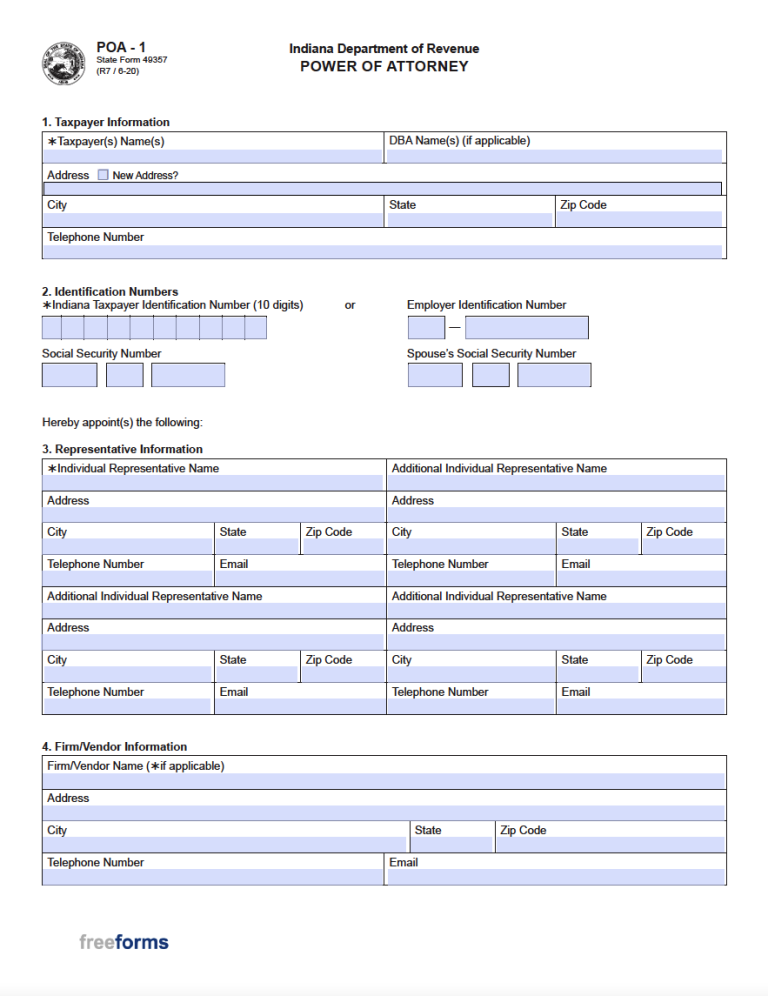

The Indiana Tax Power of Attorney (Form POA-1) makes it possible for residents of the state to appoint a tax representative. This means that the appointed party can have the capability of accessing personal tax information, signing certain paperwork, and filing returns all in the name of the principal. To get the ball rolling, interested parties will need to provide all the requested information within this form and then sign it to ensure its validity.

Laws

Statutes – § 30-5-5-14(a)(2)

Definition – “Power of attorney” means a writing or other record that grants authority to an attorney in fact or agent to act in place of a principal, whether the term “power of attorney” is used (§ 30-5-2-7).

Signing Requirements – Must be signed by the taxpayer (45 IAC 15-3-4(a)(5)).

How to File

After providing the required information within the form and signing it, individuals must then register it with the Indiana Department of Revenue. This can be done by sending the document to the department via one (1) of the following methods:

Mail: Indiana Department of Revenue

PO Box 7230

Indianapolis, IN 46207-7230

OR

Fax: (317) 615-2605

Additional Resources

- Indiana Department of Revenue – Power of Attorney Options

- Indiana Department of Revenue – Tax Power of Attorney (Form POA-1) Instructions

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments