Each document will typically require the assignor (principal) to indicate who their agent (attorney-in-fact) will be, what powers they will have access to, and what the term of the arrangement will be (durable, non-durable, commencement/expiration date). After establishing these conditions, the executor must then sign the document to verify the permissions granted (usually in the presence of witnesses or a notary public).

Laws

Statutes – Chapter 58, Article 6: Powers and Letters of Attorney

Definition – “Power of attorney” means a written power of attorney, either durable or nondurable (§ 58-651(i)).

Signing Requirements – Acknowledgment of a Notary Public (§ 58-652(a)(3))

By Type (11)

- Advance Directive (Medical POA & Living Will)

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Living Will

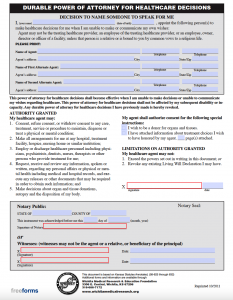

- Medical Power of Attorney

- Minor Child Power of Attorney

- Motor Vehicle Power of Attorney

- Real Estate Power of Attorney

- Revocation of Power of Attorney

- Tax Power of Attorney

Advance Directive (Medical POA & Living Will) – A combination of a declaration regarding end-of-life medical care as well as an appointment of a healthcare representative.

Advance Directive (Medical POA & Living Will) – A combination of a declaration regarding end-of-life medical care as well as an appointment of a healthcare representative.

Download: PDF

Signing Requirements: Acknowledgment of Two (2) Witnesses or Notary Public (§ 58-629(e), § 65-28,103(a)(4))

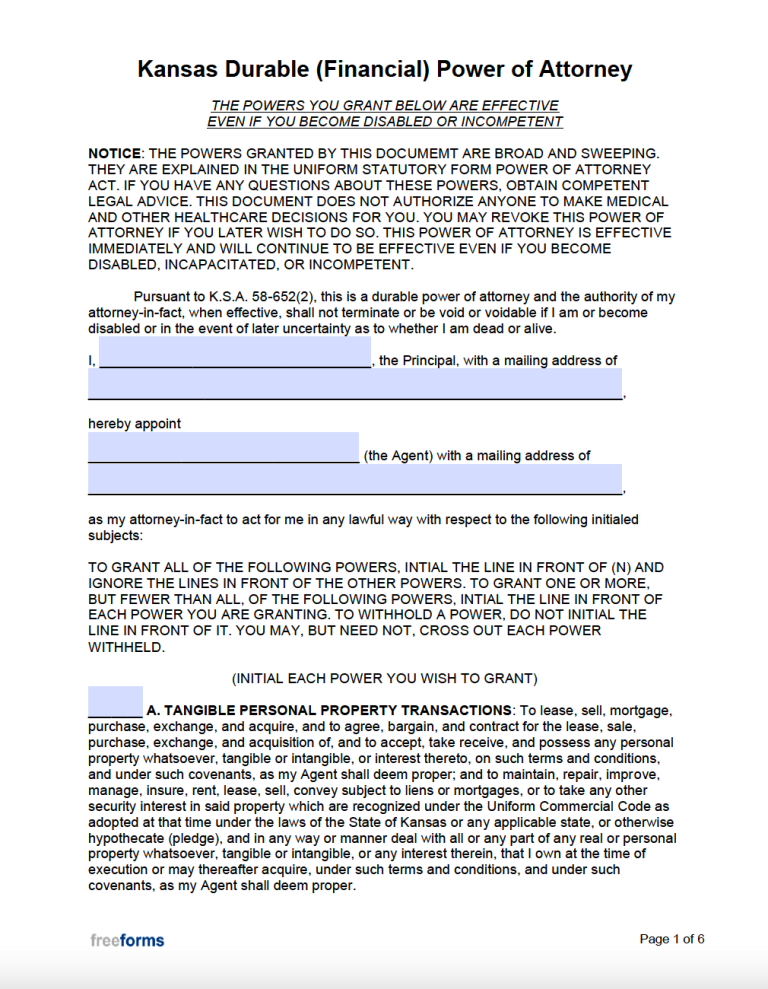

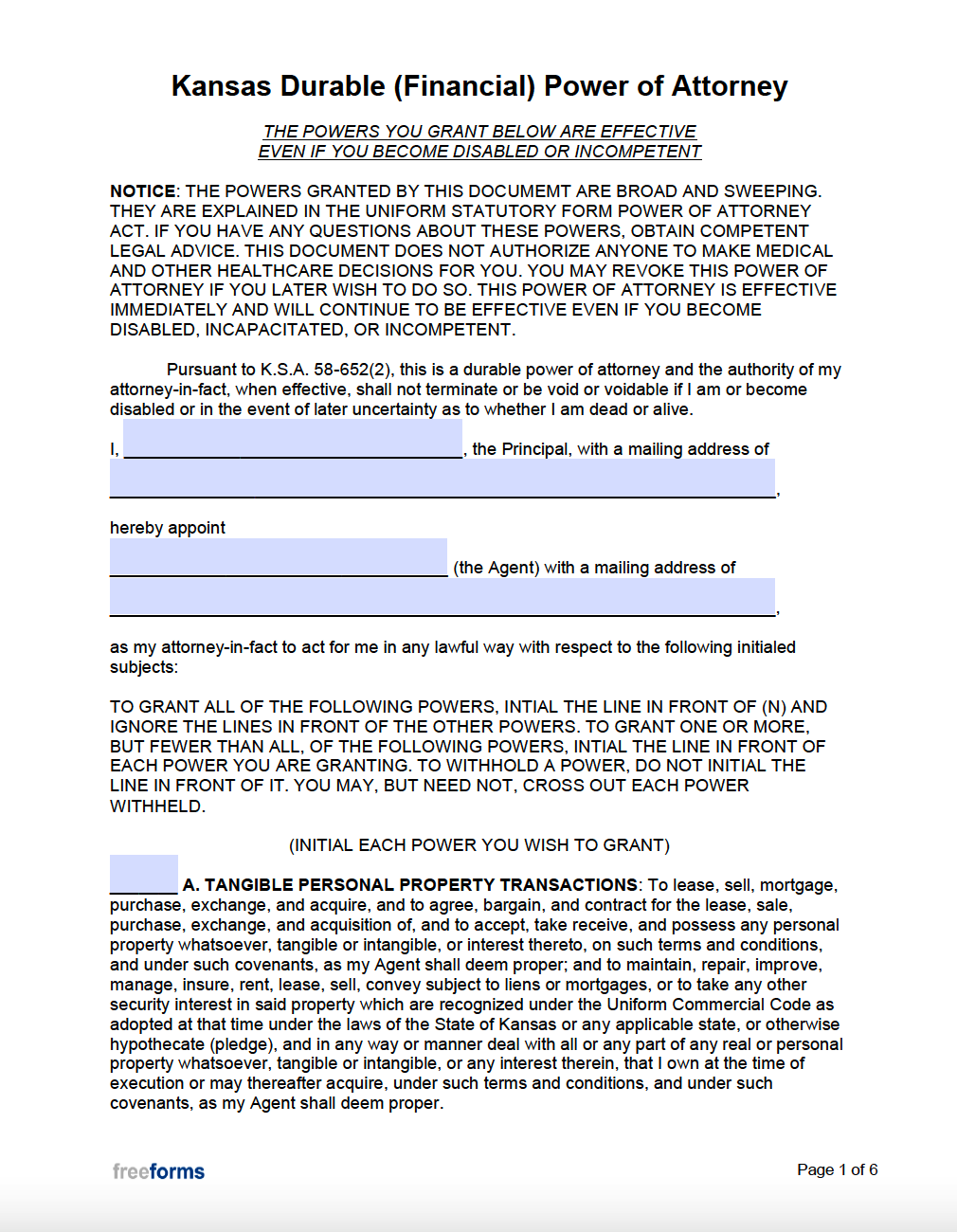

Durable (Financial) Power of Attorney – Designates financial powers to a third-party individual and sustains its effectiveness even if the principal falls into an incapacitated state.

Durable (Financial) Power of Attorney – Designates financial powers to a third-party individual and sustains its effectiveness even if the principal falls into an incapacitated state.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of a Notary Public (§ 58-652(a)(3))

General (Financial) Power of Attorney – Nominates an agent to carry out matters related to someone’s personal finances/assets and is terminated by revocation, death, or incapacity.

General (Financial) Power of Attorney – Nominates an agent to carry out matters related to someone’s personal finances/assets and is terminated by revocation, death, or incapacity.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of a Notary Public (§ 58-652(a)(3))

Limited (Special) Power of Attorney – A common POA used to grant a specific authority detailed within the form by the principal party.

Limited (Special) Power of Attorney – A common POA used to grant a specific authority detailed within the form by the principal party.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of a Notary Public (§ 58-652(a)(3))

Living Will – A proactive instrument used to convey someone’s preferences regarding life-sustaining procedures at the time of incapacity.

Living Will – A proactive instrument used to convey someone’s preferences regarding life-sustaining procedures at the time of incapacity.

Download: PDF

Signing Requirements: Acknowledgment of Two (2) Witnesses or Notary Public (§ 65-28,103(a)(4))

Medical Power of Attorney – Delegates healthcare decisions to another when the principal is not capable of voicing their own inclinations.

Medical Power of Attorney – Delegates healthcare decisions to another when the principal is not capable of voicing their own inclinations.

Download: PDF

Signing Requirements: Acknowledgment of Two (2) Witnesses or Notary Public (§ 58-629(e))

Minor Child Power of Attorney – Generally used by parents or legal guardians who are temporarily leaving their child in the care of another so that the agent can authorize any needed actions for the minor.

Minor Child Power of Attorney – Generally used by parents or legal guardians who are temporarily leaving their child in the care of another so that the agent can authorize any needed actions for the minor.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of a Notary Public (§ 58-652(a)(3))

Motor Vehicle Power of Attorney – Allows an appointee to accomplish transactions related to the appointor’s automobile.

Motor Vehicle Power of Attorney – Allows an appointee to accomplish transactions related to the appointor’s automobile.

Download: PDF

Signing Requirements: Necessitates the signature of the principal/vehicle owner.

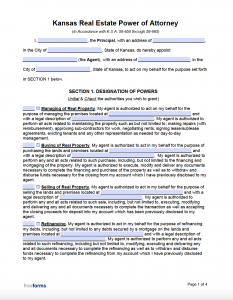

Real Estate Power of Attorney – Instead of granting a broad authority, users of this document can assign specific tasks related to real property.

Real Estate Power of Attorney – Instead of granting a broad authority, users of this document can assign specific tasks related to real property.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of a Notary Public (§ 58-652(a)(3))

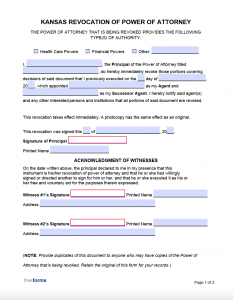

Revocation of Power of Attorney – Individuals who no longer wish for their agent to have the authority to act on their behalf may execute this instrument to end the relationship.

Revocation of Power of Attorney – Individuals who no longer wish for their agent to have the authority to act on their behalf may execute this instrument to end the relationship.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Two (2) Witnesses and/or Notary Public Recommended

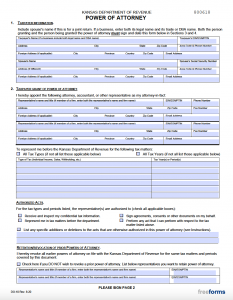

Tax Power of Attorney – Assigns tax-related matters to another individual or firm so that they can legally access the principal’s tax data, sign paperwork, and prepare filings on their behalf.

Tax Power of Attorney – Assigns tax-related matters to another individual or firm so that they can legally access the principal’s tax data, sign paperwork, and prepare filings on their behalf.

Download: PDF

Signing Requirements: Must be signed by the taxpayer(s) and their representative(s).

Comments