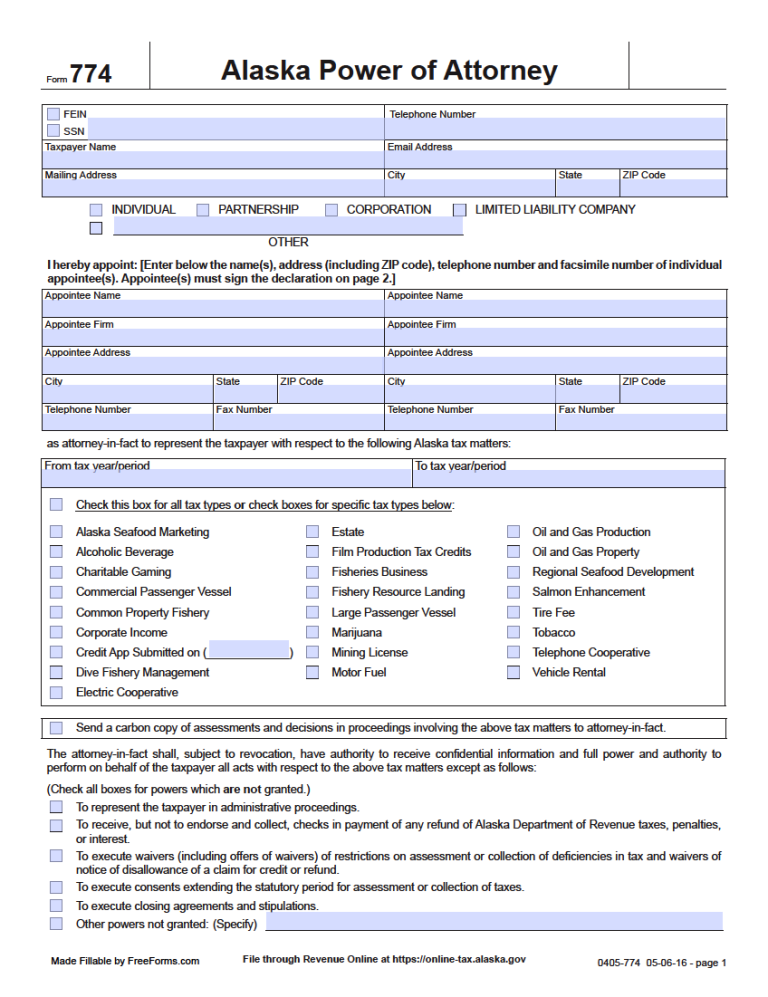

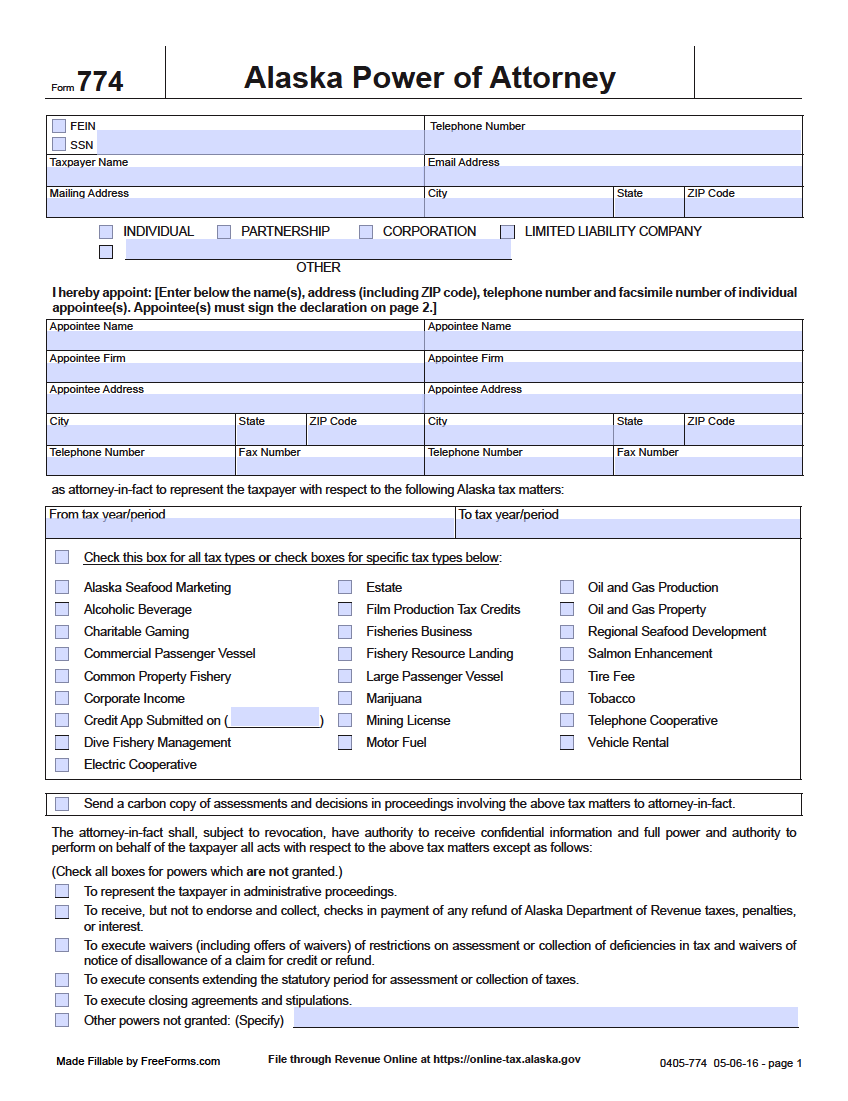

The Alaska State Tax Power of Attorney, also known as “Form 774”, allows a resident to elect someone else to file taxes and make payments on their behalf. Often, this is utilized when a client would like their accountant or attorney to handle certain liabilities surrounding the money owed to the local government at the end of the year. The form requests specific info pertaining to the identification of both parties, the types of taxes being managed, and any restrictions of power. Once the principal has customized the document, it may then be signed by the taxpayer and their representative(s) to conclude the transference of authority.

Laws

Statute – Alaska Statutes – Powers of Attorney (§ 13.26.070 – 13.26.695)

Definitions – § 13.26.645

Signing Requirements – The taxpayer and appointed agent will need to supply their respective signatures in the dedicated spaces to instate the authorization.

How to File

Alaska’s Department of Revenue requires that the form be submitted along with associated tax documents to allow the assigned agency. The commitment can be filed electronically using the Tax Division’s Revenue Online Portal. Click on the provided link and follow the on-site directions to log in or enroll to submit the form. For other submission options, you can contact the Department of Revenue by using the following contact information:

By Mail:

State of Alaska Department of Revenue

PO Box 110400

Juneau, AK 99811-0400

OR

By Phone:

(907) 465-2300

OR

By Fax:

(907) 465-2389

Related Forms

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

Download: Adobe PDF, MS Word (.docx)

Comments