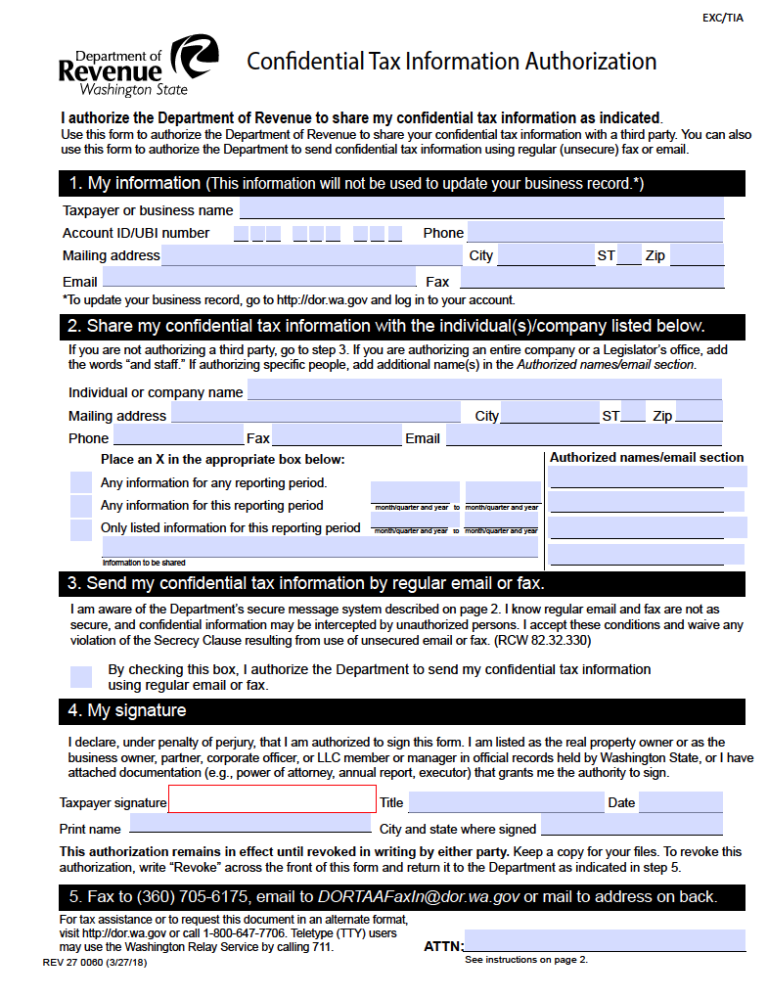

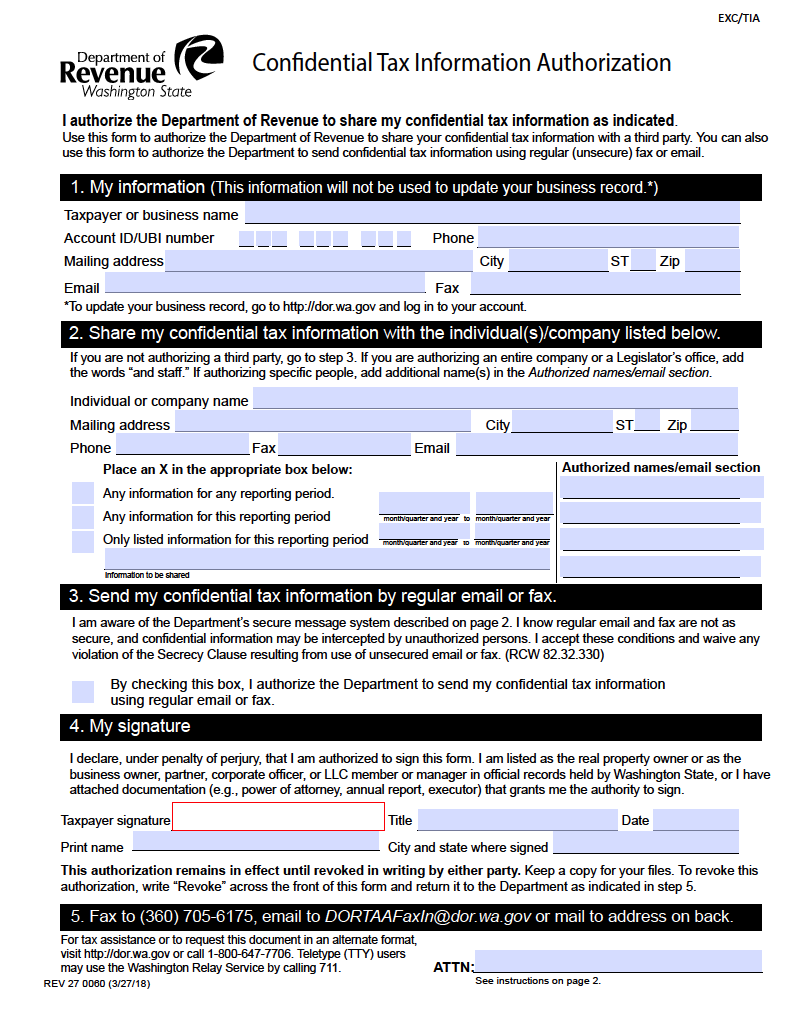

The Washington Tax Power of Attorney informs the Washington State Department of Revenue of the authorized dispensation of permissions to a designated attorney or accountant. The granted controls serve to allow the assigned agent the ability to make decisions, communicate, and submit tax documents on behalf of their client. The government document must be properly filled, signed, and registered to be instated by sending it to the Department of Revenue for acceptance. If the principal that initiated the action wishes to revoke the permissions, they can deliver the signed paperwork amended with the word “revoke” written across the front of the document to retract the given authorities.

Laws

Statutes – Uniform Power of Attorney Act (R.C.W. § 11-125-010 – § 11-125-903)

Definition – § 11-125-020

Signing Requirements – The issuing declarant must sign the form, and it does not require a witnessing party for verification.

How to File

Complete the filing with the necessary pertinent information such as the associated name of taxpayer or business, address, and account ID or UBI number. Provide necessary signatures and either submit by mail, email, or fax to the following address or number:

By Mail:

Department of Revenue

Taxpayer Account Administration – ICAP

PO Box 47476

Olympia, WA 98504-7476

OR

By email:

[email protected]

OR

By Fax:

(360) 705-6175

Additional Resources

- Washington State Department of Revenue – General Public

Related Forms (4)

- Durable (Financial) Power of Attorney

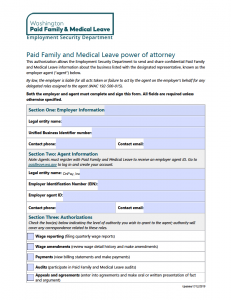

- Paid Family and Medical Leave Power of Attorney

- Power of Attorney for Unemployment Insurance

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Paid Family and Medical Leave Power of Attorney

Download: Adobe PDF

Power of Attorney for Unemployment Insurance

Power of Attorney for Unemployment Insurance

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF

Comments