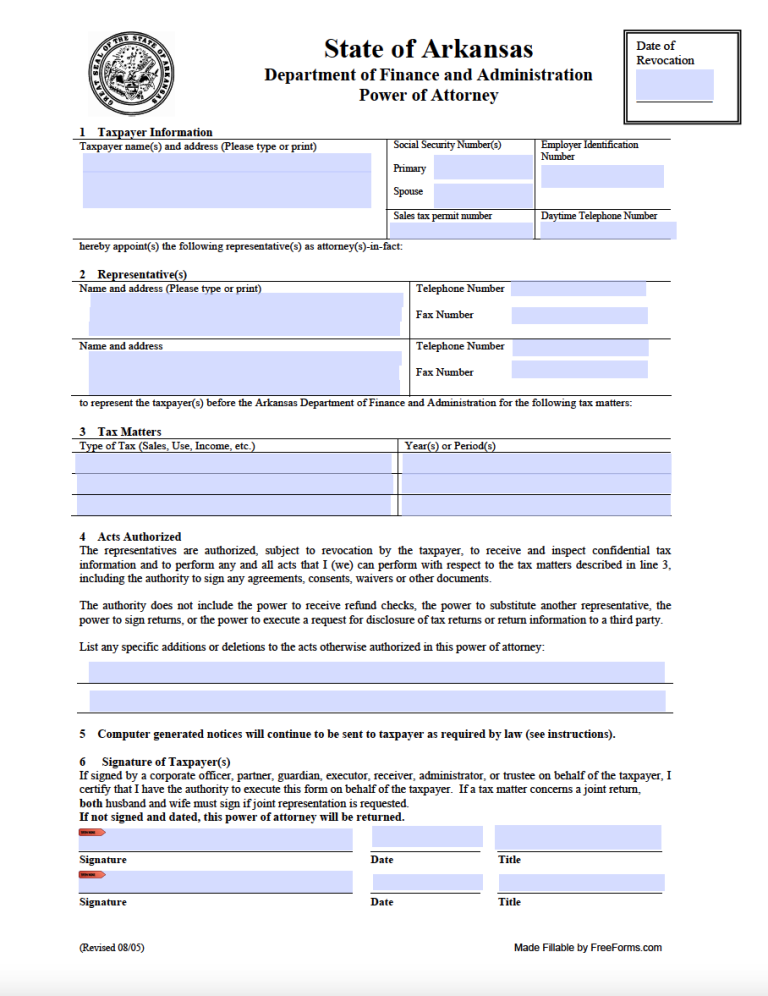

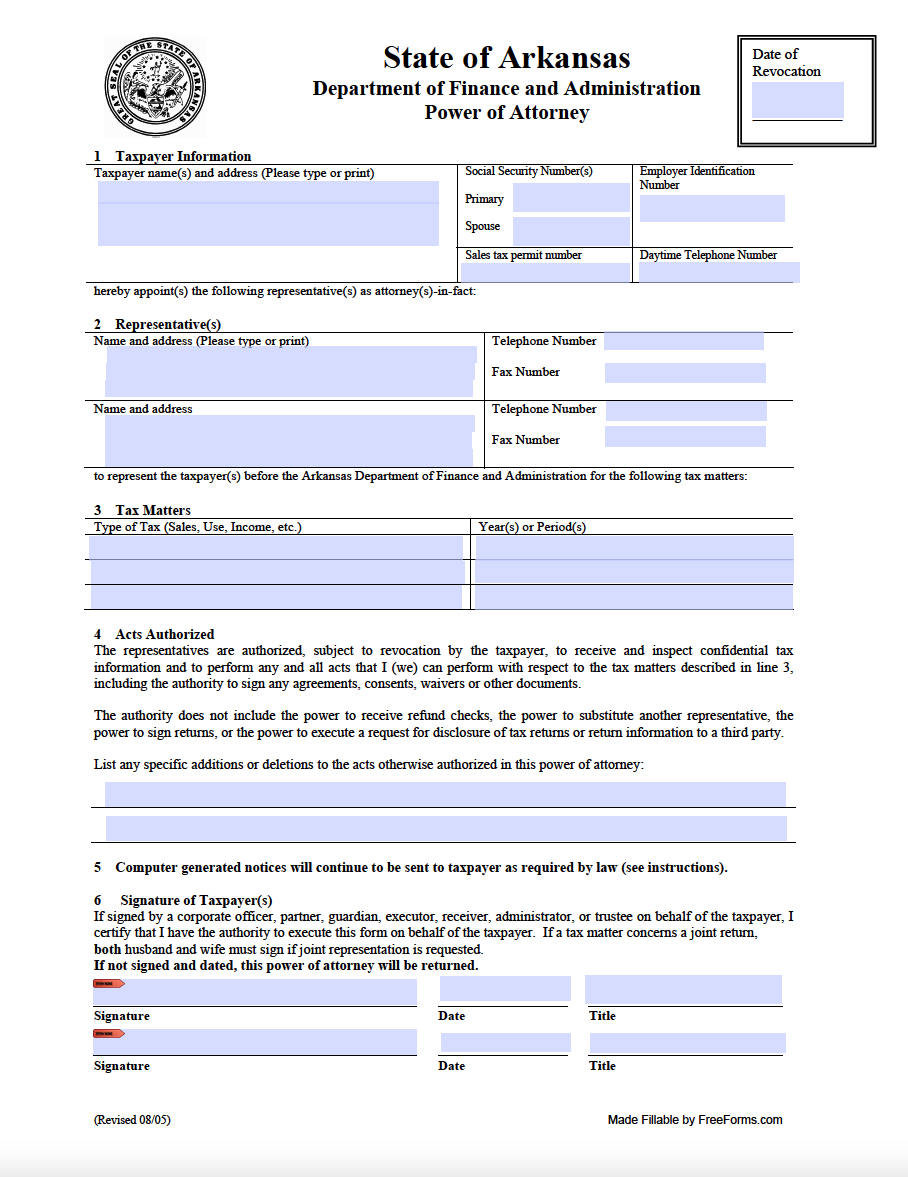

The Arkansas State Tax Power of Attorney grants certain rights to an “attorney-in-fact” to file/pay a principal party’s taxes for them. As you may know, this POA is mainly taken advantage of by those who wish to hire the services of an accounting firm or tax attorney to assist them in managing their obligations as a taxpayer. The form requests the names of the taxpayer(s) and their selected representative(s), a description of the tax matters they want to be handled, and any limitations on the powers bestowed. This is all summed up with the endorsement(s) of the taxpayer(s) to confirm that they agree to the statements made within the written instrument.

Laws

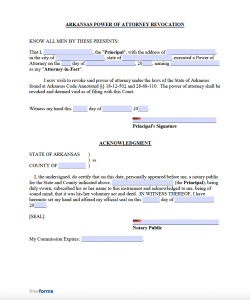

Statute – Arkansas Code – Uniform Power of Attorney Act (§ 28-68-101 – 28-68-406)

Definitions – § 28-68-216

Signing Requirements – Only necessitates the signature of the principal.

Notice Law – The taxpayer will still receive “Proposed Assessment” and “Final Assessment” notices regardless of their delegation of powers (§ 26-18-307, § 26-18-403, & § 26-18-401). It is up to them to forward the information to the agent acting on their behalf.

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Download: Adobe PDF

Comments