POA documents that allow a declarant to name an attorney-in-fact to handle their assets can be arranged to bestow privileges in a limited or broad manner depending on which form and used and how the declarant completes it. Many of the POAs can instate permissions to an appointed agent that expire if the principal sustains extended unconsciousness, while the durable contract remains in effect past the point of incapacitation.

Laws

Statutes – New Hampshire Statutes – Uniform Power of Attorney Act (§ 564-E:101 – 564-E:403) and New Hampshire Statutes – Written Directives for Medical Decision Making for Adults Without Capacity to Make Health Care Decisions (§ 137-J:1 – 137-J:37)

Definition – “Power of Attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used (§ 564-E:102(15)).

Signing Requirements – All documents classified as financial powers of attorney will require the assistance of a licensed notary to verify the endorsement process (§ 564-E:105(a)(1)). A health care POA agreement (advance directive) can either be authenticated with the commission of a notary public or two (2) eligible witnesses to corroborate provided signatures ( § 137-J:14). Specific state guidelines on mandated acknowledgment requisites for other particularized agreements are outlined below for each individual form.

Revocation – § 564-E:110 and § 137-J:15

By Type (9)

- Advance Directive (Medical POA & Living Will)

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Minor Child Power of Attorney

- Motor Vehicle Power of Attorney

- Real Estate Power of Attorney

- Revocation of Power of Attorney

- Tax Power of Attorney

Advance Directive (Medical POA & Living Will) – Creates a legal framework of a person’s preordained choices for possible medical treatment options. It allows for the nomination of a health care proxy and assigns confirmation of care preferences should the patient become consistently unconscious for a period of time.

Advance Directive (Medical POA & Living Will) – Creates a legal framework of a person’s preordained choices for possible medical treatment options. It allows for the nomination of a health care proxy and assigns confirmation of care preferences should the patient become consistently unconscious for a period of time.

Download: PDF

Signing Requirements: Acknowledgement regulations demand that the form be signed before a notary or two (2) acceptable witnessing parties according to New Hampshire State Statutes § 137-J:14(a).

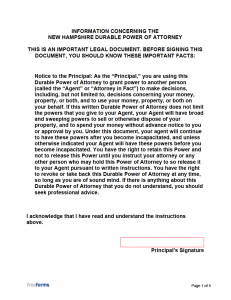

Durable (Financial) Power of Attorney – Constructs a valid contract to extend broad sweeping powers from one person to another. A durable arrangement further stipulates that the issuance stays in effect even in the event of the declarant’s incapacitation.

Durable (Financial) Power of Attorney – Constructs a valid contract to extend broad sweeping powers from one person to another. A durable arrangement further stipulates that the issuance stays in effect even in the event of the declarant’s incapacitation.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment by a notary public is needed to execute the agreement properly.

General (Financial) Power of Attorney – Confirms the establishment of conveyance delivering temporary controls over financial holdings from one individual to another.

General (Financial) Power of Attorney – Confirms the establishment of conveyance delivering temporary controls over financial holdings from one individual to another.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement must be obtained from a licensed notary.

Limited (Special) Power of Attorney – Apportions restricted permissions to an attorney-in-fact as established by the principal within the language included in the agreement.

Limited (Special) Power of Attorney – Apportions restricted permissions to an attorney-in-fact as established by the principal within the language included in the agreement.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement specifications indicate that a notary professional is required to be present at the time of signing.

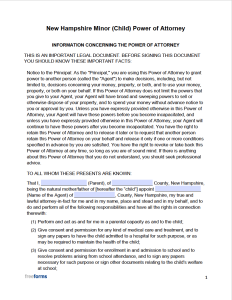

Minor Child Power of Attorney – Designates a defined agreement passing rights for a named person to legally take on child care responsibilities for a minor over a fixed period.

Minor Child Power of Attorney – Designates a defined agreement passing rights for a named person to legally take on child care responsibilities for a minor over a fixed period.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement from a notary mandated by state law for adequate certification of all recorded signatures.

Motor Vehicle Power of Attorney – Delegates an individual to receive privileges to handle transactions for the vehicle owner legally.

Motor Vehicle Power of Attorney – Delegates an individual to receive privileges to handle transactions for the vehicle owner legally.

Download: PDF

Signing Requirements: Acknowledgement by way of notarization necessitated for completion and submission.

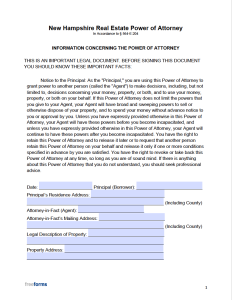

Real Estate Power of Attorney – Permits another to manage particularized actions concerning real estate holdings held by an owning principal.

Real Estate Power of Attorney – Permits another to manage particularized actions concerning real estate holdings held by an owning principal.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of the document’s execution will compel official notarization to complete the appointment of the contract.

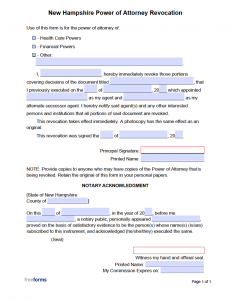

Revocation of Power of Attorney – Formally overturns an actively issued power of attorney agreement.

Revocation of Power of Attorney – Formally overturns an actively issued power of attorney agreement.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment can be submitted with the help of a supervising notary.

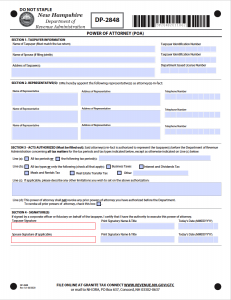

Tax Power of Attorney (Form DP-2848) – Initiates institution of granted representation rights for an outside party to handle tax matters for another.

Tax Power of Attorney (Form DP-2848) – Initiates institution of granted representation rights for an outside party to handle tax matters for another.

Download: PDF

Signing Requirements: Acknowledgement from the taxpayer(s) must be confirmed with affixed endorsements. Should the appointed representative not be classified as a legal or tax specialist or an enrolled agent, two (2) witnessing parties must be made available to corroborate the event.

Comments