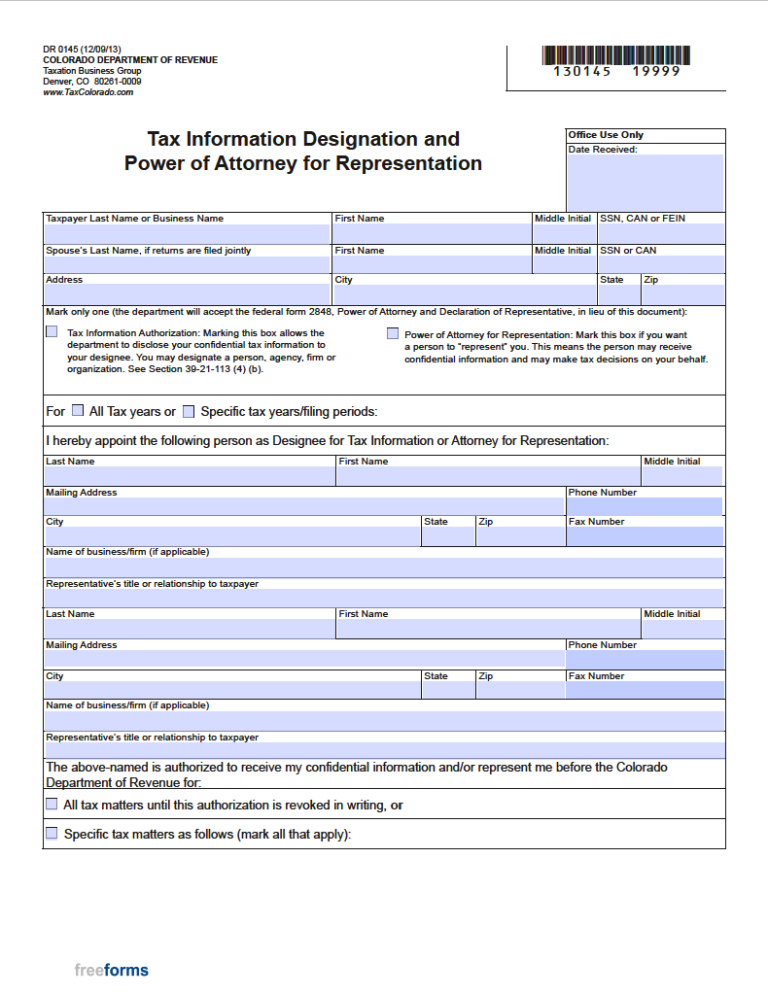

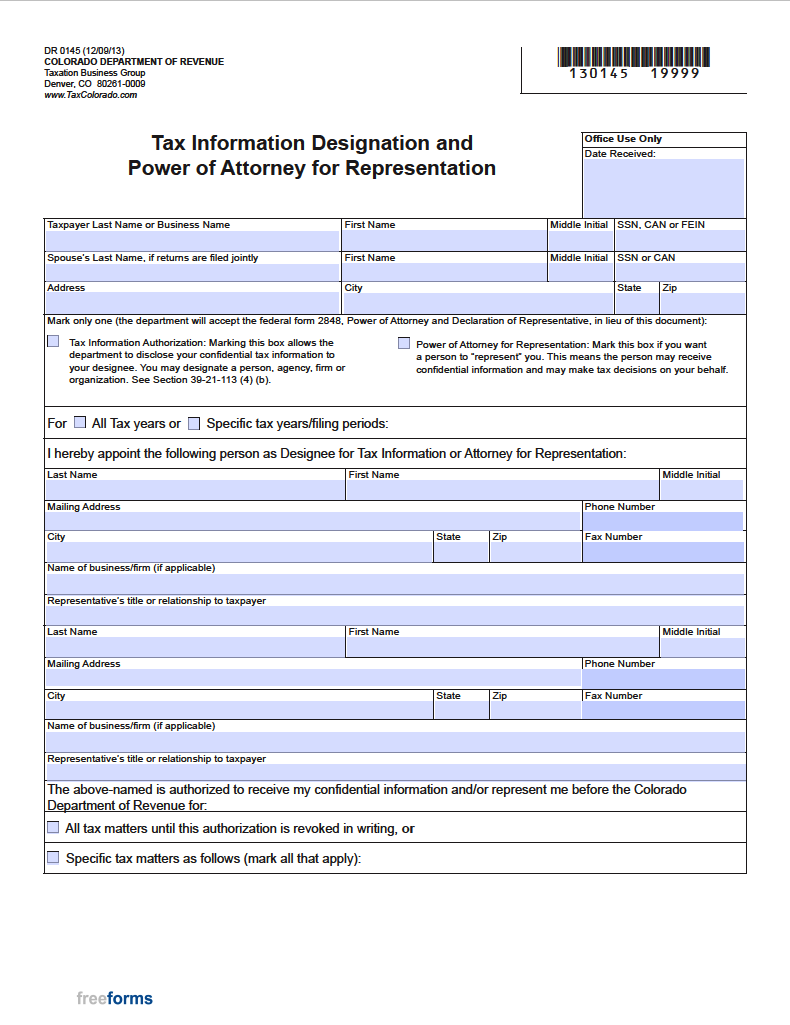

Colorado State Tax Information Authorization or Power of Attorney Form

Colorado State Tax Information Authorization or Power of Attorney Form

Download: Adobe PDF

Instructions: Adobe PDF

Additional Resources

- Colorado Bar Association – Financial Powers of Attorney Pamphlet

- Colorado Dept. of Revenue – Colorado State Tax Power of Attorney Form DR 0145 – Instructions

Related Forms

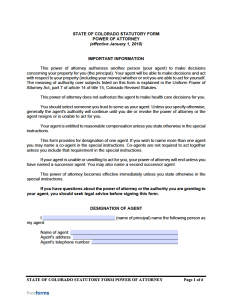

Durable (Financial) Power of Attorney

Download: Adobe PDF

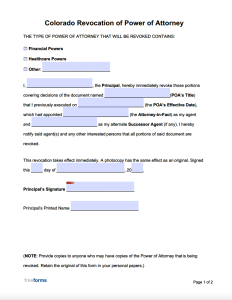

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments