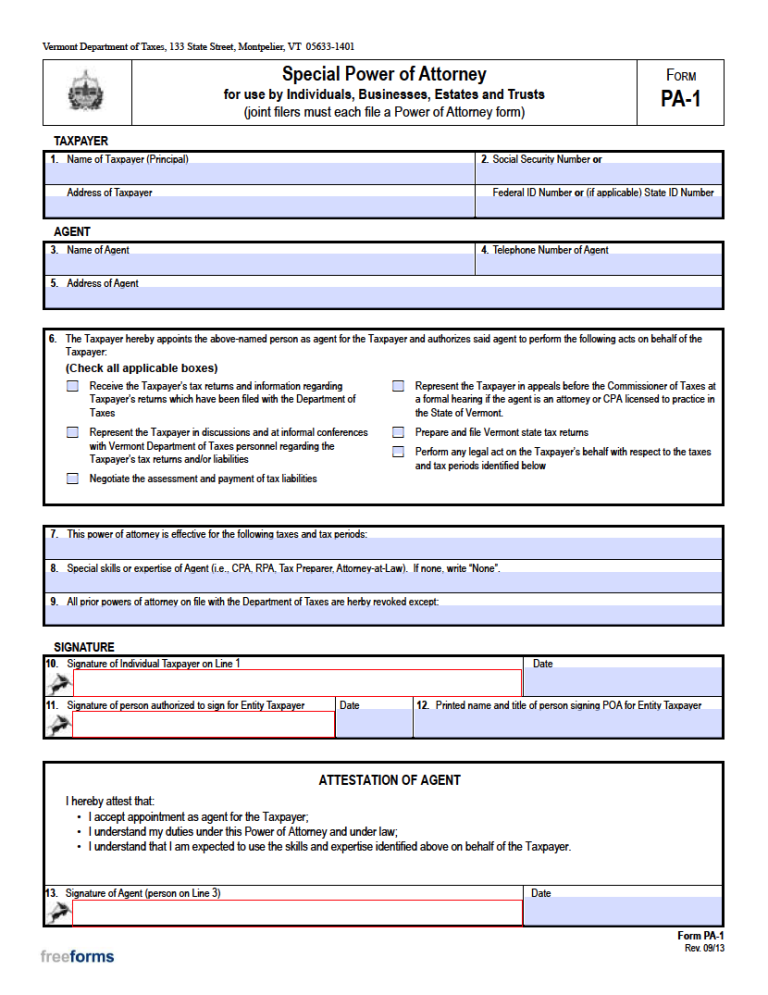

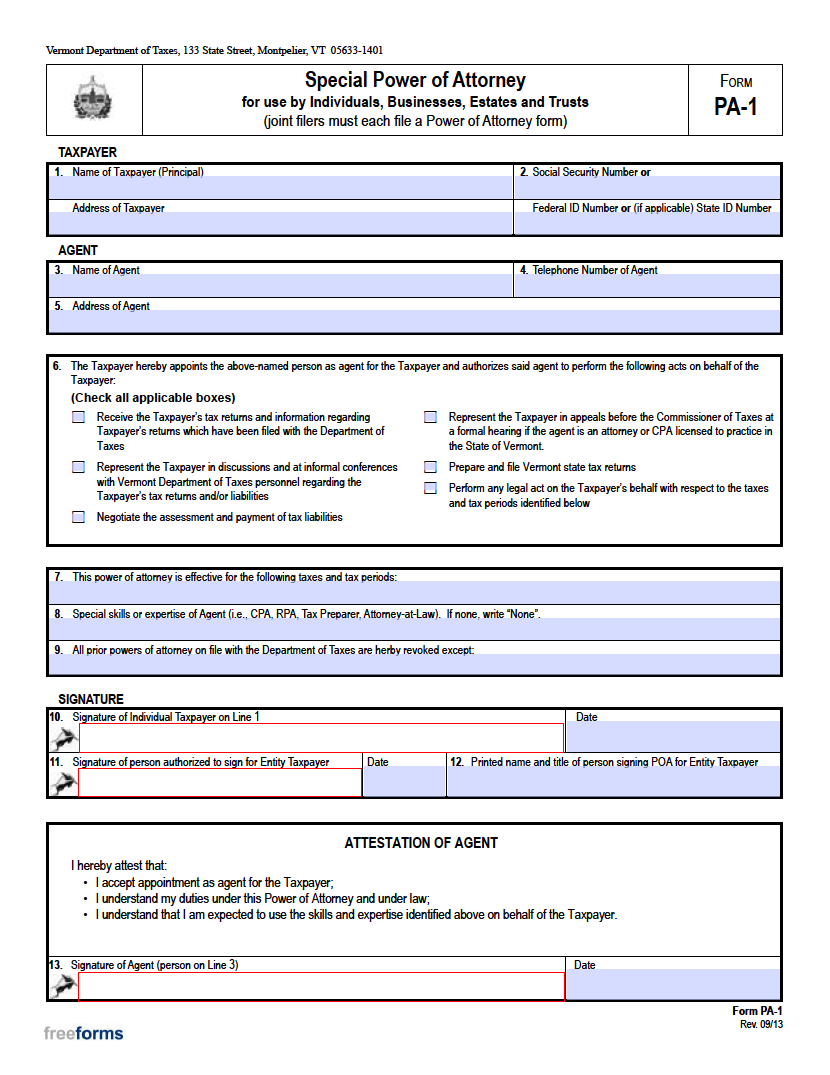

The Vermont Tax Power of Attorney registers the information assigning a person to be permitted authority to represent a taxpayer concerning their account. This state-drafted document will give permission for an accountant, attorney, or another individual access to their record, communicate with the state’s department of taxes, and sign any necessary paperwork necessary to amend or file tax submissions. The form requires completion with the solicited details, including the names, addresses, and phone numbers of the taxpayer and nominated agent and selection of granted powers. A copy of the completed form can be submitted along with the associated tax return and does not need to be filed separately. Revocation of the agreement can be later established at the principal party’s request when the services of the attorney-in-fact are no longer needed.

Laws

Statute – Powers of Attorney (14 V.S.A. § 3501 – 14 V.S.A. § 3516)

Definition – “Power of attorney” means a written document by which a principal designates an agent to act in his or her behalf (14 V.S.A. § 3502(8))

Signing Requirements – Effective execution of the form will demand that both the principal and agent sign in the appropriate areas. For those filling jointly, a separate form will need to be submitted for each. According to the Vermont Statutes Annotated (14 V.S.A. § 3502(f)), Notarization of the document and/or witness supervision is not obligated to issue the agency.

Additional Resources

- Vermont Department of Taxes – Power of Attorney

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

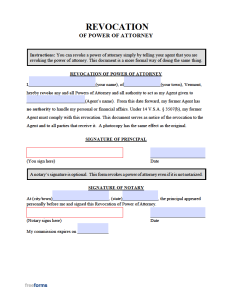

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments