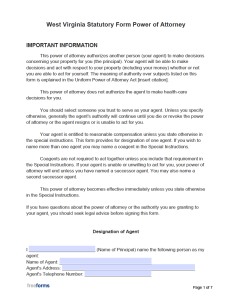

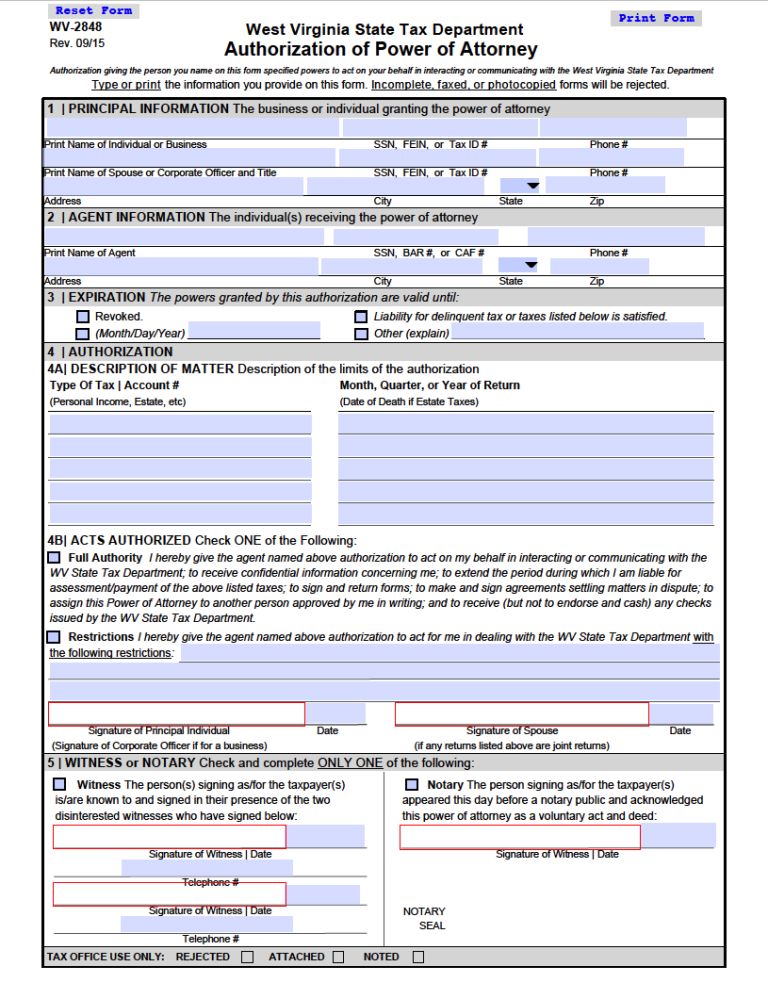

The West Virginia Tax Power of Attorney is a legal form that assists in nominating a representative to appropriate the same signing and communication rights concerning tax matters for an individual to an alternate agent. Generally, this form is utilized to denote authorization for a lawyer or accountant to decide and act on behalf of a client for tax purposes. When taking steps to submit documents or speak to the state tax department, a representative must first be legitimized as an attorney-in-fact by completing, executing, and sending the form in for approval. The agreement can be annulled upon a predetermined expiry date or at any time by instituting the revocation of the commitment. The required endorsements to enact the agency’s commencement will require either a notary or two (2) impartial witnesses to view the event and attest to it by signature before mailing in for government approval.

Laws

Statute – Uniform Power of Attorney Act (W.V.C. § 39B-1-101 – § 39B-4-103)

Definition – § 39B-1-102

Signing Requirements – Obligated acknowledgment by two (2) disinterested witnesses or a licensed notary to confirm all corroborating signatures (§ 39B-1-105).

How to File

The state of West Virginia regulates the issuance of powers regarding tex matters by requesting the provided form be filled and signed. Once all selections have been made and proper signatures recorded and authenticated by witnesses or a notary, the original paperwork can be mailed to the following address:

WV State Tax Department

Legal Division- Disclosure Officer

P.O. Box 1005 Charleston, WV 25324-1005

Other Versions

IRS Federal Tax Power of Attorney Form 2848

IRS Federal Tax Power of Attorney Form 2848

Download: Adobe PDF

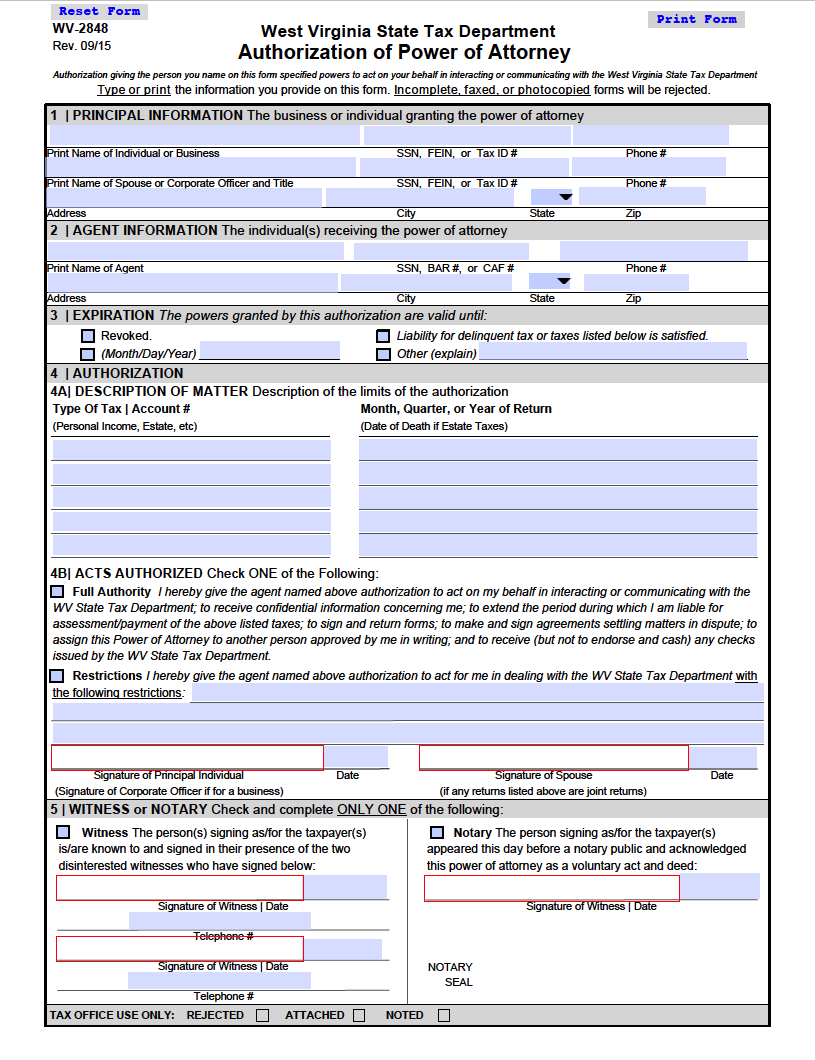

West Virginia Tax Power of Attorney Form WV-2848 – Previous Edition

West Virginia Tax Power of Attorney Form WV-2848 – Previous Edition

Download: Adobe PDF

Additional Resources

- West Virginia State Tax Department – West Virginia Tax Power of Attorney Form WV-2848 Instructions

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download:Adobe PDF, MS Word (.docx)

Comments