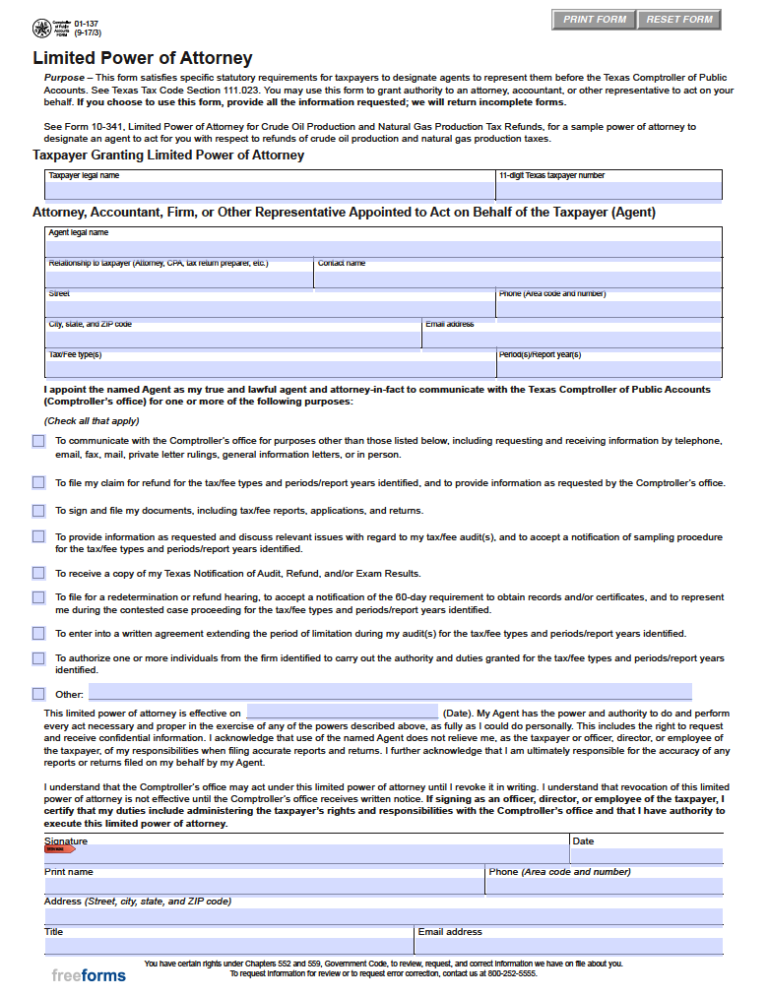

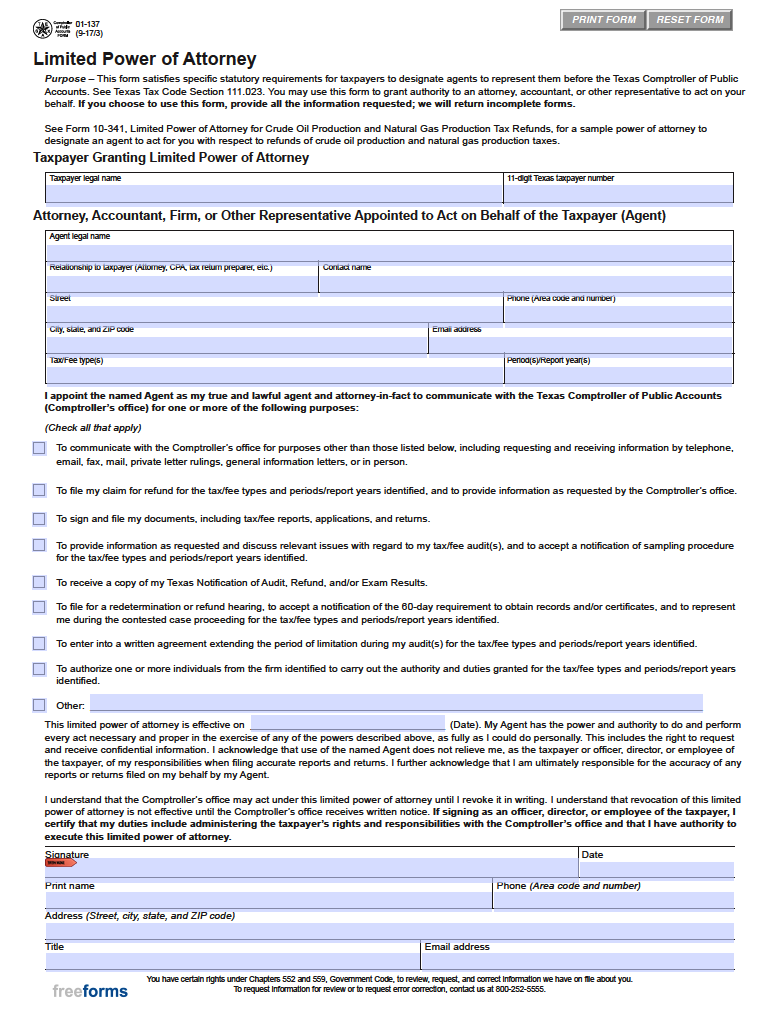

The Texas Tax Power of Attorney (Form 01-137) is utilized by residents across the state who would like to appoint a representative to conduct certain tax affairs on their behalf. As you may guess, the individuals/entities most commonly appointed as a representative are those with a background in finance, i.e., an accountant, tax attorney, or revenue agent. For a taxpayer to ensure that their attorney-in-fact will have the full capability of operating in their name, they should supply the following within the form:

- Grantor’s Information (legal name & state taxpayer number)

- Representative’s Information (individual/business name, relationship to the taxpayer, contact info, & address)

- Type of tax duties that the agent will be authorized to manage.

- Effective Date of the POA

- Signature

Laws

Statute – Tax Matters (§ 752.114)

Authorized Representatives – An authorized representative may be an attorney, an accountant, or any other person of the taxpayer’s choice (§ 1.3(a)).

Written Authorization – Any tax document submitted to the comptroller by an attorney, accountant, or other representative working on the behalf of another individual may need to be accompanied by the signed written authorization of the taxpayer (§ 111.023).

Signing Requirements – Only necessitates the signature of the taxpaying party.

Additional Resources

Texas Comptroller of Public Accounts – Sales Tax Refunds

Related Forms (4)

Appointment of Agent for Property Tax Matters (Form 50-162)

Appointment of Agent for Property Tax Matters (Form 50-162)

Download: Adobe PDF

Audit Power of Attorney (Form 86-113)

Audit Power of Attorney (Form 86-113)

Download: Adobe PDF

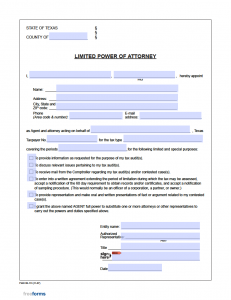

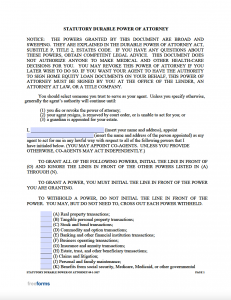

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

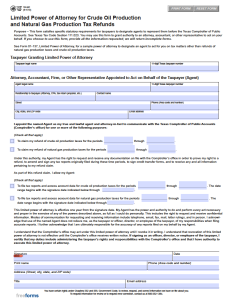

Power of Attorney for Crude Oil & Natural Gas Production Tax Refunds (Form 10-341)

Power of Attorney for Crude Oil & Natural Gas Production Tax Refunds (Form 10-341)

Download: Adobe PDF

Comments