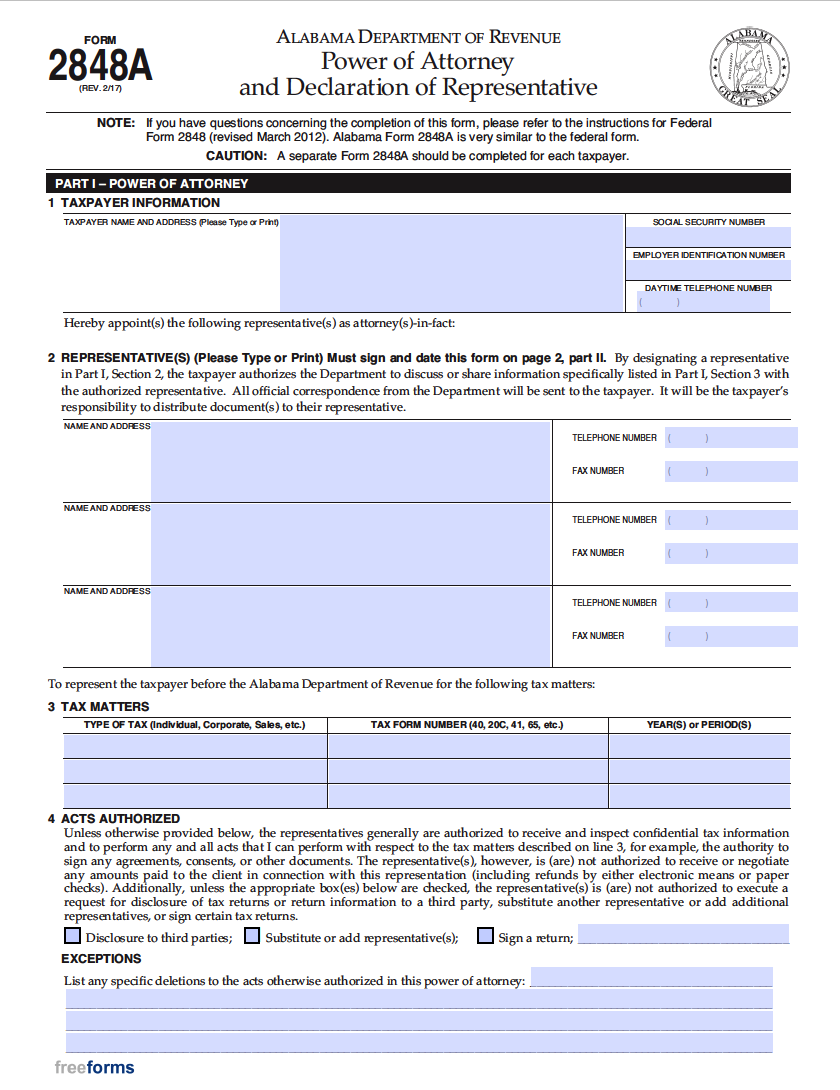

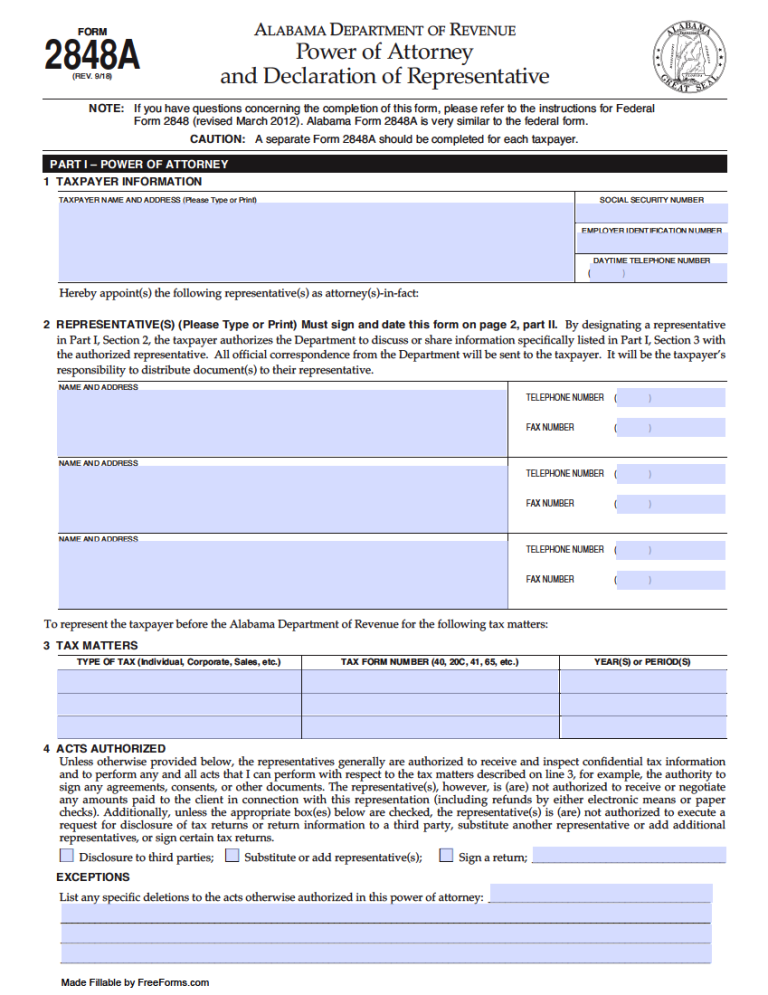

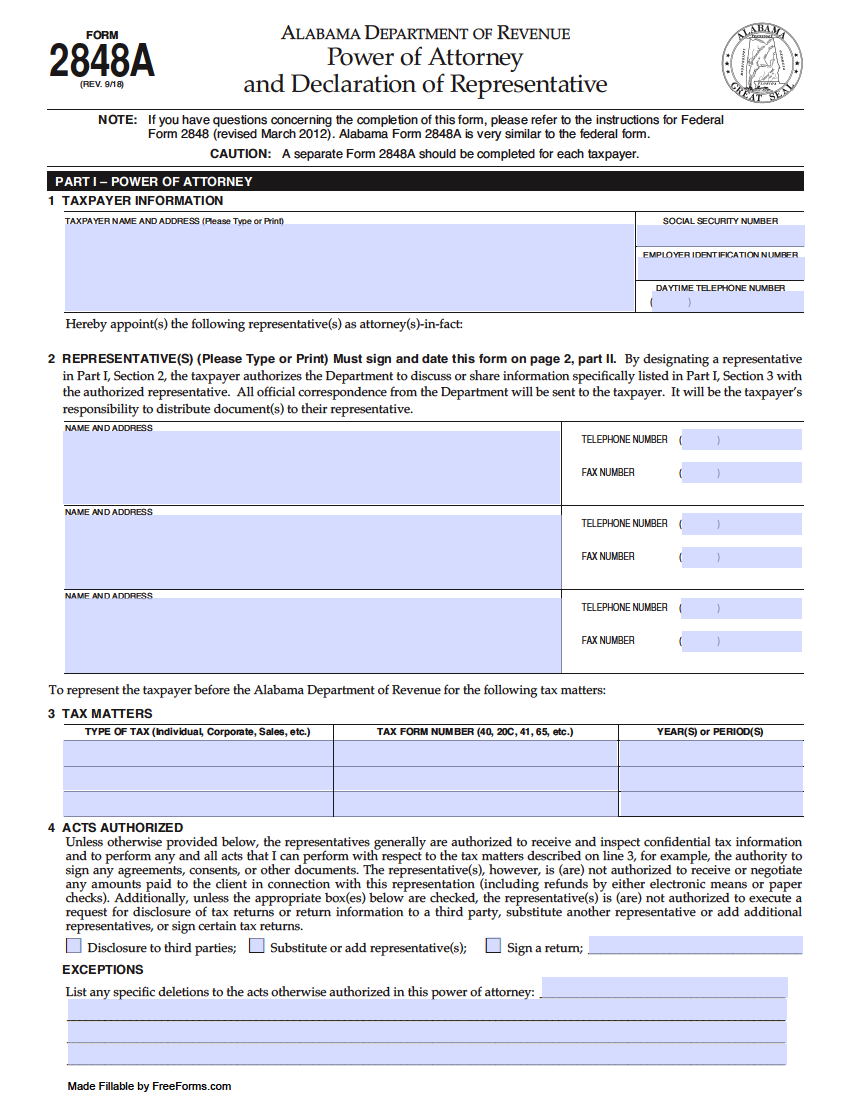

The Alabama State Tax Power of Attorney is used when a resident would like to have their representation have the ability to access their confidential tax information and sign tax documents in their name. Most individuals convey these powers to either their accountant or tax attorney. The document allows the principal party to list any tax matters that they would like taken care of, as well as any restrictions of service. Once the conveying party feels that the form contains all the needed details and is satisfactory, they may then sign it along with the agent operating on their behalf. The completed form should then be filed with the state to guarantee a binding agreement.

Laws

Statute – Code of Alabama – Alabama Uniform Power of Attorney Act (§ 26-1A-105 – 26-1A-404)

Signing Requirements – Only the individual conveying the powers must sign the form. A notary public is not required to effectively finalize the document.

Other Versions

Alabama State Tax Power of Attorney (Form 2848A) (Previous Edition)

Alabama State Tax Power of Attorney (Form 2848A) (Previous Edition)

Download: Adobe PDF

Additional Resources

- Alabama Legal Help – Powers of Attorney

Related Forms

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Comments